Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Waste Management (WM -0.06%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Waste Management's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Waste Management's key statistics:

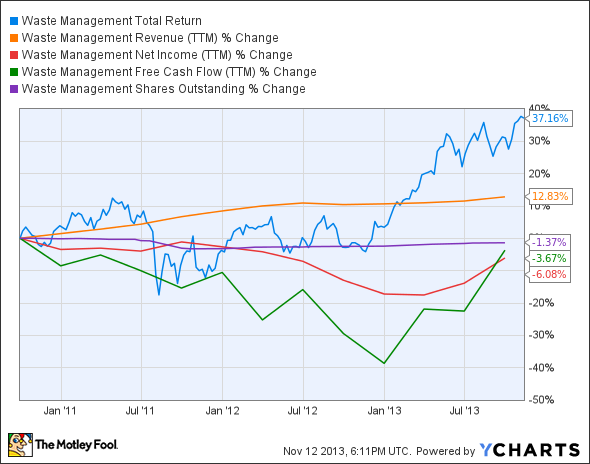

WM Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

12.8% |

Fail |

|

Improving profit margin |

(16.8%) |

Fail |

|

Free cash flow growth > Net income growth |

(3.7%) vs. (6.1%) |

Pass |

|

Improving EPS |

(2.4%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

37.2% vs. (2.4%) |

Fail |

Source: YCharts.

*Period begins at end of Q3 2010.

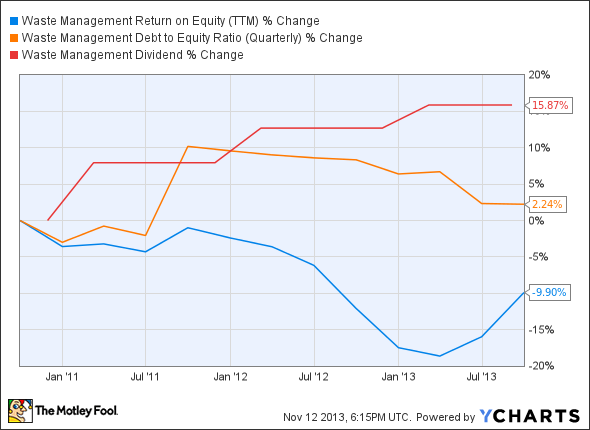

WM Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(9.9%) |

Fail |

|

Declining debt to equity |

2.2% |

Fail |

|

Dividend growth > 25% |

15.9% |

Fail |

|

Free cash flow payout ratio < 50% |

59.4% |

Fail |

Source: YCharts.

*Period begins at end of Q3 2010.

How we got here and where we're going

Things don't look good for Waste Management in its second assessment. The trash hauler's earned only one out of nine possible passing grades, the same score it picked up last year -- but even that lone pass was granted more on a technicality than because of real improvement. There's nothing necessarily terrible about this, as trash hauling is one of the foundational services of society, but mediocre progress (or no progress) points to a business that's long past any semblance of growth. Will Waste Management be able to start growing its bottom line again, or is it destined for the stock market's trash heap? Let's dig deeper to find out.

Despite apparent longer-term weakness, Waste Management posted better-than-expected results in its latest quarter -- the company's gross margin improved by 150 basis points as its collection and disposal yield climbed to 2.3%. However, Waste Management's green offerings, like recycling metals and harvesting methane-rich gas from landfills, have thus far been drags on its earnings because of lower commodity and energy prices. Fool contributor Daniel Ferry notes that China's "Green Fence" policy has heightened recycling costs, as it now requires contaminated waste meant for recycling to be cleaner and better sorted. CEO David Steiner said that the company will charge a higher processing fee from customers in order to offset the extra costs incurred by regulatory requirements.

Waste Management and peers Republic Services (RSG -0.19%) and Waste Connections (WCN -0.40%) are increasingly banking on natural-gas-powered heavy-duty trucks to save money on fueling costs, as the price of diesel fuel has been stubbornly high for several years and shows no sign of returning to pre-financial-crisis levels. Waste Management, which began moving toward natural gas last year, boasts the largest nat-gas fleet in North America, numbering around 2,200 collection trucks. The company has also established a network of more than 50 fueling stations across Canada and the U.S. to service these vehicles. Fool contributor Dan Caplinger notes that Republic fuels about 10% of its fleet with nat-gas, which works out to about 1,400 vehicles, and it plans to spend half its new vehicle purchases on CNG-fueled haulers this year. Waste Connections also has plans to spend around $15 million on trucks and infrastructure to double its CNG-powered fleet in San Jose. Natural gas prices have remained depressed for years, so this is a sensible strategy -- at least as long as prices don't succumb to a surge like the one experienced in crude oil leading into the financial crisis.

Fool contributor Howard Rothman notes that Waste Management plans to convert pipeline-ready natural gas at landfills into fuel within its Fairmont City facility, which is expected to fuel around 400 trash collection vehicles every day. In addition, the company has expanded its environmental service offerings in the Bakken Shale formation through the acquisition of Summit Energy Services and Liquid Logistic, which is expected to better its position in the growing U.S. oil and gas drilling market. Fool contributor Reuben Brewer notes that Waste Management also betting on "Energy From Waste," or EfW, but it presently maintains less than half of Covanta's (CVA) capacity in this area -- Covanta operates 45 EfW facilities across the globe. Still, Waste Management has the scale to grow rapidly in EfW, although doing so will likely incur a great deal of capital spending, keeping free cash flow depressed for however long the company decides to focus on any buildout.

Putting the pieces together

Today, Waste Management has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.