8 Steps to Retiring a Millionaire on a $50,000 Salary

8 Steps to Retiring a Millionaire on a $50,000 Salary

It can be done

When you earn several hundred thousand dollars a year, retiring a millionaire doesn't read like an unreasonable goal. But when you're more of an average earner, it becomes more challenging. The good news, however, is that it's more than possible to retire a millionaire even on a $50,000 salary. Here's how.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

1. Start saving at an early age

If you give your savings enough time to grow, you can amass a lot of wealth even if your retirement plan contributions are modest. Socking away $350 a month over a 40-year period will leave you with well over $1 million, assuming an 8% average annual return in your IRA or 401(k). That means parting with $4,200 a year, which is less than 10% of your annual $50,000 wage.

ALSO READ: 4 Ways to Grow $100,000 into $1 Million for Retirement Savings

Previous

Next

2. Live below your means

The less money you spend, the more you'll have available to save and invest. To this end, it's important to get into the habit of living below your means. You may be able to afford a more expensive home or car, but if you stick to a cheaper one, you'll be better positioned to meet your retirement goals.

Previous

Next

3. Stay away from debt

The less debt you have, the less money you'll lose to interest payments -- and the more money you'll have available to sock away for the future. While it's OK to finance a home with a mortgage, do your best to stay away from credit card debt, which can not only cost you money but also damage your credit score.

Previous

Next

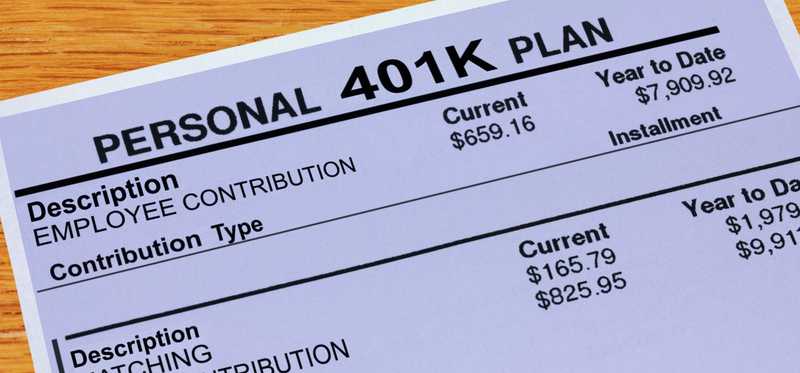

4. Snag your full employer 401(k) match

If your employer offers a 401(k) match, be sure to contribute enough money out of your own paycheck to snag that bonus cash in full. The more free money you get in your account, the easier it'll be to work your way toward becoming a retirement millionaire.

ALSO READ: How to Save $1 Million for Retirement With Minimal Effort

Previous

Next

5. Increase your savings rate every year

Ideally, your income will increase from year to year, and you should aim to capitalize on that by boosting your savings rate as your earnings go up. You don't necessarily have to bank your entire raise, but if you can set aside a portion of it, you'll get yourself closer to your goals.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. Put all of your windfalls into retirement savings

You may come into extra money at different points in life, whether it's a tax refund or a bonus at work. If you make a point to save those windfalls, you'll grow your retirement plan balance even more.

Previous

Next

7. Get aggressive with your retirement investments

Though stocks are known to be volatile, if you want to achieve solid growth in your retirement plan, they're really the way to go -- at least while you're younger and retirement is many years away. If you go heavy on stocks, you might easily snag an average annual 8% return in your portfolio (which is the percentage we used in our earlier example). Play it safe by sticking with bonds, and you'll see a lower return -- and a lower ending retirement plan balance.

ALSO READ: 5 Moves to Ensure You're a Retirement Multimillionaire

Previous

Next

8. Leave your retirement savings alone

There may be times when you're tempted to raid your retirement plan ahead of schedule. In some cases, this will result in a financial penalty, but in other situations, that's avoidable. You can withdraw up to $10,000 from an IRA, for example, to buy a first-time home. But remember, the money in your retirement plan is there for a reason -- to be an income source for you during your senior years. If you pledge to leave that money alone, you'll have a greater chance of eventually winding up with $1 million or more.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

Set yourself up for a rewarding retirement

While you don't necessarily need $1 million in savings to enjoy a fulfilling retirement, there's also nothing wrong with setting that goal. And if you follow these steps, you could end up sitting on a substantial amount of wealth by the time your career comes to an end.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.