First Job Out of College? 35 Important Financial Moves to Make

First Job Out of College? 35 Important Financial Moves to Make

Get off on the right foot -- in many ways

About 3.8 million students graduated from colleges or universities this year, with nearly 2 million receiving bachelor's degrees and the rest earning associate's, master's, or doctorate degrees. It's an exciting phase of life to be in, starting one's working life, and there are lots of important decisions to make.

Here's a look at 35 smart moves you can make now (or soon), in order to best position yourself for great financial success. "Financial success" might sound like a boring term, but read on -- because it means reaching goals such as getting out of debt, buying a home, and perhaps even retiring early!

Previous

Next

1. Choose your first job wisely

First off, choose your first job carefully -- in part because your next jobs will be looking at what you did in this job. Don't necessarily grab the position offering the most money, but instead aim to find a position that fits your intended career path. If you studied geology and want to work in the energy industry, find a job that gets you in the door there. Think, too, about where each position might lead and how you might progress along your career from it.

ALSO READ: About to Graduate College? 5 Tips for Lining Up Your First Job

Previous

Next

2. Weigh job offers carefully

When considering various positions or weighing job offers, again, don't focus on compensation above all. Jobs tend to offer a range of benefits, such as health insurance, contributions to 401(k) accounts, and perhaps even an on-site gym. Many jobs will offer tuition assistance, too, which can be helpful if you'd like to pursue additional degrees or certifications to further your career. Also consider how pleasant the job environment seems, and about how the commute will be. Choose a job that fits well with your desired career path and that offers a compelling combination of compensation and benefits.

Previous

Next

3. Consider pros and cons of moving back in with mom and dad

Whether you're thinking of moving back in with mom and dad after college or whether you're dead-set against doing that, take a little time to consider both the pros and cons. Obviously, the biggest advantage is that you can save a LOT of money. If you're going this route, be sure to do so, and not to just spend most of what you earn. Don't waste the opportunity to pay down your student debt faster and to build a war chest to help you meet financial goals such as a car and your own apartment or home. Living at home can give you a chance to get to know your parents better, adult-to-adult. But the downside of this option is that you're putting off really getting to be independent and fully taking care of yourself. You may not be able to socialize as well, either, not wanting to bring friends home to your parents, and you'll have less privacy. Still, it may be worth it, for a year or two.

Previous

Next

4. Establish an emergency fund

No matter how old you are, you should have -- or build -- a fully stocked emergency fund that can carry you through about three to nine months' worth of living expenses. That means it will cover your rent or mortgage payments, your food, transportation, utilities, phone costs, debt repayments, and more. You might keep these funds in a bank savings account or in a short-term certificate of deposit (CD) or money market account, as you want the money to be accessible, either immediately or soon.

Previous

Next

5. Start a budget

Financially successful people often have budgets, which spell out just what they plan to spend on various categories. Sit down for a few minutes and list all your expected income. Then think hard and list all your expenses and expenses you aim to have, such as savings. You can do this in annual or monthly amounts -- whichever seems best for you. Next, jot down your priorities and goals, such as rent, food, utilities, savings, transportation, and debt repayments. Figure out how much you want to or need to spend on each, and then decide how you might allocate the rest to more discretionary categories, such as restaurants, concert tickets, travel, and so on. Having a budget doesn't mean you have to deprive yourself of fun and pleasure, but it can keep you from overspending on certain categories while underspending on others.

Previous

Next

6. Choose the student loan repayment plan that suits you best

Speaking of debt repayments, know that if you're saddled with significant student loan debt, you're far from alone. More than 40 million Americans are carrying student loan debt -- that totals more than $1.5 trillion. College students these days are graduating with an average of $30,000 in student loan debt. You certainly know that you're expected to pay that debt off, starting now or soon, but you may not realize that there are various ways to go about doing so. The default is the Standard Repayment Plan, which expects you to pay off all debt over 10 years, but you can switch to other plans if they would suit you better. Visit the Federal Student Aid office of the U.S. Department of Education to learn more.

Previous

Next

7. Stay out of credit card debt

It should go without saying, but avoid credit card debt like the plague. It can derail your progress toward financial goals and throw you off-course for years, and it's especially dangerous if you're already carrying a heavy load of student loan debt. If you owe, say, $5,000 on a card that's charging you 28% (a not-uncommon and very steep rate), and you only make 4% minimum payments on it, it will take you 16 years to pay it off, and you'll be paying a total of about $11,700! That means interest alone will cost you more than $6,000, which is more than you owed in the first place.

