Sotheby's New York offices. Source: Wikimedia Commons.

In a world in which auctions have become a commonplace event, Sotheby's (BID +0.00%) has maintained its panache as a high-profile auctioneer of some of the most impressive artworks in the world. Yet just as competition spurs auction bids higher, it also threatens Sotheby's once-dominant position among top auction companies, and coming into Monday morning's first-quarter financial report, shareholders weren't certain whether the company would post a profit in light of declining revenue. The auction house defied those gloomy worries, though, with cost-cutting efforts helping Sotheby's make the most of what revenue it did collect. Let's take a closer look at Sotheby's and its latest results.

Sotheby's makes more from less

Sotheby's results were a positive surprise across the board. Revenue dropped just less than 1% to $155.7 million, but that was still better than the greater than 3% drop in sales investors had expected. More important, more of those sales fell through to the bottom line: Sotheby's earned adjusted net income of $7.4 million, reversing a year-ago loss and equating to adjusted earnings of $0.11 per share, well above the breakeven results that most of those following the stock had anticipated.

Sotheby's revenue mix once again showed how the auction house's business has evolved over time. Revenue from acting as agent for sellers at auction posted a modest gain of about 4%, but Sotheby's revenue earned as principal dealer was cut in half from the year-ago period, more than offsetting the agency-revenue gain. Sotheby's finance segment continued its strong performance, with revenue more than doubling from the year-ago level to $12.7 million.

Where Sotheby's results really shone, though, was on the expense side of the ledger. Direct costs of agency auctions rose, but declines in salaries and other overhead costs helped Sotheby's reduce its total expenses by 10%, which in turn quadrupled operating income. In addition, with principal-dealer margin being the lowest in the company's three major segments, the favorable shift of business helped add to profits as well.

Newly installed CEO Tad Smith was pleased with Sotheby's performance. "Our company delivered significant profit growth in the quarter as compared to last year," Smith said in a press release, "through strong sales in Old Masters, Impressionist & Modern and Contemporary Art." Smith also echoed former CEO Bill Ruprecht's belief in the breadth and depth of Sotheby's history and experience.

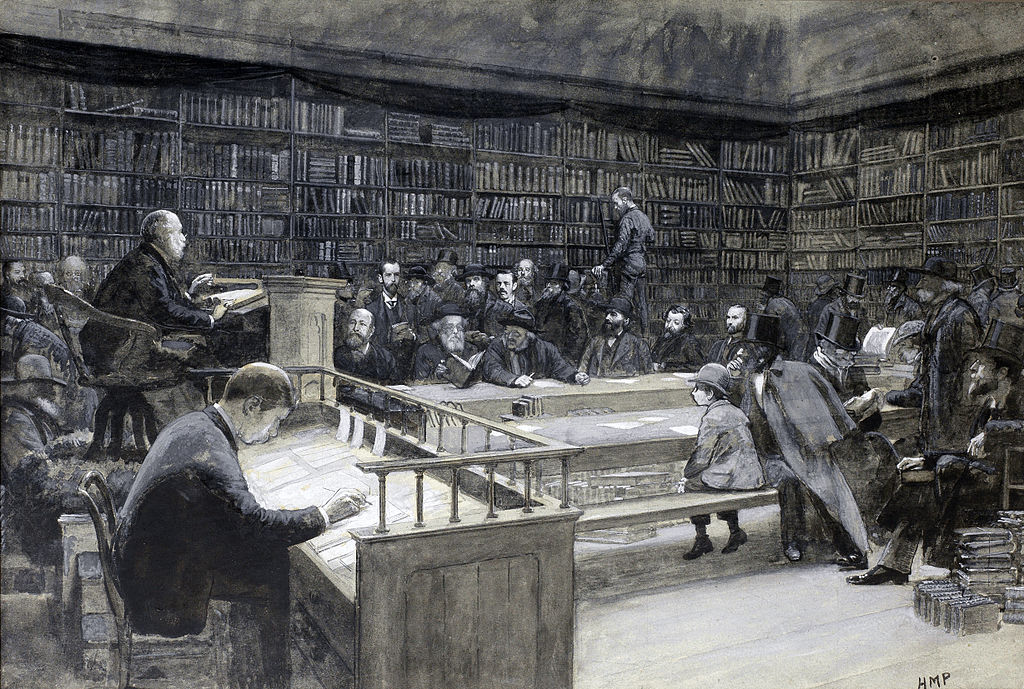

How Sotheby's got started. Image source: Wikimedia Commons.

What's up for bid next at Sotheby's?

Going forward, the most interesting question for Sotheby's is how Smith's tenure as CEO will change the way the company operates. Prior to taking his new position, Smith was CEO of Madison Square Garden (MSG +0.00%), which also has the name-brand recognition as a New York institution, and so investors hope Smith can use some of his enthusiasm for marketing and exciting events to liven up what many consider to be a staid and outdated corner of the retail industry. When he came on, Smith noted that "with its strong relationships in the art world, trusted brand, and exceptional team, Sotheby's has a very bright future," and that he believed that by embracing new technology, he could help Sotheby's investors over the long run.

Financially, Sotheby's is happy to put its CEO transition in the past. For the quarter, Sotheby's recognized about $4.2 million in pre-tax costs from the separation with the former CEO and the transition to the new leader, costing the company about $0.04 per share in earnings. Having paid Smith restricted stock awards worth about $9 million at current prices to make up for forfeited money from his previous employer, though, Sotheby's has invested a lot in its new CEO.

Still, the big problem for Sotheby's remains competition. Rival Christie's International has fought for the rights to sell the best-known artworks in a rapidly escalating price environment, and that could lead to long-term margin compression if either party decides to engage in a price war.

For now, though, Sotheby's has demonstrated that it can control costs in order to boost profits. The next step is for Sotheby's to further enhance its reputation and hopefully pull in more of the high-profile auction items that make or break companies in the industry.