Image source: DowJones.com.

In no particular order, here are 10 facts about the Dow Jones Industrial Average (^DJI +0.14%) that just might blow your mind:

-

Twenty-two of the 30 Dow Jones components trade within 5% of their 52-week highs today. Seventeen of the 30 blue chips are within 2% of their annual tops.

-

To confirm the upward momentum, only three Dow stocks trade within 10% of their annual lows right now. Only IBM (IBM +0.46%) sits within 5% of its 52-week bottom, and even Big Blue has bounced back 3.7%. You can enjoy a deeper discussion of these three Dow dogs by clicking here.

-

The average Dow member has grown revenue by an annual clip of 5.2% over the last three years. The fastest sales grower? Caterpillar (CAT 1.11%) looks back at three years of 15% revenue CAGR.

-

Despite Caterpillar's massive sales growth, the stock is also on that list of bottom-rung performers. That's the way the cookie crumbles when growth by massive acquisition goes wrong.

-

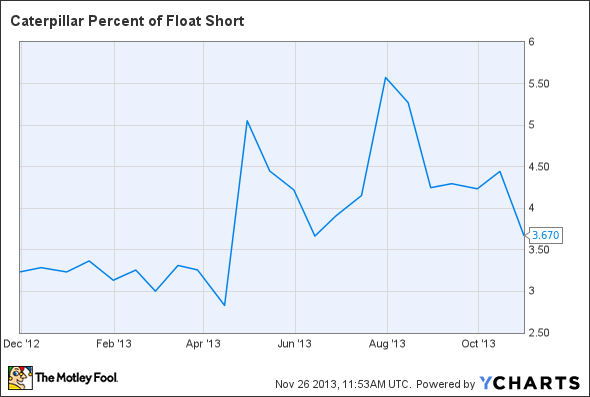

And investors still expect more trouble for Caterpillar. The heavy-equipment manufacturer is the second-most shorted stock on the Dow, with 3.6% of shares sold short.

CAT Percent of Float Short data by YCharts.

-

At only $77.7 billion, Dow Jones newcomer Goldman Sachs (GS +0.10%) carries one of the smallest market caps on the index. If the Dow were a cap-weighted index, like the S&P 500, Goldman Sachs would account for just 1.6% of the Dow's total score. But we call it the Dow Jones Industrial Average for a reason, as the scores are calculated as an adjusted average of the component share prices. Instead, Goldman's $170 share price gives it a 6.8% weight in the Dow's price-weighted system.

-

The price-weighting choice used to put IBM head and shoulders above all other Dow stocks. This summer, IBM represented more than 10% of the Dow's total weight. Chevron (CVX +0.13%) ran a distant second at just 6.1%. All of that changed when the Dow's steering committee kicked out three of the index's smallest and cheapest tickers. Two of the replacement stocks came with triple-digit share prices to match IBM's formerly dominant weight, and the third trades close to $100. Now, IBM controls 7.1% of the Dow's score, and Chevron sits at 4.9%.

-

The Dow's average annual growth was just 5.6% across the last decade, 12.5% in each of the two decades before that, and 5.8% between 1974 and 1983 -- hardly hypergrowth, even in the best years.

-

The restrained growth of the Dow Jones index may not set many hearts aflutter, but you can still get rich by investing in a Dow Jones tracker. Little by little, those four decades add up to a 2,500% return on your 1974 investment. That's 26 times your money, proving that patience truly is a virtue.

-

Speaking of eternal patience, IBM first joined the Dow Jones in 1932. Only six of the 30 Dow components of that time remain today, and IBM took a 40-year break between 1939 and 1979. If you (or your great-grandfather) bought IBM shares for $9 1/8 in 1932, the starting price works out to just $0.35 per share after 2,615% of split adjustments. Today's $179 price gives you more than 510 times the original investment. Annual returns of 8.4% really add up over 77 years.