Previous

Next

8. Use the credit card(s) that will serve you best

All credit cards are not created equal; many are designed to serve certain kinds of users -- so find one that's best for you. For example, if you're carrying credit card debt, you'd want to favor low-interest-rate cards and perhaps do a strategic balance transfer. Otherwise, consider signing up for the best rewards cards or the best cash-back cards that fit your spending habits. There are cards that offer anywhere from 1% to 2% back on every purchase, and some that pay up to 5% or 6% back on certain purchases, such as those at supermarkets or certain retailers. If you spend $150 per month at Amazon.com, for example, and earn 5% back on most purchases there, you'll essentially be spending 5% less while saving about $90 annually. If you travel a lot, look for a card that offers travel rewards and discounts.

Previous

Next

9. Start establishing a strong credit history and credit score

As you progress through life, you'll be creating a credit record that's used to calculate a credit score -- that lenders and others will look at when deciding what kind of interest rate or deal to offer you. So it's in your best financial interest to have a high credit score. If you're fresh out of college, it's a great time to start off on the right foot, such as by paying all bills on time and not borrowing too much.

By the way, you're entitled to a free copy of your credit report annually from each of the three main credit agencies -- consider visiting AnnualCreditReport.com annually to order yours, to see how you're doing. (It's a good idea to review your credit record before applying for a credit card -- and, indeed, to review it at least once a year, checking for errors.)

Previous

Next

10. Don't pay too much for housing

Next up is housing. If you're not living in your parents' home, you'll likely find that housing is one of your biggest expenses. Don't let it be much bigger than it has to be, though. Many recommend keeping your housing expenses to no more than about a third of your income. So if you're bringing in about $3,000 per month, look for an apartment or apartment-sharing situation where you'd be paying around $1,000 monthly.

Previous

Next

11. Live below your means

Living below your means will not only help you achieve your financial goals, but it can keep you out of disastrous situations, as well. To pull it off, know just how much money you've got coming in and make sure you're spending less than that. When you're about to purchase something, pause for a moment to think about whether you will be able to pay for it or whether you'll be having to take on some debt. It's a common habit of people who have become millionaires to live below their means.

Previous

Next

12. Start saving and investing as soon as possible

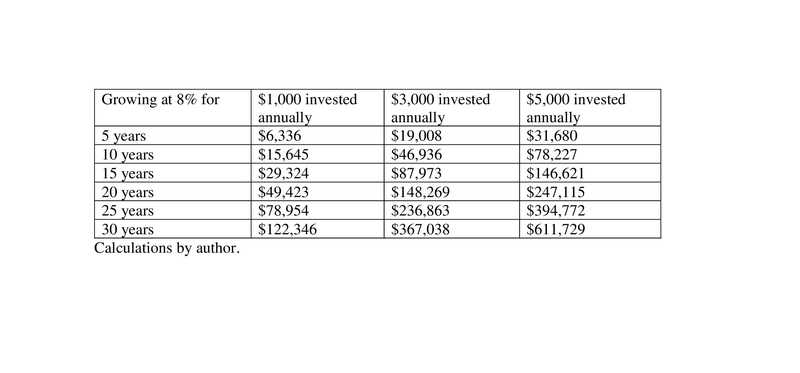

When you're young, you have a massive advantage over older folks: You have lots and lots of time ahead of you. That can help you amass huge sums of money, if you start saving and investing now and continue doing so. You don't even have to be investing huge amounts, either. The table above shows how much you could amass over various periods if your investments average 8% average annual growth.

Note, too, that as you get older and have jobs that pay more (and perhaps a spouse who's also earning and saving), you'll likely be able to sock away ever larger sums, such as $10,000 or more annually. Doing so could get you to a million dollars while you're still only in your fifties.

Previous

Next

13. Don't try to get rich quick

As a young person, you're probably relatively new to money management, which means you'll be extra vulnerable to some bad ideas. Chief among them is succumbing to various get-rich-quick schemes. You'll likely occasionally be tempted to try day trading, investing in penny stocks or cryptocurrencies, or borrowing a lot of investing money. Remember that any idea that sounds too good to be true probably is. Most people who have built great fortunes have done so over many years and even decades, not weeks or months.

Previous

Next

14. Consider index funds for your stock investing

If you're all fired up to save and invest aggressively, how should you actually invest your money effectively? Well, it's hard to beat stocks for your long-term dollars. Learning to study individual companies and to get in and out of them at the right time takes a lot of time and effort. Instead, you can do nearly as well and possibly even better by simply opting for one or more low-fee, broad-market index funds such as the SPDR S&P 500 ETF (SPY), which distributes your assets across 80% of the U.S. stock market. Even Warren Buffett recommends index funds for most investors.

