12 Checklist Items to Have Before Closing on Your New Home

12 Checklist Items to Have Before Closing on Your New Home

The devil's in the details when it's time to close the deal -- these tips can help

As any experienced real estate agent can tell you, buying a house is easy, at least when it comes to shopping and even when striking a deal. It's closing the deal where a lot of the real work comes in. Closing day doesn't have to be stressful, though, and these tips can help you have as many ducks in a row as possible when that exciting day arrives.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

1. Proof of who you are

This shouldn't be too much of a surprise, given the amount of identity fraud that occurs every day. Anyone on the mortgage and deed will have to prove their identity with a photo ID like a driver's license or current passport.

Previous

Next

2. Proof of resolved contingencies

The purchase contract will include contingencies that must be resolved before or at the closing. They were agreed to either in the initial contract or along the way and include such items as inspections, insurance, and financing. Bring proof they occurred or ask for such proof at the closing. Next, we'll look a bit more at some of these typical contingencies.

Previous

Next

3. Home inspection report and repairs

By now, you should have had the property inspected by a qualified professional. You also should have contractually agreed to any repairs or modifications with your seller. Be sure you have proof that those did occur.

ALSO READ: Your Seller Won't Fix Problems Found in a Home Inspection. Now What?

Previous

Next

4. Title proof and title insurance

Ensure you have proof that the seller owns the property you're being sold. That means the title search should already have been completed and that you have a title insurance policy ready to go. The lender will require that -- and for good reason. Ownership history can be a murky thing, and you don't want it to cloud your big day.

Previous

Next

5. The Closing Disclosure

Your lender is required to provide you with the federally mandated Closing Disclosure at least three days before the closing. This five-page form lists your fees and mortgage points and other closing costs for the loan, as well as your expected monthly payments.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. Your promissory note and mortgage package

The promissory note is just that: It's your promise to pay the lender what you borrowed to buy the house. Everyone involved in the process will work to make sure you have this and the whole package of documents that goes with it, but be sure you have that in advance, if you can, so you have time to look it over yourself or with a trusted advisor.

Previous

Next

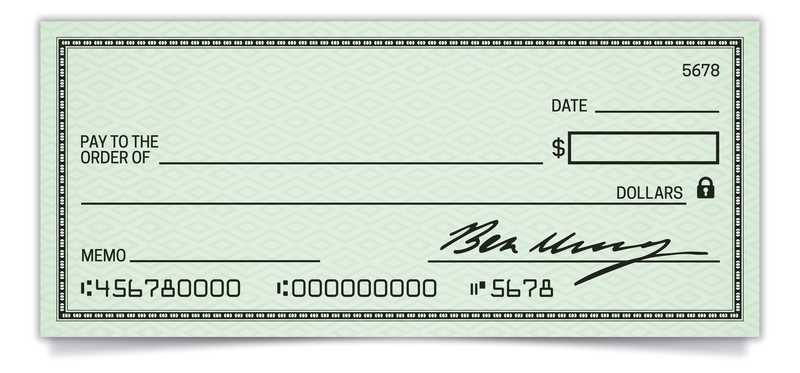

7. A cashier's check or proof of wire transfer

Personal checks won't do here. You'll need to hand over a cashier's check or proof of wire transfer for the exact amount you'll need to pay your seller. Your closing attorney or lender or title insurer should provide that -- and don't be surprised if that happens only hours or a day or so before the big signing event.

Previous

Next

8. Personal checks

Bring personal checks, too, for any other fees you find need to be paid at your closing. Those could include attorney's and recording fees, taxes, title insurance, homeowners association dues, and other items specific to your situation.

Previous

Next

9. Proof of property insurance

You're required to insure the property your lender accepts as collateral for giving you the loan. Your policy's declaration page should suffice. It contains the basics: your name, the address, a description of the property, and premiums.

Usually, all you're required to have is enough insurance to cover the size of the note in case of a total loss, but it's very common to get more, including to cover your contents and total replacement of the property.

Previous

Next

10. A personal representative

Whether it's a real estate attorney, your agent, or both, be sure to take someone with you to the closing who is professionally representing your interests. Closings are a complicated matter. Don't go it alone. Make sure you have experts there who have seen these kinds of documents many times and can answer any questions you have before you sign.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

11. A clear understanding of the move-in date

Your original purchase contract should also include the occupancy date: when you can actually take possession and begin moving in. Usually, it's right after the closing, of course, but have it in writing either way and bring that to the closing. It'll help ensure you walk away with the keys.

Previous

Next

12. Preparation for a virtual closing

Technology and regulations -- and a pandemic -- have resulted in the growing use of remote closings. Prepare for that event as you would an in-person closing, with the additional caveat of making sure you have a good internet connection. And some privacy. This isn’t a coffee shop-and-laptop event.

ALSO READ: 4 Closing Costs You Can Save on When Buying a New Home

Previous

Next

A completed list will help complete the deal

Every stakeholder is interested in getting the deal done when it comes to a house closing. But having a list like this and checking it twice can help ensure things don't go naughty -- but nice. It's a good backstop to the professional help you've enlisted along the way.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.