Berkshire Hathaway (NYSE: BRK-A) (NYSE: BRK-B) has generated some serious attention by disclosing its addition of Verizon Communications (VZ 1.03%) to is portfolio last Thursday.

Due to the smaller size of the investment -- $520 million -- it's fair to assume this pick was made by one of Buffett's lieutenants, either Todd Combs or Ted Weschler. However, considering the two investors' recent track record of destroying the market, their similar investing style to Buffett, and fact they're likely to eventually inherit the portfolio, the pick deserves some attention.

The question is: what do they see in Verizon, and is now a good time to buy?

The business

Rule number one in Buffett's book of investing is to understand what you're buying. Considering Verizon's extreme visibility and massive network, it's likely you're already somewhat familiar with what the company does -- but it never hurts to review.

Verizon Communication can be broken into two segments: Verizon Wireless and Verizon Wireline.

Verizon Wireless sells wireless communication products and services over its vast U.S. network. This business accounted for roughly 70% of Verizon's over $30 billion in revenue in the first quarter.

The remaining percentage of revenue comes from the Wireline segment. This includes data cloud storage and all forms of wired communications including: Internet, cable, and land lines. These services are provided to consumers, businesses, the government, and other communications service providers in the U.S and in 150 countries around the world.

The 100 year test

A great business isn't just great today, but it has to be able to successfully compete for decades. For that, a company needs a strong and durable competitive advantage, or moat, that makes the business difficult to duplicate.

Verizon Wireless has more than its fair share of moat-like qualities. The company has the largest communications network in the U.S., which has helped build the now powerful brand name. And because of Verizon's sheer size, it has greater access to resources for advertising, repairing and expanding its network, and investing in innovation.

Verizon's Wireline segment doesn't seem to have the same advantages has its wireless counterpart. However, it does still benefit from massive amount of resources available to the company.

Ultimately, this sector of the market is incredibly competitive because there's incredible opportunity. While the future of technology is wildly unpredictable, I believe Verizon has the size and strength to adapt to new trends and continue to grow for years to come.

Management

One of the most important Berkshire criteria is finding management with integrity. Without getting the opportunity to meet them, the next best way is to take a look at their compensation.

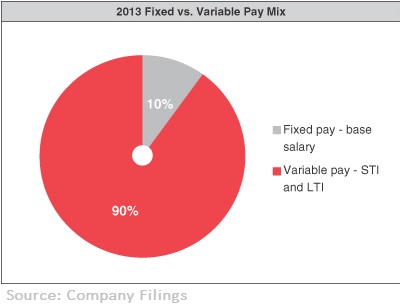

Most importantly, if you're not making money management better not be cashing in. As the chart below shows, only 10% of compensation is fixed. This means 90% of pay is based on short and long-term performance, and that's exactly what you'd hope to see.

How performance is judged, however, is just as critical. As a long-term investor I want management's pay to be most heavily based on long-term performance. At Verizon, 65% to 70% of incentive pay is determined by three-year cycles of total shareholder return (price appreciation plus dividends).

However, since everything in the stock market is relative, management's compensation also factors in how Verizon's total return compared to peer companies.

| Company | CEO Compensation (3-years combined) | Total Shareholder Return |

| Verizon | $53 million | 60% |

| AT&T | $67 million | 41% |

| Intel Corporation | $30 million | 36% |

| Microsoft | $4 million | 42% |

McAdam's isn't quite the steal Microsoft's Steve Ballmer is, but considering Verizon's near 60% total return from 2011 to the end of 2013 I believe the compensation is warranted.

To buy, or not to buy

Verizon's a titan of a company with a solid competitive advantage. It also has sizable 4% dividend yield, and it just got the ultimate endorsement by being added to the Berkshire Hathaway portfolio.

With that said, despite the company's 2% jump in the last week, I think think it's still a strong value and would be a solid addition to any portfolio.