A company's accounting profit, better known as its net income, strongly influences its stock price. Investors focus on this number, which is calculated by subtracting all expenses from revenue, more than any other performance metric. Let's take a look at how to calculate accounting profit and learn about other related metrics.

How to calculate accounting profit

How to calculate accounting profit

The best way to explain how to calculate accounting profit is to provide and work through an example.

| Revenue | $200,000,000 |

| Cost of Goods Sold | $ 50,000,000 |

| Gross Profit | $150,000,000 |

| Sales and Marketing | $ 10,000,000 |

| Payroll | $ 5,000,000 |

| Rent | $ 25,000,000 |

| Depreciation | $ 2,500,000 |

| Operating Profit | $107,500,000 |

| Interest | $ 5,000,000 |

| Taxes | $ 38,000,000 |

| Net Income (Accounting Profit) | $ 64,500,000 |

This company's revenue for the reporting period is $200 million. Its gross profit, which is revenue minus the direct costs of making the company's product, otherwise known as cost of goods sold, is $150 million. Subtracting fixed costs, such as rent or marketing that do not vary with how much product the company makes, from the company's gross profit yields an operating profit of $107.5 million. The company's accounting profit or net income of $64.5 million is equal to the $107.5 million operating profit minus non-operating expenses such as interest payments on debt and taxes.

Accounting profit versus economic profit

Accounting profit versus economic profit

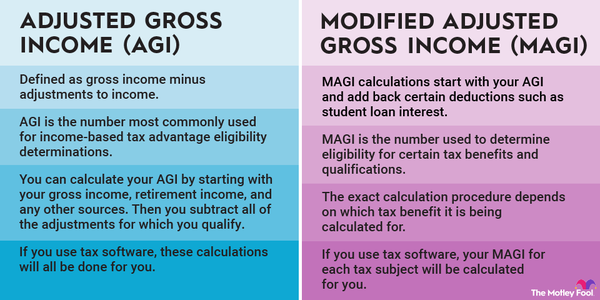

Economic profit is accounting profit minus opportunity cost. Opportunity cost is what the assets invested in the business could have earned in a different investment. If a company's opportunity cost is more than the accounting profit, then the money invested in the business could have been put to better use in a different way.

Although the Securities and Exchange Commission (SEC) requires companies to report accounting profit, economic profit can be a more useful number to calculate if you're trying to decide if a company is using its resources wisely.

Both accounting and economic profit are calculated using explicit costs — that is, expenses actually incurred. But economic profit also considers implicit cost, which is the fancy accounting term for opportunity cost .

If a company is always incurring economic losses, then its stock is likely to underperform over time. Eventually investors will opt for better-performing investments.

Opportunity Cost

Accounting profit versus underlying profit

Accounting profit versus underlying profit

Many managers have qualms with accounting profit because they believe that it understates the true income of the business. Even Warren Buffett has criticized how Berkshire Hathaway (BRK.A -0.28%) (BRK.B -0.68%) is required to report accounting profit. Companies prefer to focus instead on underlying profit, sometimes called pro forma income. Underlying profit is accounting profit with one-time payments subtracted or expenses added.

A fast-growing tech company might add back stock compensation expenses and other growth-oriented costs. Insurance companies tend to add back catastrophic losses. But you should be suspicious of underlying profit numbers since accounting profit is reported for a reason. For the most part, it accurately reflects the profits of a business.

Over time, accounting profit should closely resemble underlying profit for most industries. If a company is reporting substantially different numbers each year, then it's prudent to find out why.

Accounting profit versus cash flow

Accounting profit versus cash flow

Accounting profit is also different from cash flow. Many investors use cash flow numbers when valuing a company because they better reflect how the business is doing. Companies can manipulate their accounting profits to a point, but how much cash they have is a clear indicator of their financial position.