LVMH's (LVMUY +0.76%) luxury watch brand TAG Heuer recently partnered with Google (GOOG +1.17%) (GOOGL +1.18%) and Intel (INTC 3.57%) to develop a luxury Android smartwatch.

Not much else is known about the watch, which the trio claimed "signifies a new era of collaboration between Swiss watchmakers and Silicon Valley." The device is clearly a response to Apple's (AAPL 1.29%) upcoming Apple Watch, which is expected to sell 10 million to 30 million units within the first year.

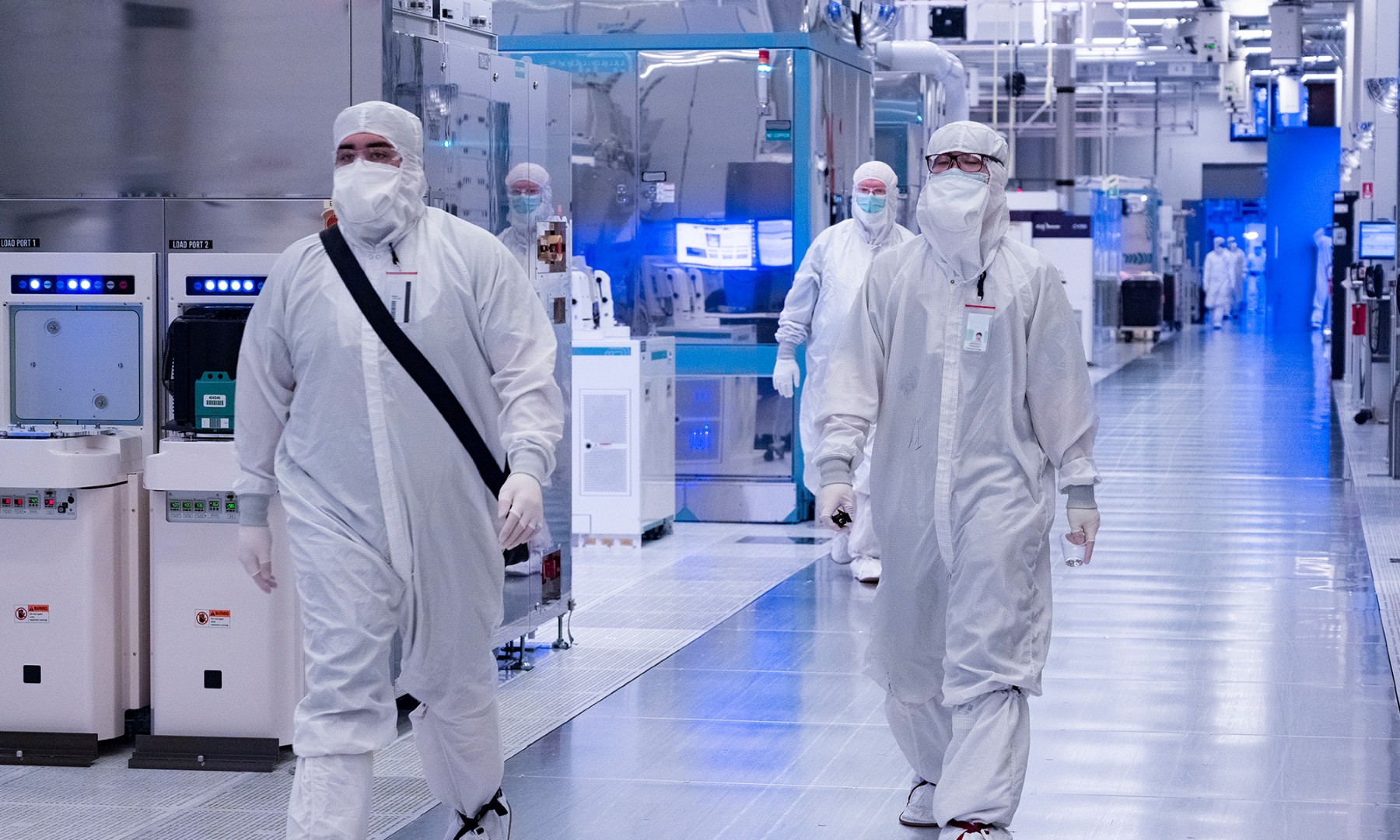

Source: TAG Heuer.

