It's important to realize that the method you use will produce the same end result for operating cash flow. It's also worth noting that cash flow statements generally provide a total of operating cash flow, as you'll see in the next section.

The other commonly used cash flow metric is known as free cash flow, which is defined as the company's net cash from operating activities (operating cash flow) minus its capital expenditures, which is listed in the investing activities section.

Free cash flow is an important metric because it shows the company's available cash generated during the time period, which can then be used to reinvest in the business, pay dividends, make acquisitions, repurchase stock, and for other desirable uses. Some businesses (airlines and oil companies, for example) can be rather capital-intensive, while others don't require a ton of ongoing capital investment. So, free cash flow can provide valuable insight into how much of a company's operating cash flow is actually available for use.

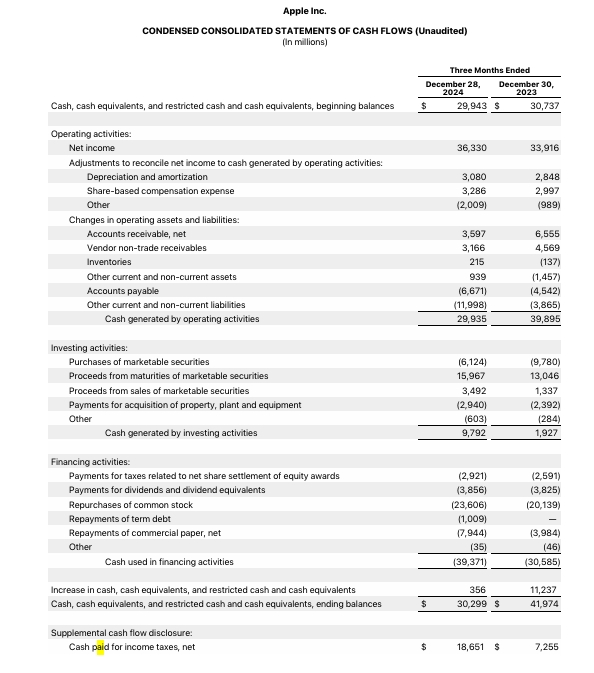

Example of a cash flow statement

To give you a better idea of what a cash flow statement looks like and how to use it in your investment analysis, here's a real-world example. This is Apple's (AAPL -1.66%) cash flow statement from the first quarter of its 2025 fiscal year.