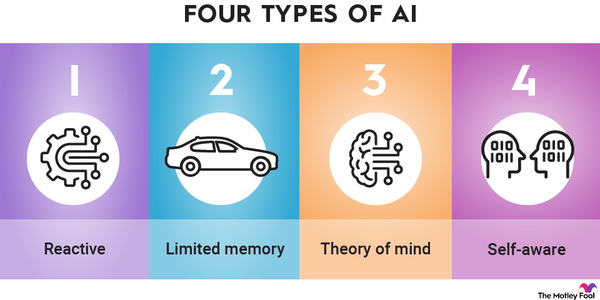

Computers excel at crunching numbers but not at the things many people do with ease, like language processing, visual perception, object manipulation, reasoning, planning, and learning. Artificial intelligence (AI), including its offshoots of deep learning and machine learning, uses computers to perform tasks that typically require human intelligence, such as language generation and facial recognition.

Machine Learning

How do companies use AI?

How do companies use artificial intelligence?

Artificial intelligence, or AI, is created through machine learning, which involves training a system with a tremendous amount of data. It then uses the trained system to make inferences about new data it's never seen.

The simplest example is a system designed to detect objects in images. Images containing those objects are provided to the system, which "learns" how to detect them in other images. The more objects it detects in images, the more accurate the detection system becomes.

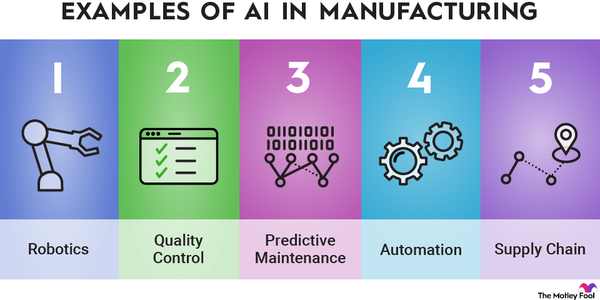

Companies employ AI in two main ways. Many tech companies use it to make their existing operations more powerful through such things as high-profile applications like robotics, self-driving cars, and virtual assistants. AI is used by Alphabet subsidiary (GOOGL -1.97%) (GOOG -1.96%) Google to filter spam in Gmail, by Amazon (AMZN -1.65%) to recommend products to customers, and by Netflix (NFLX 1.74%) to guide content creation and recommendations.

More recently, OpenAI's ChatGPT has shown how far generative AI -- a division of artificial intelligence capable of generating texts, images, sounds, and ideas -- has come. It can capably answer questions directly, write poems, and has even passed bar and medical exams. The potential of such large language models is enormous.

Generative AI

Some companies also profit directly from AI by selling hardware, software, services, or expertise that the technology requires. These are true AI stocks and include those listed and described below.

5 AI stocks to buy in 2024

Five AI stocks to buy in 2024

| Company | AI Focus |

|---|---|

| NVIDIA (NASDAQ:NVDA) | Graphics chips and self-driving cars |

| Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) | Generative AI and self-driving cars |

| Microsoft (NASDAQ:MSFT) | Memory chips for data centers and generative AI tools |

| Amazon (NASDAQ:AMZN) | Voice-activated technology, cloud computing, and e-commerce |

| C3.ai (NYSE:AI) | Software-as-a-service used to provide enterprise-scale AI applications |

1. Nvidia

Leading graphics chip company Nvidia has taken advantage of the AI boom, with its graphics cards becoming the de facto standard in data centers worldwide. Machine learning's training phase demands a lot of computing power; the phase that follows, the inference phase, requires less. Graphics processing unit (GPU) chips, used primarily for rendering video games, support both phases well.

Nvidia's data center business now makes up the vast majority of the company's revenue, thanks to the emergence of generative AI. Because it sells the building blocks for AI infrastructure, Nvidia became the first major company to see a significant boost from AI as revenue doubled in the second quarter of 2023 and the stock soared in 2023 and well into 2024.

