15 Ways to Stretch a Smaller Retirement Nest Egg

15 Ways to Stretch a Smaller Retirement Nest Egg

Don't risk running out of funds

Many people have the goal of retiring with millions of dollars. But many people also inevitably reach retirement age with a much smaller nest egg than that. If that's the situation you're in, worry not. Here are a few things you can do to stretch your existing savings -- and live comfortably all the while.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

1. Downsize your home

Your home may be your single largest monthly expense. And so swapping a larger home for a smaller one could save you a nice amount of money, especially when you account for expenses like maintenance, insurance, and property taxes.

Previous

Next

2. Rent out part of your home

Don't want to downsize? Instead of shrinking your costs by moving to a smaller home, take steps to monetize your existing home. If you're able to rent out a portion of it, the income you collect could make it so you're tapping your savings less frequently.

Previous

Next

3. Get rid of a vehicle

Once you retire, the amount of driving you need to do may be minimal, and so you may not need a car once you stop having a job to commute to. In that case, unloading a vehicle and hailing a rideshare a few times a week as needed could save you money when you account for costs like maintenance and auto insurance.

Previous

Next

4. Swap your vehicle for a less expensive one

Drive a fancier car? It may be time to swap it for a more basic model. It's one thing to bear the cost of a higher-end vehicle when you're using it every day to get to and from work. But if you're retired and won't be driving as often, downgrading to a simpler car shouldn't be as large a sacrifice -- and the savings at hand could be huge.

Previous

Next

5. Relocate to a city where you don't need a car

Some cities are walker friendly and have extensive public transportation networks. And as a senior, you may be entitled to discounted rail or bus passes. That means that if you're able to live someplace where you don't need a car, you might lower your monthly spending substantially.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

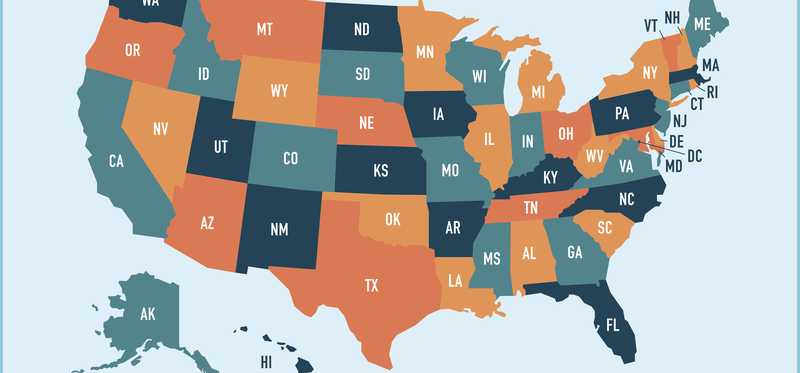

6. Move to a state with no income tax

There are nine states that do not impose an income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Moving to one of these could help your nest egg last longer.

Previous

Next

7. Cook your own meals rather than dine out

Dining at restaurants can get expensive -- even with those early bird specials. It pays to look at cooking your own meals rather than dining out if funds are at all limited. But don't make that a bad thing. Instead, research recipe ideas and enjoy experimenting in your kitchen.

Previous

Next

8. Reduce your utility usage

Being savvy about utility usage could shrink your costs. That could mean turning lights off when you leave the room, taking shorter showers, or even investing in a programmable thermostat so you're not blasting the heat or air conditioning when you're not home.

Previous

Next

9. Pursue free or low-cost entertainment

You may be surprised at how easy it is to stay entertained on the cheap. If you don't have a ton of savings, look into low-cost options like hiking or programs at your local community center.

Previous

Next

10. Seek out senior discounts

Seniors are privy to a host of discounts, such as reduced public transportation, museum entry, and movies. It pays to do your research to see what discounts you're entitled to.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

11. Choose the right Medicare plan

Selecting the right Medicare coverage could leave you with lower premium costs and out-of-pocket expenses. Spend some time reviewing your options with regard to Advantage plans, as well as Part D drug plans.

Previous

Next

12. Take advantage of free Medicare services

Medicare enrollees are entitled to certain free services every year, like a wellness visit. Do some research into your benefits to see what services you're eligible for.

Previous

Next

13. Fill your prescriptions wisely

Medication can be a huge expense for seniors, but there are steps you take to spend less on yours. For one thing, ask for generics when possible, as that alone could be a money saver. Also, see about ordering medications in bulk for added savings.

Previous

Next

14. Boost your income with part-time work

If you're in good enough health, it could pay to hold down a part-time job in retirement. Doing so will give you a way to occupy your time, all the while adding to your income so you don't need to take money out of your savings as often.

Previous

Next

15. Be less generous

Kind as it is to want to help your loved ones financially, if you're sitting on limited funds, you may need to cut back. That means not helping your adult children with their bills if you can't comfortably afford to do so.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

Make that money last

It can be disappointing and stressful to enter retirement with less money than you may have initially counted on having. But don't despair. A few smart choices could make it so your nest egg lasts throughout your senior years -- and helps you maintain a nice standard of living.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.