Each year, the IRS adjusts certain figures to keep up with inflation, and one of them is the standard deduction. And we just got updates for 2026 for this and most other inflation-dependent IRS numbers.

As you might expect, the standard deduction for 2026 will be a little higher than it was in 2025. Here's a rundown of how much the 2026 standard deduction is, and what it could mean to Americans who earn $100,000 per year.

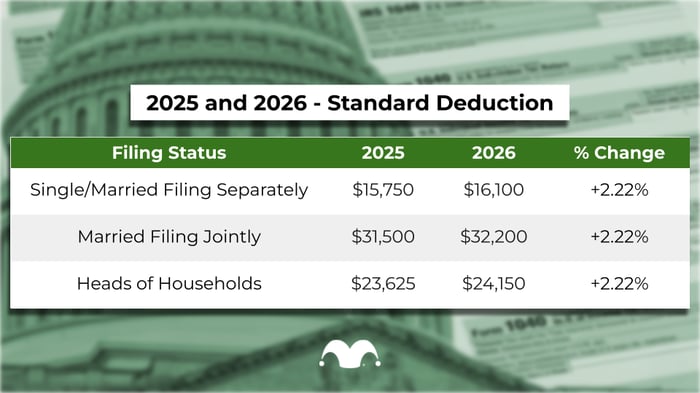

Image source: The Motley Fool.

The 2026 standard deduction

To be clear, the 2026 standard deduction applies to income you earn in 2026 but is for the tax return you'll file in 2027. The 2025 standard deduction applies to the federal income tax return you'll file next year.

Let's get right to it. For the 2026 tax year, the standard deduction is increasing. For single taxpayers, it is rising from $15,750 to $16,100, and for married couples filing jointly, the standard deduction will increase from $31,500 to $32,200. Of course, many people will choose to itemize deductions, especially those who pay lots of mortgage interest, healthcare expenses, and other itemizable expenses. But most American taxpayers use the standard deduction every year.

So, if you make $100,000 per year and are single, the short version is that the higher standard deduction will lower your taxable income from $84,250 in 2025 to $83,900 in 2026. If you're a married couple and file a joint tax return, your taxable income will fall from $68,500 for 2025 to $67,800 for 2026. In other words, single and married taxpayers will see their taxable income fall by $350 and $700, respectively.

Of course, this assumes your income stays the same from year to year, so if you get a raise, it could more than offset the impact of the higher standard deduction (but that would be a good problem to have!).

The 2026 tax brackets matter, too

It isn't just the higher standard deduction that could potentially lower your tax bill. In addition, the IRS has adjusted the tax brackets for 2026. And without going through an entire mathematical example of how the income tax brackets are applied, the key takeaway is that they have all been adjusted higher.

Just as one example, the lowest (10%) marginal tax rate will apply to the first $24,800 in taxable income for married couples, up from $23,850 in 2025. The 12% bracket will apply to income greater than this amount but less than $100,800, up from a threshold of $96,950 in 2025 before higher rates are applied.

Again, I'll spare you the math. But a married couple with income of $100,000 in 2026 that takes the standard deduction would pay a little over $100 less in taxes than a couple of the same income would in 2025, all other factors being equal. In other words, the effective tax rate on $100,000 of income would be slightly lower than it is now.

There are other variables that could change your 2026 taxes

To be sure, even if we fully consider the effects of the standard deduction and tax brackets on your 2026 taxes, there are several other variables that could come into play. For example, President Donald Trump's recently passed tax bill included an above-the-line deduction for interest on an auto loan, meaning that you can take advantage even if you don't itemize. So, if you buy a new car in 2026, this could certainly make your taxable income substantially lower. The same can be said if you turn 65, as there's a new tax deduction for the 65-and-older age group, designed to help offset the taxation on Social Security benefits.

The point is that even though using the standard deduction may sound like an extremely simple way to file taxes, there are more variables that can impact your 2026 taxes than you might think. But by understanding how the higher standard deduction affects you, you'll have a more accurate baseline expectation of your tax liability going forward.