Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does BorgWarner (BWA -0.68%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

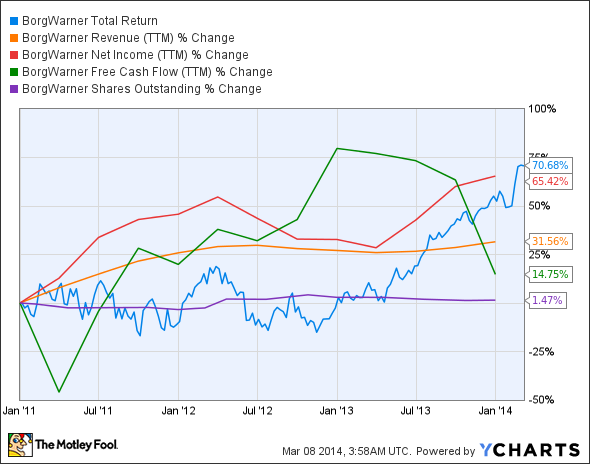

The graphs you're about to see tell BorgWarner's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at BorgWarner's key statistics:

BWA Total Return Price data by YCharts.

|

Passing Criteria |

Three-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

31.6% |

Pass |

|

Improving profit margin |

25.7% |

Pass |

|

Free cash flow growth > Net income growth |

14.8% vs. 65.4% |

Fail |

|

Improving EPS |

78.8% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

70.7% vs. 78.8% |

Pass |

Source: YCharts. * Period begins at end of Q4 2010.

BWA Return on Equity (TTM) data by YCharts.

|

Passing Criteria |

Three-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

10.7% |

Pass |

|

Declining debt to equity |

(34.3%) |

Pass |

|

Dividend growth > 25% |

Reinstated in 2013 |

Pass |

|

Free cash flow payout ratio < 50% |

23.3% |

Pass |

Source: YCharts. * Period begins at end of Q4 2010.

How we got here and where we're going

BorgWarner comes through with flying colors, earning eight out of nine possible passing grades. The company missed out on a perfect score only because its free cash flow recently went into decline after years of strong growth. However, BorgWarner's EPS growth has actually increased at a faster rate than its share price during our three-year tracking period, and the company reinstated quarterly dividend payouts last year after suspending payouts in 2009. Will this automotive supplier be able to sustain its progress in current economic conditions? Let's dig a little deeper to find out.

BorgWarner recently posted market-topping revenue and EPS in its fourth-quarter results, which was primarily driven by higher sales of engine and safety products. The company also inked an agreement to purchase Gustav Wahler, a manufacturer of exhaust gas recirculation (EGR) valves, EGR tubes, and thermostats, which will strengthen its competitive position in EGR systems and provide better market opportunities in passenger and commercial vehicle applications and systems. Over the past few years, the demand for EGR valves has accelerated, as this component helps curb NOx emissions while boosting fuel efficiency in diesel and gasoline-direct injection engines. With the acquisition of Gustav Wahler, BorgWarner is expecting full-year organic sales to grow by between 7% and 11% for the 2014 fiscal year.

According to a Consumer Reports National Research Center survey, the majority of car owners have been eager to trade capacity and comfort for a more fuel-efficient car. Fool contributor Mark Lin notes that BorgWarner's Eco-Launch solenoid valve technology is well-positioned to capitalize on fuel economy trends as governments in Europe, China, Japan, and the U.S. all plan to tighten fuel economy standards to curb harmful vehicle emissions. However, Delphi Automotive's (DLPH) Multi-Port Folded Tube Condenser, which contributes to fuel savings by increasing heat-transfer capabilities, might pose significant threats to BorgWarner. Delphi's exposure to multiple long-running automotive trends (fuel economy, safety, and connectivity) do appear to provide a competitive edge over the less diversified BorgWarner -- but there's also something to be said for specialized expertise.

BorgWarner's order backlog now totals more than $2.9 billion for deliveries scheduled from here through 2016, largely driven by growing demand for advanced powertrain technologies. The company also plans to roll out its Supplier Performance Monitor systems in the United States and Europe, with Indian and Chinese launches to follow later this year. These new monitors will have to be top notch -- Delphi already sells integrated radar and camera systems, which combine radar sensing, vision sensing, and data analytics in a single module. BorgWarner's turbocharger business is also expected to grow by as much as 50% over the next five years.

Putting the pieces together

Today, BorgWarner has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.