Its chips are popular for demanding workloads that applications like large language models require. The company also just announced an upgraded version of its AI computing platform, the HGX H200, which major cloud infrastructure services plan to deploy in 2024.

Self-driving cars are another area of focus. Nvidia develops hardware and software platforms that can power driver-assistance features and fully autonomous driving.

A self-driving car must process massive amounts of data from multiple sensors and cameras in real time, detect objects such as pedestrians and other vehicles, and make complex decisions. They require tremendous computing power -- and that's exactly what Nvidia's platform delivers.

Its professional visualization segment, which includes its omniverse, also has a lot of potential in AI. Nvidia's graphics cards could someday be supplanted by more specialized processors designed for AI, but the company is in an enviable position for now.

2. Alphabet

Alphabet has been preparing for the AI revolution for years, acquiring the AI research lab DeepMind in 2014. It's also among the leaders in autonomous vehicles through its Waymo subsidiary, which is now ferrying passengers in its driverless cars in cities like San Francisco and Phoenix.

Alphabet also launched Bard AI, its own AI chatbot, in response to ChatGPT, which was seen as a threat to Google Search. So far, concerns about a challenge to its search dominance seem to have been overblown.

With information at the heart of its business, it's unsurprising that the company has prioritized AI. It's rolled out AI tools for Google Cloud and Google Workspace, including a generative AI assistant that helps write emails. Even its customer acquisition strategy in the cloud is based around AI, as the company has targeted AI start-ups for its cloud infrastructure service.

AI also plays a role in improving its search engine and in YouTube, where it can pinpoint a relevant section of a video and direct users straight to it.

3. Microsoft

Microsoft has gotten a lot of buzz of late, thanks to its partnership with OpenAI. The tech giant began investing in the tech start-up in 2019 and recently invested another $10 billion in OpenAI following the launch of ChatGPT.

Microsoft unveiled a new version of its Bing search engine, powered by ChatGPT, and the company is racing to incorporate GPT features across its product portfolio, including its Azure cloud infrastructure service, Edge web browser, Office productivity software suite, Bing, and its Copilot for Microsoft365.

CEO Satya Nadella has repeatedly said that he sees AI as the next major computing platform, and the $10 billion investment in OpenAI is a sign of the company's conviction in AI and belief that it needs to lead that transition or get left behind as it did with mobile.

Microsoft is also harnessing the power of AI in other ways, including automated clinical documentation in healthcare to reduce paperwork and administrative needs. Additionally, it's using Azure to allow customers to build custom AI tools.

4. Amazon

Perhaps no company is using AI more widely than Amazon. Founder and executive chairman Jeff Bezos has long been an evangelist for AI and machine learning, and although Amazon started as an online retailer, technology has always been at the company's core.

Today, Amazon uses AI for everything -- from Alexa, its industry-leading, voice-activated technology; to its Amazon Go cashierless grocery stores; and its Amazon Web Services Sagemaker, the cloud infrastructure tool that deploys high-quality machine learning models for data scientists and developers. It also introduced Bedrock, a service for building AI applications; invested in Anthropic AI, the maker of the AI chatbot Claude; and designed its own AI chips, Inferentia and Trainium.

Amazon Bedrock

Amazon's e-commerce business is also built on AI, as algorithms run its top-flight recommendation engines for e-commerce and video and music streaming. In addition, Amazon uses AI to determine product rankings.

Even Amazon's logistics operations benefit from its AI prowess, which helps with scheduling, rerouting, and other improvements to delivery accuracy and efficiency. Drone delivery, which the company has long sought to implement, would be another AI application for the tech giant. It's difficult to quantify AI's impact on Amazon's business, but it's clearly a key component of the company's competitive advantage.

Throughout its history, Amazon has been at the forefront of emerging technologies such as e-commerce, e-books, cloud computing, video streaming, and voice-activated technology. AI provides much of the infrastructure that helps the company move into new businesses quickly and effectively.

5. C3.ai

C3.ai may be the closest thing on the stock market to a pure-play AI stock, as the "ai" in the company's name and ticker might indicate. While the companies on the list above are diversified tech giants or chipmakers that have some businesses involved with AI, artificial intelligence is the entire focus of C3.ai.

