DirecTV (DTV +0.00%) is having much success in Latin America, seeing rapid growth of its subscriber base. This is happening for two reasons. One reason is a rapid rise of the middle class in most of the Latin American countries in which DirecTV operates. The other reason is that DirecTV is the best available option for consumers in those markets.

All that said, DirecTV can't just sit around and expect growth to continue. DirecTV is keeping its eye on the ball (or screen) with several key initiatives for Latin America. While DirecTV is one of the best investment options in its peer group, that doesn't mean it's the best. We'll also take a look at Comcast (CMCSA 0.27%) and Dish Network (DISH +0.00%). These will be slightly different comparisons than were given in the recent DirecTV U.S. article.

Three key initiatives

DirecTV's three key initiatives for its Latin America market:

- Profitability Expand Relationships Across All Demographic Segments

- Enhance Productivity and Effectively Manage Costs

- Leverage DirecTV's Latin America and Customer Base to Introduce Complementary Services

Profitably expand relationships across all demographic segments

DirecTV looks to accomplish this goal by strengthening its leadership in higher-end markets, with a focus on DVR and HD superiority. Last year, DirecTV obtained DVRs that are more functional and cost-effective than other DVRs in the marketplace. Accomplishing the goal of strengthening leadership in higher-end markets with quality DVRs shouldn't be difficult considering most consumers throughout Latin America don't already own DVRs. As far as HD goes, it's a slow-moving process in Latin America. However, at least it's moving, and DirecTV is well-positioned to capitalize on that growth.

DirecTV doesn't plan on leaving out the middle market, where it sees significant growth opportunities thanks to the rapid rise of the middle class. DirecTV plans on using targeted marketing and distribution strategies to accomplish its goals. That's really all it needs since demand is high.

Furthermore, DirecTV knows that Colombia is its market with the most potential -- it has more households than any other DirecTV Latin America market. DirecTV cites an improved business market and favorable economic trends as reasons to be highly optimistic in Colombia. DirecTV has already acquired the rights for the Colombia Soccer league, and it plans on making more of an impact in Colombian sports.

Enhance productivity and effectively manage costs

This initiative can be summed up easily. Just as in the domestic market, DirecTV aims to improve its customer service. If customer service improves, this leads to fewer service calls, which then reduces costs. DirecTV also aims to upgrade its IT and billing systems, which will enhance productivity and further reduce costs.

Leverage DirecTV's Latin America customer base to introduce complementary services

The main focus here is for DirecTV to offer fixed wireless broadband services in order to minimize churn and attract new customers. DirecTV also wants to extend premium video services. In regard to the latter, Sky Online was established in 2011, allowing customers to download and stream online content for a flat monthly fee.

DirecTV vs. peers

Comcast recently delivered its third quarter results. If you look at the numbers on the surface, all is well:

- Revenue: Up 5.2%

- Operating Cash Flow: Up 10.5%

- Earnings-Per-Share: Up 41.3%

- Free Cash Flow: Up 30%

- $1.0 Billion Returned to Shareholders Via Dividends and Buybacks

On the other hand, if you exclude the 2012 London Olympics & pension termination costs, revenue declined 2.4%. However, the big picture is what's most important. Comcast is doing just fine in that regard:

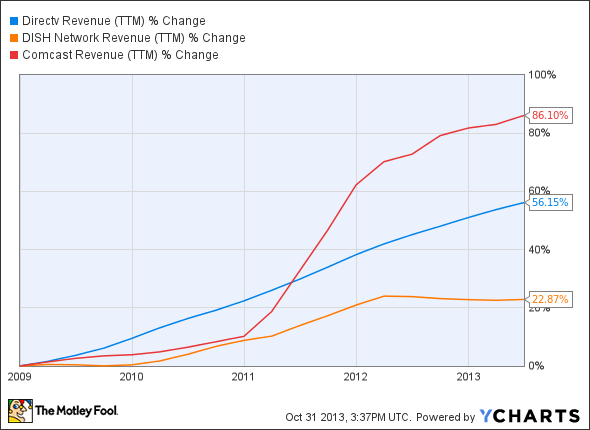

DTV Revenue (TTM) data by YCharts

While DirecTV has performed well over the past five years, Comcast shined. Note that Dish Network has also seen revenue growth in a challenging economic environment. However, have all three companies performed well on the bottom line over the same time frame?

DTV EPS Diluted (TTM) data by YCharts

Not so much. While Dish Network has struggled on the bottom line, DirecTV and Comcast have been rewarding shareholders in a big way. However, Brean Capital thinks the future is bright for Dish Network, recently rating it a Buy and upping its price target to $54 from $49.

Brean Capital feels that Dish Network will reestablish itself as a top option as a low-cost provider, which will lead to subscriber growth, market share gains, and then stock appreciation. This is possible, but DirecTV and Comcast have established themselves as stronger players in the market, which in my opinion would make them better investments.

The bottom line

Those with long memories will remember when DirectTV was introduced to the public at large and became all the rage in the United States. That's what is occuring in Latin America right now. This alone is enough reason to consider an investment in DirecTV. Its top-line growth coupled with a strong performance on the bottom line is comforting and makes the company worth looking into for Foolish investors.