10 Reasons You're Not a Millionaire

10 Reasons You're Not a Millionaire

What should you be doing differently?

One million dollars is still a lot of money in today's society. Indeed, it’s more than most people amass in their lifetimes. Still, despite the fact that few actually achieve it, becoming a millionaire is a goal that’s within reach of most people that start early and invest consistently throughout their working lives.

That raises a key question -- if becoming a millionaire is within reach, why haven’t you gotten there yet? These 10 reasons are common ones that keep people from reaching that rarefied financial status.

Previous

Next

1. You're just getting started

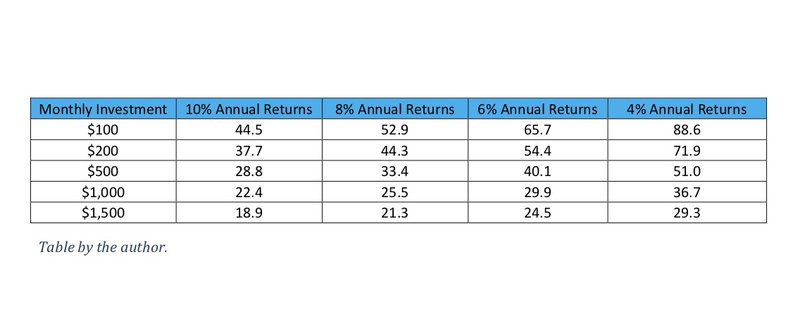

It can take decades of dedicated savings and investment to reach millionaire status. Even if you’re doing all the right things and are on track to get there, you need to let compounding work its magic over time. The table below shows you how many years it will take to reach millionaire status starting from $0, given different levels of monthly investments and rates of return along the way. So if you’re on your way, have patience, and enjoy the journey.

Previous

Next

2. You don't have steady income

If you get paid on commission, work in a seasonal or cyclical industry, or have found it difficult to keep steady employment since the financial crisis, the concept of investing regularly may seem like a fantasy. While it’s true that it can be tougher for you to invest than those with steady paychecks, you will still benefit from having a savers mindset.

With irregular income, you need something to tide you through the lean times. The best way to come up with that cash is to save some of what you earn when you’re making money, so you have it available when the checks dry up. While you shouldn’t invest money that you expect to spend in the next slow period, any money you can save beyond that amount can be available for investing.

Previous

Next

3. You're facing substantial medical bills

While heavy healthcare costs tend to hit the elderly more than other age groups, the reality is that medical emergencies can strike at any age. If you’re uninsured, find yourself with an out-of-network provider, or are unable to work after a medical issue, medical bills can be devastating. Indeed, medical bills are the number one cause of personal bankruptcy in the United States.

Although you can’t avoid all medical issues, you can ready yourself financially for them. A well-stocked emergency fund can help cover your immediate medical costs and help tide you through a short term reduction in income while you recover. In addition, funding a Health Savings Account if your health plan allows it is a great way to be prepared to cover not only today’s medical bills, but your future ones, too.

ALSO READ: More Than Half of Americans Fear Medical Bills as Much as Health Issues Themselves

Previous

Next

4. You took on too much debt for education

A college degree is not an automatic path to financial security. Certain majors generally lead to higher paying careers than others, and even college graduates can go through periods of unemployment. Yet college debt needs to be paid back, pretty much no matter what. College debt is notoriously difficult to discharge, even in bankruptcy, and even Social Security payments can be garnished to pay back education loans.

Be very careful taking out student loans to pay for your college costs, and consider other ways to pay for your education -- especially if you expect to major in a generally lower-paying area of study. Co-Ops, working while attending class part time, and working for a company with a tuition reimbursement program are all feasible alternatives to borrowing the entire cost of college.

Previous

Next

5. You aren't automatically investing

Many people find that their spending tends to expand to cover their available income. If more money than you strictly need shows up in your paycheck, it’s easy to use that cash on the little extras in life that individually don’t seem like they’re that big a deal. Make several small decisions like that each month, and it can add up to some serious coin that you don’t have available to you to invest.

The easiest way to put yourself on a path to millionaire status is to make it automatic. By signing up to fund your 401(k) or similar retirement account at work, the money gets directly invested every payday, before it ever hits your checking account. Do so, and you’ll likely soon find you won’t miss what you never saw, while that money you otherwise would have spent has the potential to grow on your behalf.

