Google (GOOG +2.87%) (GOOGL +2.90%) could soon add a "buy" button to its mobile search ads, according to a recent report in The Wall Street Journal. Today, Google's product listing ads link to external sites where the purchases are completed. If new buy buttons are added, a customer could complete the purchase within Google without navigating through merchant websites.

Source: Pixabay.

Buy buttons are aimed at strengthening Google's position in product searches against Amazon (AMZN +1.43%).

Every time a user starts at Amazon or other e-commerce sites, Google loses potential ad revenue from a retailer's search ad. Last year, Google chairman Eric Schmidt admitted that "almost a third of people looking to buy something started on Amazon... more than twice the number who went straight to Google."

Turning retailers into faceless order takers

In a recent note to investors, Baird Equity Research analysts claimed that the buy button would help Google in three ways: widen its defensive moat against e-commerce rivals like Amazon, boost the value of its mobile ads, and provide Google with more user data regarding buying habits.

Unfortunately, what's great for Google might not be so great for retailers. With buy buttons, Google is basically attempting to build its own e-commerce while rendering merchant sites obsolete. That could diminish their identities, weaken their relationships with individual shoppers, and basically turn them into faceless order-takers.

To address those concerns, Google's order pages will be heavily branded for individual retailers. Google will also let customers opt-in to the retailer's marketing emails during the checkout process. However, retailers who hoped that a single click-through to the site would lead to prolonged leisurely and multiple purchases could be out of luck.

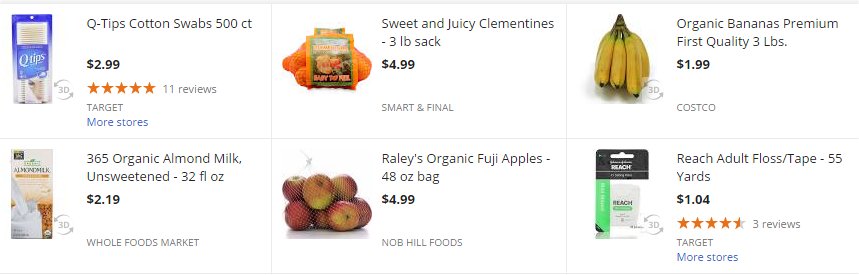

This isn't the first time Google has united retailers under a common umbrella. Its same-day delivery service, Google Express, uses contract drivers to deliver goods from brick-and-mortar retailers like Costco, Target, and Barnes & Noble to homes. Those orders are all processed within Google's ecosystem without visiting external sites.

Google Express. Source: Google.

Why Amazon isn't losing any sleep

However, Google lacks an effective way to counter Amazon Prime, the annual subscription service that has become the heart of Amazon's growing ecosystem.

For $99 a year, Amazon Prime customers get free two-day shipping on select items, discounts, free streaming of select media content, free e-books from the lending library, unlimited cloud photo storage, and other benefits. In areas served by Prime Fresh, $200 more per year gets free same-day and early morning delivery for purchases over $50.

Amazon Prime. Source: Amazon.

Amazon expands its reach of the Prime ecosystem by selling cheap devices like Kindle tablets and Fire TV set-top boxes at low margins.

Last September, RBC Capital estimated that Amazon Prime had 50 million members, up from 20 million last January. The company also estimates that Prime members spend 68% more annually than non-Prime members on Amazon products and services.

Google's benefits are far less lucrative. Google Express members can pay $95 per year, or $10 per month, for unlimited same-day deliveries of purchases over $15. There aren't any added perks for free media streaming, digital content, or cloud storage. Therefore, the only way Google can convince customers to stop visiting Amazon for product searches is to halt the growth of Prime -- which could be a nearly impossible task.

The key takeaways

Google's buy button might slightly boost the value of its mobile ads and improve its position in product searches, but I doubt it will slow Amazon down. If retailers feel like Google is cutting them out of the loop and turning them into faceless order-takers, the initiative could backfire and hurt mobile ad sales.

Google's blind spot in product searches against Amazon is similar to its weakness in social networking against Facebook (FB +1.59%). Both Amazon and Facebook are drawing visitors away from Google's main site, which diminishes the value of its search engine and ads. In response, Google is superficially imitating their strategies, yet failing to build lasting ecosystems that complement its core competencies of search and advertising.