Breaking up isn't always easy, but Duke Energy (DUK 0.88%) is proving that it is possible to move on. The power generator was once in love with coal, even though the U.S. Environmental Protection Agency tried to tell it how coal was dirty and that the company could do much better. Unfortunately, the EPA just couldn't get through to Duke Energy, which generated 48% of its power from coal in 2010. That's when the agency decided to take a tougher stance.

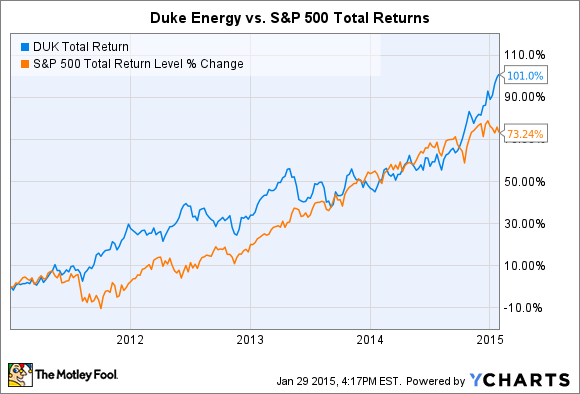

In 2011, the EPA announced tough new air pollution controls on nitrogen oxides and sulfur oxides. As a result of the emissions mandates, Duke Energy started closing coal power plants and became more interested in cleaner natural gas, which wasted no time helping push coal out the door. At the time, many doubted if the power generator would ever recover. After all, it depended on coal for nearly half of its power output. But in the subsequent four years the company has made strides to modernize its generation portfolio with newer, cleaner, and more profitable assets. In fact, Duke Energy stock has doubled since it began breaking up with coal in 2011.

DUK Total Return Price data by YCharts.

The company's rebound has been nothing short of spectacular, no doubt aided by shedding 3,800 megawatts of coal capacity. However, Duke Energy still owns nearly 19,500 MW of coal generation that produces about 39% of its power. That dependence will soon become a greater risk once the EPA's tough new carbon dioxide emissions regulations go into effect in 2020, although companies must present their long-term plans by summer 2016. Is Duke Energy's rebound at risk?

Regulations keep on comin'

Cheap natural gas and stricter air pollution limits on toxic emissions have placed economic pressure on many coal power plants. While scrubber equipment can be installed to remove pollutants from the emissions vented into the atmosphere, it sometimes makes more economic sense instead to close a coal power plant a few years ahead of schedule. The decision varies from facility to facility, as demonstrated by Duke Energy's actions. In addition to closing nearly 3,800 MW of coal capacity since 2011, it has added advanced scrubber technology to 22 coal-fired units in the last decade to extend their useful lives in the midst of new regulations.

Duke Energy has invested over $7 billion in scrubber systems since 2004 in response to state and federal air pollution regulations. It's an admirable effort, but, the EPA last year proposed adding a few more hoops to jump through. The Clean Power Plan is intended to slash carbon dioxide emissions from the power sector 30% from 2005 levels by 2030. Thanks to coal power plant closures in response to air pollution mandates in 2011, the United States is actually already one-third of the way to its goal.

The bad news is that the bulk of the remaining carbon dioxide reductions are once again expected to come from coal. In response to the Clean Power Plan, Duke Energy has highlighted plans to close an additional 2,800 MW of coal generation if needed. That should drop its total dependence on coal to around 36%, although natural gas and renewable energy additions will dilute that contribution even further. What level of exposure should investors be looking for?

The company's dependence on coal has roughly tracked that of the entire United States over the years. When Duke Energy owed 48% of its power output to coal in 2010, the United States' dependence stood at 45%. Today coal contributes 39% for each. It might be an imperfect or oversimplified measure, but since both entities need to shed more coal capacity in the next 15 years, it could be a simple way to gauge what level of exposure is considered "safe." At the moment, the company appears to be right on track to mitigating risk to investors and ensuring it keeps up with the latest regulations.

What does it mean for investors?

Investors and analysts have been very happy with Duke Energy's rebound since it began breaking up with coal in 2011. While a merger with Progress Energy grew assets and earnings potential, divestments from coal power and investments in cleaner natural gas and renewable energy have boosted shareholder confidence in management's execution. There's plenty of work ahead to keep up with new emissions regulations, but power generators aren't (usually) as inflexible as the individual industries in which they operate.

Why? Because they can diversify across several power sources, while there's little coal can do to economically clean up its act. That being said, investors have no reason to lose confidence in Duke Energy in light of the inevitable coal power plant closures that lay ahead. Remember, if you sold Duke Energy shares at the end of 2010 because of the troubles facing coal power, then you would have lost out on the opportunity to double your investment. You probably won't double your investment from here as quickly, but I think you'll be better off focusing on the long term once again.