C3.ai is a software-as-a-service (SaaS company) whose software allows companies to deploy large AI applications. The company's tools help its customers accelerate software development and reduce cost and risk, and they have a wide variety of applications.

For example, the U.S. Air Force uses C3 AI Readiness to predict aircraft systems failures, identify spare parts, and find new ways to increase mission capability. European utility company Engie (ENGIY -0.52%) uses C3 AI to analyze energy consumption and reduce energy expenditures.

It's also launched its own generative AI suite, with enterprise search as the first product. Enterprise search allows customers to use a natural language interface to locate and retrieve relevant data across all of the enterprise's information systems.

C3.ai is the first mover in its industry and says it is unaware of an end-to-end enterprise AI development platform in direct competition with it. That unique positioning could make the company a big winner over the long term. However, the AI SaaS market is evolving and could attract competition from big cloud infrastructure services like Amazon or Microsoft.

Machine learning stocks

Machine learning stocks

All the stocks above use machine learning technologies, but if you’re looking for more options, here are two others worth considering:

- Alteryx (NYSE:AYX) is a provider of data analytics software that empowers data workers to solve problems with a wide range of analytics and data science tools. Its Alteryx Intelligence Suite, one of several products, offers machine learning capabilities, including automated modeling and natural language processing (NLP) to build models.

- DocuSign (DOCU 0.1%), an AI-powered leader in digital signature software, has made significant inroads into machine learning in recent years. In 2020, the company acquired Seal Software, an enterprise contract analytics company that uses machine learning for organizing and identifying risks and opportunities in contracts. For years, DocuSign has been building machine learning tools such as DocuSign Insight to help with contract analysis through NLP.

Deep learning stocks

Deep learning stocks

Deep learning is a subset of machine learning that uses artificial neural networks inspired by the human brain. It's the most advanced kind of AI and is crucial in technologies like self-driving cars. Deep learning is advancing in areas such as preventive healthcare, where predictive algorithms are necessary, and it differs from machine learning in that it doesn't require human input.

Deep Learning

Among the companies closely associated with deep learning is Nvidia, whose GPU chips use deep learning to power data centers and enable autonomous driving and cloud computing, among other functions.

Alphabet has exposure to deep learning through a number of its businesses, including its autonomous vehicle start-up, Waymo. It also owns DeepMind, a deep learning platform that can diagnose eye diseases, predict the shapes of proteins, and accelerate the scientific discovery process.

Related investing topics

AI is a growth business

AI is a growth business

Total spending on AI systems is forecast to reach $97.9 billion in 2023, up from $37.5 billion in 2019. For the five-year period ending in 2023, the AI sector is predicted to grow at an annualized rate of 28.4%.

With the AI market already large and still growing quickly, plenty of companies can profit from AI. Although picking stocks in a growth industry comes with a lot of uncertainty, these top AI stocks are all worth considering.

FAQs

Frequently Asked Questions

What is the best AI stock to buy?

Artificial intelligence is a fast-moving technology, and AI stocks will likely be volatile as the sector evolves. Some AI stocks that have attracted the most attention include Nvidia, Microsoft, and Alphabet, but finding the best stock to buy is also a matter of price and valuation, which changes quickly.

Is it good to buy Nvidia stock?

Nvidia has jumped into the lead among semiconductor companies in making AI chips and accelerators, but the space is changing rapidly, and competition is coming from Advanced Micro Devices and others. The semiconductor sector can also be highly cyclical, and pricing can change rapidly. If Nvidia can maintain its lead in AI chips, the stock should continue to be a winner, but the stock will likely be volatile as the AI landscape is still developing.

What is the biggest AI company?

Currently, the biggest company that has made AI central to its business model is Microsoft, which has a market cap approaching $3 trillion. The tech giant is a major investor in OpenAI and has used its technology in a wide range of products, seeing it as a way to add value for customers, charge a premium, and stay ahead of the competition.