Let's look at Google and Intel's partnership with TAG Heuer, and whether the 155-year-old watchmaker can defend its core market against Apple.

A looming threat to Swiss watchmakers

When Apple unveiled the Apple Watch last September, Jean-Claude Biver, the head of TAG Heuer, told the German daily Die Welt the device had "no sex appeal" and looked like it was "designed by a student." A month later, Biver told the Swiss newspaper NZZ am Sonntag that he wanted "to launch a smartwatch at TAG Heuer, but it must not copy the Apple Watch."

Biver's comments were noteworthy because high-end Apple Watches could disrupt the luxury watch market. TAG Heuer watches, which generally cost between $2,000 and $10,000, account for a tenth of the world's luxury watches, according to the company.

Apple also poached Patrick Pruniaux, TAG Heuer's vice president of sales, as its new senior director of special projects last July. That move indicated Apple had its sights set on the high-end market, which was confirmed by the recent appearance of top-tier Apple Watches that cost between $5,000 and $17,000.

Apple Watch. Source: Apple.

Despite these developments, Biver dismissed the notion that the Apple Watch poses a threat to TAG Heuer. Speaking at the Baselworld watch expo, Biver declared, "The difference between the TAG Heuer watch and the Apple watch is very important. That one is called Apple and this one is called TAG Heuer."

The Apple Watch is more dangerous than TAG Heuer thinks

Biver believes consumers will never consider Apple to be a comparable luxury brand to TAG Heuer. In terms of the watch market, he might be right -- a 2014 report from Digital Luxury Group revealed that TAG Heuer was the third most searched-for luxury watch brand in the world, behind Rolex and Omega.

But if we look at China, the world's largest consumer of luxury goods, TAG's prospects look much dimmer. A recent survey from the Hurun Research Institute in Shanghai found that Apple was the top brand for gifting among China's richest men and women in 2014. Apple was the only electronics company that made the list, which included Louis Vuitton, Gucci, Dior, and Hermes. TAG Heuer didn't make the cut.

Why Google and Intel are helping TAG Heuer

Google and Intel are both looking to hitch a ride to the luxury market on TAG Heuer's coattails.

Last year, Google launched Android Wear, a slimmed-down version of its OS for smartwatches, but mainstream adoption has been sluggish. In 2014, Google's OEM partners only shipped 720,000 Android Wear devices among a total of 4.6 million wearable bands, according to Canalys.

Several OEMs -- including Motorola, Huawei, and LG -- have launched pricier Android Wear devices that cost over $300. Unfortunately, none of those brands can match Apple's luxury brand appeal. Therefore, having TAG Heuer launch an Android-powered luxury smartwatch could help Android Wear match Apple Watch's presence in the luxury market.

Huawei Watch (L) and LG's Watch Urbane (R). Source: Company websites.

Intel, which will provide the system-on-chip, or SoC, for the device, desperately needs allies to match ARM Holdings' presence in the smartwatch market. ARM previously crushed Intel in the smartphone market with its low-power designs, which it licenses to chip manufacturers. Many top smartwatches -- including Samsung's Gear devices and Pebble watches -- already use ARM-licensed chips.

In response, Intel partnered with Fossil to provide SoCs for upcoming Android Wear watches and launched its own health-tracking smartwatch, the Basis Peak. Partnering with TAG Heuer is a clear extension of that strategy.

The verdict

Revenue at LVMH's watch and jewelry division -- which includes TAG Heuer, Bulgari, Hublot, Zenith, and Christian Dior -- rose 3% year over year in 2014 and accounted for 9% of the company's top line. Apple Watch, which Strategy Analytics expects to capture over half of the global smartwatch market this year, is a dangerous wild card that could cause LVMH's watch and jewelry sales to dip, as they did in 2013.

TAG Heuer, Intel, and Google were wise to team up to strengthen their defenses against Apple Watch, but it might not be enough to counter widespread disruption in China and other lucrative luxury markets.