For most Americans, Social Security is more than just a monthly check. It represents a financial security blanket that helps them make ends meet.

According to the Center on Budget and Policy Priorities, Social Security lifted 22 million people above the federal poverty line in 2023, with 16.3 million of them aged 65 and above. Meanwhile, nearly a quarter-century of annual surveys shows that 80% to 90% of retirees rely on their monthly payout to cover at least some portion of their expenses.

For the more than 53 million retired workers who received Social Security income in August, few if any announcements were more anticipated than the annual cost-of-living adjustment (COLA) revealed in October. While this raise, and the estimated average payout for retired-worker beneficiaries in 2026, is historic, it's still set to leave a majority of aged beneficiaries disappointed.

Image source: Getty Images.

Social Security's COLA helps beneficiaries combat inflation

Before diving into the specifics of next year's raise and how much the average retired worker will take home, it's essential to understand the role Social Security's COLA plays.

The purpose of the program's COLA is to help recipients fight back against the effects of inflation (rising prices). If the average cost for a large basket of goods and services regularly purchased by Social Security's 70 million traditional beneficiaries (retired workers, workers with disabilities, and survivor beneficiaries) increases by 3%, monthly payouts would need to rise by the same percentage to avoid a loss of buying power.

Prior to 1975, there wasn't a defined system in place for measuring the impact of inflation on Social Security benefits. During the 1940s, no adjustments were made, which led to Congress passing the largest-ever COLA of 77% in 1950.

Thankfully, a system has been in place for the last half-century to track these inflationary pressures. The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has been used as a tool to measure price changes since 1975. It has more than 200 unique percentage-weighted spending categories, all of which help whittle this index down to a single figure each month.

To keep things simple, if the average CPI-W reading from the third quarter (July through September) of the current year is higher than the comparable period of the previous year, inflation has taken place, and Social Security benefits will climb in the upcoming year. Although the CPI-W is based on trailing-12-month inflation data, only readings from the months ending in July, August, and September factor into the COLA calculation.

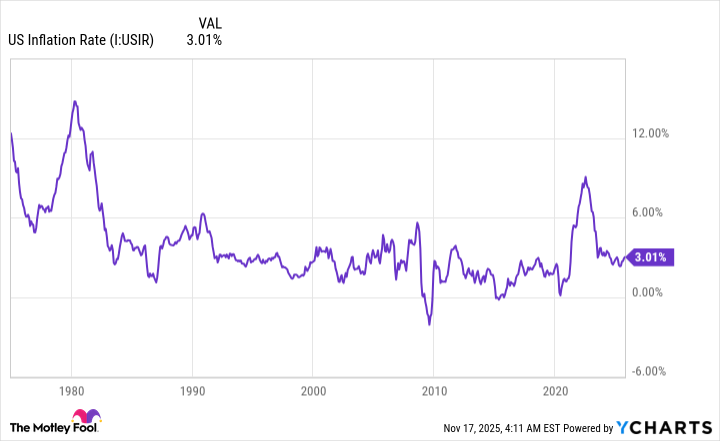

Social Security COLAs have picked up in recent years in lockstep with the prevailing rate of inflation. US Inflation Rate data by YCharts.

The average retired-worker benefit will be historic in 2026

Typically, beneficiaries would have known how much extra they'd have for the following year by the 10th to 15th of October (i.e., when the September inflation report is normally released). But due to the government shutdown, this highly anticipated announcement was pushed back to Oct. 24.

In some respects, the wait was worth the reward.

According to the Social Security Administration (SSA), the 2026 COLA clocked in at 2.8%. While this is lower than the 5.9%, 8.7%, and 3.2% raises that were passed along from 2022 through 2024, respectively, it's still modestly higher than the 2.3% average COLA since 2010.

Furthermore, this benefit increase is historic. While a 2.8% raise is modest, in nominal terms, it marks the fifth consecutive year that benefits are climbing by at least 2.5%. We'd have to go back to 1988 through 1997 to find the last time Social Security COLAs were 2.5% or above for at least five straight years.

In May, the average monthly retired-worker benefit crested $2,000 for the first time in the program's nine-decade history. According to estimates from the SSA, the 2.8% COLA is expected to raise the average monthly retired-worker benefit by $56 in 2026 to $2,071. This means that the typical retired worker is forecast to receive nearly $25,000 annually.

However, this raise applies to all of the program's traditional beneficiaries. The average worker with disabilities is estimated to see their monthly payout climb by $44 to $1,630. While the SSA didn't extrapolate the average payout for survivors of deceased workers, I estimate the average monthly payout for these individuals should rise by $44, as well, to $1,622.

Image source: Getty Images.

Social Security's 2026 COLA is likely to come up short for most aged beneficiaries

Although history-making moments should represent good news for Social Security beneficiaries, this isn't necessarily the case with the 2026 cost-of-living adjustment.

Ideally, Social Security's near-annual raises should match the inflationary pressures the program's beneficiaries are contending with -- but this often isn't the case.

As the CPI-W's full name shows, it's an inflationary index that tracks the cost pressures for "urban wage earners and clerical workers." These are typically working-age folks who aren't currently receiving a Social Security benefit. Approximately 87% of Social Security's traditional beneficiaries are age 62 and above, and they spend their money differently than working-age Americans.

For retirees, shelter expenses and medical care service costs represent a higher percentage of their budget when compared to urban wage earners and clerical workers. However, the CPI-W isn't factoring in this added importance.

What's more, the respective trailing-12-month inflation rates for shelter and medical care services are currently higher than the 2.8% COLA that's being passed along to beneficiaries in 2026. If the costs that matter most are rising by more than 2.8% throughout the upcoming year, there's a good chance retirees will see the purchasing power of their Social Security income shrink.

Additionally, the Medicare Part B monthly premium for 2026 is climbing by 9.7% to $202.90, representing a year-over-year jump of $17.90. A nearly double-digit percentage increase in the premium for the traditional Medicare segment that's responsible for outpatient services can partially or fully offset the 2026 COLA for dual enrollees (Social Security beneficiaries enrolled in traditional Medicare).

In other words, Social Security's 2026 raise is likely to come up short for some of the retirees who count on it most.