Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

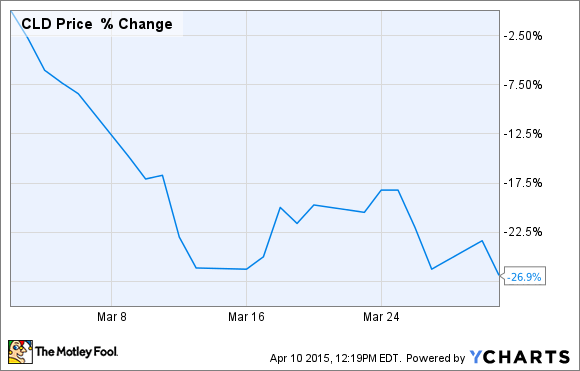

What: Bankruptcy fears continue to pummel coal stocks, sending them down in March. Cloud Peak Energy's (CLD) stock was swept up in these fears, which is what helped to fuel its devastating 26.9% sell-off in March.

So what: In mid-March, Macquarie Research warned investors that the outlook for U.S. coal producers was becoming "increasingly bleak." Worse yet, the company warned that the sector was about to get swept up in a "wave of bankruptcies." The company also lowered its 2015 and 2016 metallurgical coal price target by $5 per ton, and said that there could be even more downside to U.S. coal prices, which are decoupling from international prices. This will likely result in more production cuts from producers, and bankruptcies during the near-to-medium term.

Cloud Peak Energy isn't in as bad a shape as some of its peers. That's why Macquarie actually reiterated its neutral rating on Cloud Peak Energy, and kept its $8 price target. However, the company cut its price target on many other coal stocks, which soured investors on the whole sector. The concern is that, once one coal stock goes belly up, it could cause more dominoes to fall, with no one knowing how many coal companies could collapse.

Now what: There's just not a lot to like about coal stocks right now. The outlook is awful, and there are no real signs that a turnaround is on the horizon. That suggests there could be a whole lot more downside in Cloud Peak Energy, as its stock trades alongside its beleaguered peer group.