There are three main financial statements all publicly traded companies are required to make available to shareholders -- the income statement, balance sheet, and cash flow statement. Of the three, the cash flow statement is perhaps the least understood by many investors.

In this article, we'll go through the basics of a cash flow statement, the information it contains, and how cash flow is calculated. We'll also go through a real-world example of how you can read and use the information from a cash flow statement.

Cash Flow

How cash flow statements work

A cash flow statement is a financial statement that provides details on the money flowing into and out of a business during a given time period. As the name implies, the central purpose is to show the amount of cash flowing into a business, and it can be very useful when analyzing the financial health of a company.

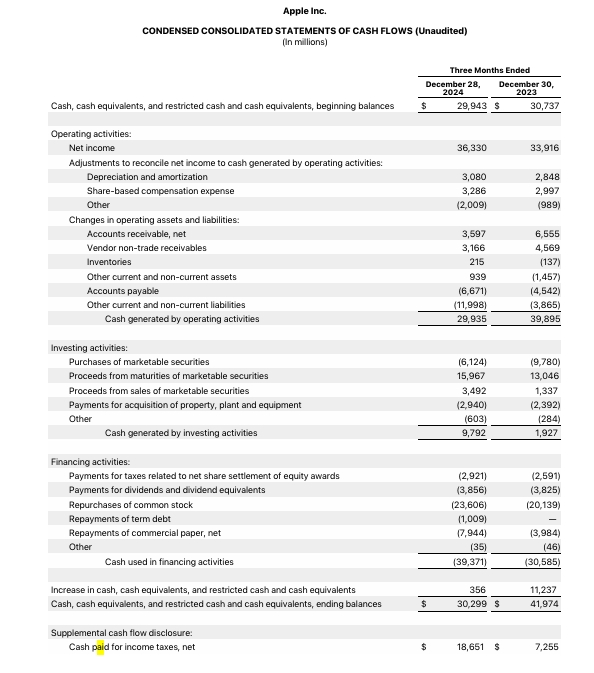

Note that on company earnings reports, the title of the cash flow statement might be a little different, such as "condensed consolidated statements of cash flows." However, it will always be one of the three main financial statements issued by any publicly traded company.

Components of a cash flow statement

Cash flow statements categorize the money flowing in and out of a business into three different sections. These are:

- Cash flows from operations.

- Cash flows from investment activities.

- Cash flows from financing activities.

Let's take a look at these one at a time.

Cash flows from operations

This is also referred to as operating cash flow. This portion of the cash flow statement contains cash flow activity directly related to the company's business activities. It includes the net income the business generated for the given time period and makes a few adjustments to more accurately reflect true income. For example, depreciation of real estate and equipment is counted against net income, but it isn't an actual expense, so it is added back in on the cash flow statement.

This section also contains information about the money flowing into and out of the business for items related to its revenue-generating activities. For example, accounts receivable and accounts payable are both included in this section, and any deferred revenue is accounted for here as well.

Cash flows from investing

When a business generates cash, it typically doesn't just leave it sitting around in a savings account or in a pile of money somewhere in a warehouse. It takes some of its cash and reinvests it to help fuel growth and/or generate revenue. Some businesses buy shares of stock in other companies, some invest in Treasury securities and other fixed-income investments, and almost all businesses reinvest capital into their own property and equipment needs. All of these things are included in the "investing activities" section of the cash flow statement.

Revenue

Cash flows from financing

In a nutshell, this category includes cash flows related to the company's stock and debt. For example, if the company pays a dividend to shareholders or repurchases shares of stock, these cash flow activities will be included in the financing section. This also includes any debt the company repays, as well as certain tax payments related to equity awards.

Disclosure of non-cash activities

This section is also referred to as the "supplemental cash flow disclosure." There are a few items that aren't included in any of the other three categories mentioned, specifically taxes and interest. If a business pays income taxes or pays interest on its debt, those amounts are typically not included in the cash flow calculation but are listed on the cash flow statement in a separate section.

How to calculate cash flow

The company's cash flow from operating activities, otherwise known as its operating cash flow, is the most commonly used metric to describe the "cash flow" of a business. And this certainly makes sense -- after all, investing activities such as buying Treasuries and financing activities such as repurchasing stock don't necessarily have to do with the financial health of the business itself. As a good rule of thumb, operating cash flow should be higher than the company's net income.

There are two methods of calculating the cash flow of a business -- the direct and indirect methods. Direct cash flow involves simply adding all of a business's cash transactions in the operating activities section of the cash flow statement. The indirect cash flow method starts with the business's net income and makes a series of adjustments.

It's important to realize that the method you use will produce the same end result for operating cash flow. It's also worth noting that cash flow statements generally provide a total of operating cash flow, as you'll see in the next section.

The other commonly used cash flow metric is known as free cash flow, which is defined as the company's net cash from operating activities (operating cash flow) minus its capital expenditures, which is listed in the investing activities section.

Free cash flow is an important metric because it shows the company's available cash generated during the time period, which can then be used to reinvest in the business, pay dividends, make acquisitions, repurchase stock, and for other desirable uses. Some businesses (airlines and oil companies, for example) can be rather capital-intensive, while others don't require a ton of ongoing capital investment. So, free cash flow can provide valuable insight into how much of a company's operating cash flow is actually available for use.

Example of a cash flow statement

To give you a better idea of what a cash flow statement looks like and how to use it in your investment analysis, here's a real-world example. This is Apple's (AAPL -0.39%) cash flow statement from the first quarter of its 2025 fiscal year.

Here are the key takeaways:

Operating cash flow: In the "operating activities" section, you'll notice that Apple's net income for the quarter was about $36.3 billion. After making adjustments and accounting for accounts payable and receivable transactions, we see that Apple's operating cash flow for the quarter was $29.9 billion.

Free cash flow: In the "investing activities" section, you'll see that Apple spent $2.9 billion on property, plant, and equipment (capital expenditures) during the quarter. Subtracting this from the operating cash flow shows that Apple generated about $27 billion in free cash flow for the quarter. This is the money that allowed it to spend $23.6 billion on stock buybacks, pay almost $4 billion in dividends, and more.

A final thought: While most of the information in the financing, investing, and disclosure sections of the cash flow statement isn't used in either of the above calculations, that doesn't mean it should be overlooked by investors. Cash flows from investment activities can be especially useful for companies where investments are a particularly large component of the company's strategy, such as with Berkshire Hathaway (BRK.A +1.34%)(BRK.B +1.22%).

In the financing section, noticing the cash flows for dividends and repurchases shows how much a company prioritizes the return of capital to investors, and it also lets you know whether their dividends and repurchases are well covered by the cash generated by the business.