Anyone wondering about the state of play in the economy should keep a close eye on the commercial construction sector in the U.S. While, the recovery in the U.S. residential market is likely to moderate from its torrid pace last year, the commercial construction sector has yet to really take off at all. In this regard, Caterpillar (CAT +0.00%), Johnson Controls (JCI +0.97%) and NCI Building Systems (NCS +0.00%) are all interesting to look at for clues as to if and when the sector will meaningfully contribute to economic growth again.

Caterpillar and Johnson Controls

At first, they may appear to be a disparate collection of business to look at, but all three have a specific exposures to the industry. Moreover, as outlined in a previous article they all looked like they were giving somewhat conservative guidance in their results in the first calendar quarter. Now that the second calendar quarter results are in, what are they saying about the state of the industry?

Caterpillar's results and guidance were the most positive overall, as the company upgraded its full-year forecast for construction machinery sales from 5% to 10%. Essentially, Caterpillar's construction machinery sales are receiving a boost from an inventory rebuild by its customers after they ran down inventory in 2013. On a positive note, management also outlined on the conference call, that there had been an increase in end-user demand -- a good sign for the industry.

However, Johnson Controls's results were not so positive for the sector. Johnson Controls has a building efficiency segment which sells heating, ventilation and air conditioning, or HVAC, equipment. Its management used words like "frustrating" when talking about the commercial HVAC market on the recent conference call The interesting thing about Johnson Controls is that it's generating margin improvements in its building efficiency segment -- implying that it's operationally leveraged when a pickup occurs.

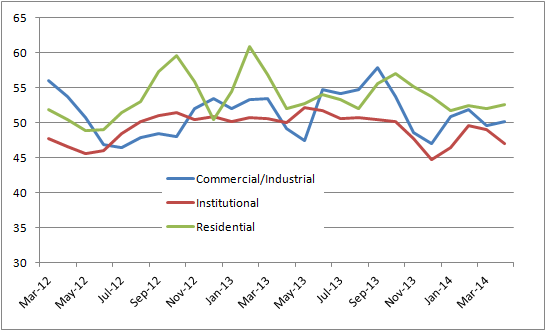

In fact, the negative commentary from Johnson Controls mirrors the weakness demonstrated in the Architectural Billings Index from the American Institute of Architects.

Source: American Institute of Architects

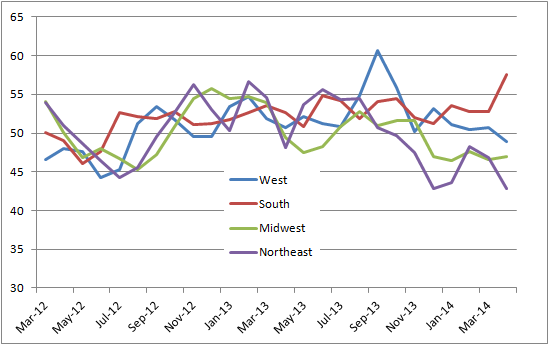

However, a lot of the recent weakness is likely to be weather related. Indeed, looking at the regional breakdown reveals that the South and West regions of the U.S. are doing better in terms of construction activity. In other words, the worst weather affected regions underperformed the most. Indeed, the regional disparity was also outlined in the recent results of Home Depot and Lowe's Companies.

Source: American Institute of Architects

NCI Building Systems

The company's focus is on non-residential construction activity in the U.S., so its color on the sector is particularly interesting. Its recent results were mixed with disappointing results balanced by some positive commentary on future growth prospects. NCI's management had previously expected its second quarter margins to be similar to last year's , but gross margins actually came in with a 120 basis point decline to 19.5%. However, it turns out that weather related disruptions affected its gross by 130 basis points.

Weather was obviously a bigger factor than previously anticipated, but the good news is that margins sequentially recovered through the quarter. Quoting from management on the conference call: "[M]argins sequentially recovered each month strengthening a 130 basis points from February to March and an additional 90 basis points from March to April. And finally sequential monthly improvement has continued into May..."

In addition, management disclosed that bookings in its building systems segment -- its most cyclically exposed -- were up 8% in April and then 28% in May. Clearly, some of this is going to be a release of pent-up demand caused by the weather. However, when pushed on the issue on the conference call, company CEO Norman Chambers estimated that at least half of the company's work in early May were new jobs, rather than pent-up demand.

Where next for Caterpillar, Johnson Controls, and NCI Building Systems

All told, the indications are for an improvement in commercial construction in the second half. Caterpillar's outlook was positive, but the company's revenue base is more global, and it has to deal with a difficult mining market, too. NCI Building Systems' anecdotal guidance, bookings trends, and sequential improvements in margins suggest that it is going to have a strong second half, and that the market could be about to get better on an underlying basis. And finally, Johnson Controls could be set for some good news in the second half, particularly if it continues to generate margin improvements in its building efficiency segment.