Almost six months ago, Darden Restaurants (DRI 0.66%) announced that it would be tossing its Red Lobster restaurants back into the sea through a sale or spin-off. This proposal was met with skeptical reactions from the investing community, which failed to see how such a transaction could unlock shareholder value or fix the company's performance issues. In a written statement advocating a special meeting of Darden shareholders, activist shareholder Starboard Value (which owns 6% of Darden) argued that such a transaction would be "the wrong spin-off, at the wrong time, and for the wrong reasons."

Source: flickr.com

On May 16, Darden announced that it had agreed to sell Red Lobster to Golden Gate Capital for $2.1 billion ($1.6 billion net after tax). Shares of Darden fell on this news, since the announcement was considered to be contrary to the interests of shareholders.

A look at the sales price

Darden's press release announcing the sale focuses on the favorable impact on Darden's balance sheet that comes with a $1.6 billion infusion of cash. Debt will be reduced by $1 billion, $500-$600 million will be used to repurchase shares, and the new capital structure will allow Darden to maintain its $0.55 quarterly dividend.

These are all positive developments, but the case that the transaction maximized shareholder value is a bit weak. According to Starboard, the $1.6 billion in net cash to be received is only $100 million more than the value of the real estate to be sold to Golden Gate Capital. If these estimates are accurate, the sale price is simply non-sensical. Aside from the argument that the Red Lobster brand name itself may be worth that much, $100 million is less than half of Red Lobster's trailing twelve-month EBITDA.

If Darden's management had simply followed Starboard's advice to spin-off or sell the underlying real estate assets, Darden shareholders would have both $1.5 billion in cash and the ongoing operations of Red Lobster.

Panic to sell a distressed asset

Yes, Red Lobster has had its share of difficulties in recent years. These difficulties were certainly highlighted in the most recent quarter, in which Red Lobster reported an 8.8% decline in comparable restaurant sales.

However, selling Red Lobster solves only part of the problem. Olive Garden, which will represent 60% of Darden revenue after the sale is closed, is in a similar position. A stale concept in a highly competitive (and shrinking) casual full-service market, Olive Garden reported a 5.4% decline in comparable restaurant sales last quarter. Many would argue that the situations at Red Lobster and Olive Garden are quite similar, so selling one of the stagnant brands while keeping the other doesn't really fix the larger problem.

A missed opportunity to deliver value

When selling a business, management should be seeking an excellent sales price or have a sound strategic reason for entering into the transaction such as a desire to focus on a core business or stockpile cash for another transaction. At a price less than the sum of the estimated value of the underlying real estate and trailing EBITDA, the sale of Red Lobster for $1.6 billion in net cash is definitely not a sale resulting from a buyer willing to pay an "excellent" valuation. Likewise, the sale doesn't change Darden's strategic focus; after completion of the sale, Darden will still have 60% of its revenue generated from a stagnant, low-growth concept (Olive Garden).

Starboard had an interesting idea with its proposal to unlock shareholder value buried within the real estate assets of Darden. Another idea would have been the spin-off of some (or all) of Darden's high-growth concepts. Such a move would provide current shareholders with ownership in two separate companies that have very different investment characteristics. Olive Garden (and Red Lobster) would continue to appeal to income investors looking for stable, low-growth restaurants that can reliably generate a dividend yield of 4%.

Meanwhile, the spin-off of some or all of Darden's high-growth concepts to current Darden shareholders would create a hot growth stock. With the ability to grow the number of locations multiple times the current restaurant count, such a company would attract an entirely different audience within the investing community while also commanding a significantly higher valuation than Darden because of this tremendous growth potential. That growth potential and the corresponding premium valuation continue to be lost within Darden following the sale of Red Lobster given the much larger size of Olive Garden compared to any of the company's other brands. Growth investors that follow Peter Lynch's advice to "investigate whether the product that's supposed to enrich the company is a major part of the company's earnings" will continue to steer clear of Darden's Specialty Restaurant Group for as long as it continues to be a small fraction of the total company.

For example, the spin-off of Darden's 53 Capital Grille locations would likely fetch a valuation similar to the 40-location Del Frisco's Restaurant Group (DFRG). Del Frisco's occupies a position similar to Capital Grille's within the fine dining market, which is experiencing solid growth. Del Frisco's commands a market capitalization over $600 million; a similar valuation for Capital Grille would equate to almost 10% of Darden's current market capitalization of $6.6 billion. In this simplified example, spinning off 2% of Darden's restaurants could create a company worth 10% of Darden's current market capitalization. Alternatively, Darden could sell or spin-off its entire Specialty Restaurant Group, which also includes brands such as Bahama Breeze and Seasons 52. Such a combination could unlock value by creating a stand-alone company with significant growth potential: the Speciality Restaurant Group doubled revenues from $500 million in 2011 to $1 billion in 2013, and would certainly command a higher valuation multiple than shares of Darden.

Alternatively, Darden could sell or spin off its LongHorn brand to unlock the potential of one of the leading national steakhouse chains. LongHorn's 453 locations, rapid growth, and positive comparable restaurant sales are very comparable to Texas Roadhouse (TXRH 0.06%), a stand-alone steakhouse with a track record of success. For a sense of scale, Texas Roadhouse and its 425 restaurants command a market capitalization of $1.8 billion.

Darden continues to lag the market

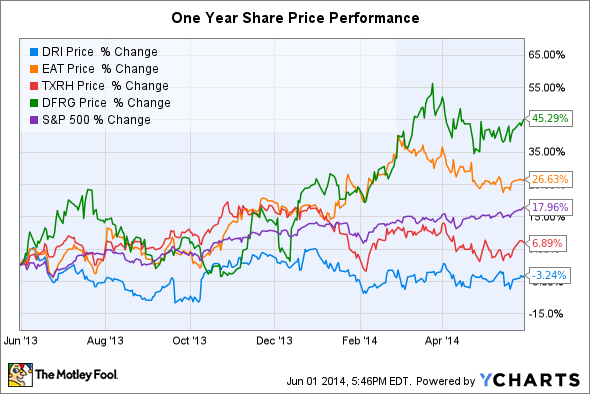

With the weight of its two largest brands reporting declines in comparable restaurant sales and management's misguided attempts to "unlock value," it should be no surprise that shares of Darden continue to lag its peers as well as the market:

Selling Red Lobster at a lackluster price is not a catalyst that is likely to turn around this under-performance. Until Darden's LongHorn and/or Specialty Restaurant Groups become independent companies, there are far better investment options within the casual and fine dining markets. Look to Del Frisco's, Texas Roadhouse, or any number of fast-growing fast casual restaurants as better investment alternatives than Darden.