Social Security represents more than just a monthly check for most retirees. To many, it's a financial lifeline that surveys and studies have shown they'd struggle to make do without.

For 23 consecutive years, national pollster Gallup surveyed retirees to determine how important their Social Security income was to covering their expenses. Every year, no fewer than 80% of respondents noted it was necessary, in some capacity, to cover their costs.

A separate analysis from the Center on Budget and Policy Priorities found that Social Security pulled 22 million people above the federal poverty line in 2023, including 16.3 million adults aged 65 and above. If the Social Security program didn't exist, the poverty rate for this group would be nearly four times higher (37.3%, estimated) than it was in 2023 (10.1%).

Image source: Getty Images.

For lawmakers, ensuring the financial health of Social Security should be of paramount importance. But based on the latest Social Security Board of Trustees Report, America's leading retirement program is on anything but stable ground.

Social Security benefit cuts are expected to become a reality by 2033

In January 1940, the Social Security program doled out its very first retired-worker benefit. Since then, the Social Security Board of Trustees has published an annual report intricately detailing how the program generates income, as well as where every dollar in outlays ends up.

But what tends to garner even more attention is the Trustees' forecasts of what's to come for Social Security. Specifically, the short- (10-year) and long-term (75-year) projections, which are regularly updated to reflect fiscal policy changes, monetary policy shifts, and an assortment of demographic adjustments.

Last week, the 2025 Social Security Board of Trustees Report was released -- and it contained some rather chilling news for current and future retirees.

To begin with, the program's long-term unfunded obligation continues to widen. Every annual report since 1985 has pointed to a 75-year funding deficit between projected income to be collected and forecast outlays, which includes annual cost-of-living adjustments (COLAs). In present-day dollars, discounted to Jan. 1, 2025, this 75-year deficit stood at a staggering $25.1 trillion.

However, the more worrisome news is the short-term forecast for the Old-Age and Survivors Insurance trust fund (OASI). This is the fund responsible for doling out monthly benefits to retired workers and survivors of deceased beneficiaries.

The OASI's asset reserves are projected to run dry by 2033. US Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

Beginning in 2021, the OASI began outlaying more in benefits than was being collected in income. This outflow from the OASI's asset reserves is expected to grow with each passing year. By 2033, the OASI's asset reserves are projected to be completely exhausted.

Before going any further, let's make clear that the OASI doesn't need a penny in asset reserves to remain solvent and continue to pay benefits to eligible recipients. With the lion's share of Social Security income collected from the 12.4% payroll tax on wages and salary, there will always be income to disburse to qualified beneficiaries.

But if the OASI's asset reserves are depleted in eight years, as the latest Trustees Report predicts, the current payout schedule, inclusive of COLAs, won't be sustainable. The Trustees are forecasting a 23% cut to payouts may be necessary for retired workers and survivor beneficiaries by 2033 -- this is up from an estimated 21% cut outlined in the 2024 Trustees Report -- to sustain monthly benefits without the need for any further reductions through 2099.

Image source: Getty Images.

Social Security's worsening financial outlook boils down to these factors

With Social Security providing a financial foundation to retirees for more than eight decades, the obvious question for current and future retirees is simple: How did Social Security get into this mess?

What can be said with certainty is that "congressional theft" and "undocumented migrants receiving traditional Social Security benefits," which are two common myths/scapegoats mentioned by some people online, are the wrong answers.

Rather, Social Security's worsening financial outlook is a function of numerous ongoing demographic shifts, as well as inaction on Capitol Hill.

Some of these shifts are well-documented and understood by the public. For example, baby boomers reaching retirement age and leaving the workforce in larger numbers are weighing down the worker-to-beneficiary ratio. Likewise, people are living longer today than they were when Social Security initially began paying retired-worker benefits in 1940. To be somewhat blunt, the program wasn't designed to dish out payments to retirees for two or more decades, as is somewhat commonplace today.

But a number of these demographic shifts aren't nearly as visible -- nevertheless, they're playing a key role in weakening the program.

For starters, the U.S. fertility rate (i.e., hypothetical lifetime births per woman) hit an all-time low in 2023. A laundry list of factors, ranging from people waiting longer to get married and have children, to concerns about the health of the U.S. economy, have reduced the number of children being born and will, eventually, weigh down the worker-to-beneficiary ratio.

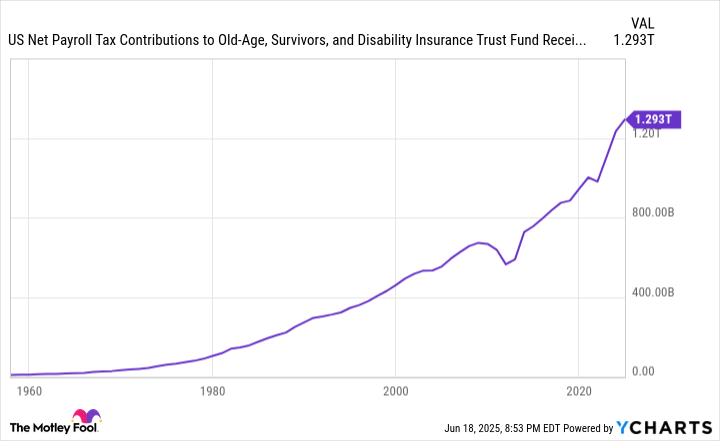

The 12.4% payroll tax on earned income generates the bulk of the income collected by the OASI and Disability Insurance trust fund, combined. US Net Payroll Tax Contributions to Old-Age, Survivors, and Disability Insurance Trust Fund Receipts data by YCharts.

Rising income inequality is another issue for Social Security. Based on data from the Social Security Administration, approximately 90% of all earned income (wages and salary, but not investment income) was subject to the 12.4% payroll tax in 1983. By 2023, only 83% of earned income was subject to this program-funding tax. In simple terms, the wages and salaries for high earners have been increasing at a faster pace than the National Average Wage Index, which determines the upper range of earned income exposed to the payroll tax. In short, more earned income is escaping the payroll tax as time passes.

Insufficient net migration into the U.S. has been problematic, too. Social Security relies on younger people migrating to the U.S. and contributing to the program for decades via the payroll tax before earning a retirement benefit for themselves one day. Since 1997, the net migration rate into the U.S. has dropped off dramatically.

The final culprit is the aforementioned lack of action by lawmakers in Washington, D.C. Although plenty of bills have been proposed, the cavernous ideological gap between Democrats and Republicans on Capitol Hill as to how best to strengthen Social Security has led to an ongoing stalemate.

If there's a silver lining here, it's that lawmakers do have a knack for coming to Social Security's rescue in the 11th hour. But the longer Congress waits to tackle this issue, the costlier it's going to be on working Americans to fix.