Previous

Next

6. You aren't in control of your spending

Investing enough money for long enough time to become a millionaire will require you to forgo some of what you want to buy with your money between now and then. To be successful, you will need a good spending plan to make sure you’re able to cover both what you really need and enough of what you want so that you can enjoy life along the way. Otherwise, you’ll likely find yourself coming up short when an unexpected bill that you have to cover comes along.

In other words, you need a budget. Done right, a budget can free you from your daily money worries. A budget can help you know what you have to spend to cover your essentials, let you make investing a priority, and enable you to choose what else you most want to spend your remaining money on. By making those big choices in advance, you will find it easier to say no to the lower priority spending options that head your way, assuring more of your money can go where it matters most to you.

Previous

Next

7. You don't invest in stocks

Volatility and fear of loss scare many people away from stocks, despite the fact that over the long haul, stocks can be some of the most rewarding investments to own. Key to dealing with the ups and downs of the stock market is to not rely on your stocks for any money you need to spend within the next five or so years. Key to handling that fear of loss is the one-two punch of spreading your investments around multiple companies and having a solid estimate of the underlying value of the companies you’re buying.

By not relying on stocks for your near term spending, you don’t wind up forced to sell when prices are down, just to cover your bills. That helps you keep your long term perspective to ride out the volatility. By using a reasonable estimate of the underlying value of the companies you’re buying, you can better determine what to do when (not if) the market moves against you. And by spreading your investments around multiple companies, you reduce the impact that any one corporate failure has on you overall.

ALSO READ: How to Invest in the Stock Market Even if You Can't Pick Stocks

Previous

Next

8. You're too generous lending money to friends and family

If you’ve ever co-signed on a loan, you may have learned the hard way that you’re responsible to pay it back if the person who actually borrowed the money can’t. Likewise, if you’ve ever directly loaned money to friends or family, you’ve probably learned the reason behind the old saying “never loan out money you can’t afford to lose.”

It’s hard to say “no” to those you love, especially when they’re facing a legitimate shortfall. Still, instead of being their bailout backstop, consider the fact that you can help them better in the long run by helping them get in control of their own finances. As you’re working to be able to save and invest, share with them your strategies and the sacrifices you’re making, and show them the benefits of having a savings buffer of their own. In the long run, they’ll be better off and thankful for the life-changing help.

Previous

Next

9. You care too much what other people think

Trying to “Keep up with the Joneses” is one of the easiest ways to not become a millionaire. Drive a flashy, late model car? Live in a nicer neighborhood than you really need to just to keep up appearances? Dress to impress, not just for success? Can you be counted on to buy a round at the team happy hour? No matter how much you’re spending trying to keep up with conspicuous consumption, there will always be something more to spend your money on.

When all is said and done, all that money you’re spending to keep up the appearance that you’re financially comfortable is actively keeping you from reaching millionaire status. Consider this: if your friends are only friends because of your flashy display of cash, will they really be there for you if the cash dries up? If not, why spend your time and money to have them as friends? If so, do you really need to spend the money to impress them in the first place?

Previous

Next

10. You mistake gambling for investing

At a casino, the odds are generally stacked against the gambler, no matter how visibly the casino advertises the promised payoff for a win. Likewise, excessively risky so-called investing options are usually promoted based on their spectacular potential returns, hiding the risks that investors face when things don’t go perfectly. A good rule to follow in investing is that if something sounds too good to be true, it’s probably far riskier than its promoter is letting on.

Any investment involves risk, but smart investments have both positive expected returns for those risks and reasonable chances of success. You won’t win with every investment -- even Warren Buffett makes mistakes and takes losses from time to time. If you understand the risks and the investment is still priced reasonably enough to offer you a decent overall likelihood of a reasonable positive return, it may be a risk worth taking. But if you don’t understand the risks, you’re not really investing, you’re gambling.

Previous

Next

You may still have a path to becoming a millionaire

Starting from scratch, it will likely take most people who put their minds and wallets to it around two decades or more of dedicated savings and investing to become a millionaire. If you’re already on the path there or if you’re able to sock away some serious coin every month, you could potentially get there in less time.

Still, despite the time and financial commitment it will take to get there, becoming a millionaire is a goal that may very well be within your reach. If you quickly address the barriers keeping you from reaching millionaire status, you can set yourself up on a path to improve your chances of getting there.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.