Previous

Next

15. Participate in your employer's 401(k)

If your employer offers a 401(k) plan, participate in it! (Many non-profit companies and schools will offer a 403(b) plan, which is very similar.) These plans allow you to sock away a lot of money in a tax-advantaged manner. Traditional 401(k)s take pre-tax contributions and let that money grow, invested, for many years, free from taxation. It's only taxed when you withdraw it, ideally in retirement. There are now Roth 401(k)s, which work much like Roth IRAs, taking post-tax contributions and letting you ultimately withdraw funds in retirement tax-free. For 2019, the contribution limit for 401(k)s and 403(b)s is a hefty $19,000 (plus $6,000 for those 50 and up).

Previous

Next

16. Contribute enough to your 401(k) to max out the employer match

Many 401(k) plans feature matching contributions from employers -- which is essentially free money. A typical employer match might be 50% of worker contributions up to 6% of pay, resulting in employers contributing a maximum of 3% of worker pay. Be sure to contribute enough to your account to at least grab all available company matching money. With the match example above, if you earn $40,000, you'll be socking away $2,400 and your employer will add another $1,200 -- which is free money.

Previous

Next

17. Increase your savings each year

Of course, contributing much more than 6% to your 401(k) will help your savings grow much faster. If you can't start contributing at a high level, start as generously as you can and aim to increase your contributions regularly. Contributing 8% of your earnings? Make it 9% next year and 10% the year after, and don't think it's crazy to go to 15% or beyond. Remember that the dollars you invest earliest have the longest time to grow and are your most powerful dollars. Being aggressive early can take a lot of pressure off later.

Previous

Next

18. Don't borrow from your 401(k) -- or cash it out

Once you have a 401(k) account with thousands of dollars in it, don't short-change your future by borrowing from it. That's removing dollars that could be working and growing for you -- and that may never be repaid if you run into more trouble. (Not repaying such a loan can result in penalties and taxes, too.) Don't cash out your account early, either, even if it doesn't seem to have much in it. Many people do so when they change jobs, ending up with meager long-term savings. If you withdraw just $20,000 that might have remained invested for another 20 years, averaging 8% annual growth, you miss out on more than $90,000 in future funds.

Previous

Next

19. Contribute to a Roth IRA

Along with a 401(k) account, you might want to fund an IRA, too. A 401(k) will typically offer a limited menu of investment options (though a simple, low-fee index fund or two is really all you need), while an IRA will let you invest in individual stocks or a wider range of mutual funds, if you so desire. The contribution limit for IRAs in 2019 is $6,000 (plus $1,000) for those 50 and older. IRAs come in two main types -- traditional and Roth -- and Roth IRAs are the best bet for many young people. That's because you have such a long investing horizon that you may be able to amass a lot of money, and you may be able to take it all out tax-free in retirement. That can be quite powerful.

Previous

Next

20. Automate your savings

Being a great manager of your money takes discipline, but you can relieve yourself of some responsibility by setting some savings to be made automatically. Many employers will let you have a set amount routed directly from your paycheck to a certain bank account or two each pay period. You might, for example, have $300 sent to a savings account every pay period, and thereby end up with $7,200 in savings each year.

Previous

Next

21. Save and invest your tax refund

The average American taxpayer got a tax refund of roughly $3,000 last year. Yours may be larger or smaller. (Smaller is ideal, really -- because your tax refund is your money that Uncle Sam is returning to you after having held it for many months.) Whatever yours is, consider sending it directly into a savings account. That way it can grow and it will be very helpful when it comes time to buy a car or make a down payment on a home.

Previous

Next

22. Try to bank your raises

Try to bank any raises you get, too. A typical raise may be anywhere from 2% to 5%, and it isn't likely to make a huge difference in your paycheck, but invested over many years, it can be powerful. If you're earning, say, $40,000 and get a 3% raise, that's $1,200, or about $23 per week. Sock those raises away for a few years and you'll end up with thousands of dollars saved and growing. You probably can't do this forever -- it would be hard to still be living on $40,000 in 10 years -- but you can do it in many years. Or, if you move from job to job and see your income rise along the way, you might be able to keep banking your raises -- every year.

Previous

Next

23. Get insurance

It's easy to dismiss insurance, or to regard it with a bad attitude, since no one likes forking over a lot of money for things that we rarely seem to need. But insurance is very important. You're not getting nothing if you don't file a claim from year to year -- you've been protected all year long. Now that you're an adult, you'll be needing all kinds of insurance. Be sure to get health insurance, for starters -- because even young people can get sick or injured. If you have a car or home, insure them, too. (Renters should buy renter's insurance, to cover their belongings. It's often very inexpensive.) It's not a bad idea to have disability insurance, too. (Many employers offer various kinds of insurance to their workers, sometimes at a discount.) You can probably skip life insurance while you're young and single. If no spouse, kids, parents, or anyone else is depending on your financially, you don't need life insurance.

Previous

Next

24. Think twice before buying a home

You may be eager to buy a home, but think the decision through carefully and consider not doing so. For one thing, owning a home ties you down to your current location. While you're young, you may want or need to be more geographically nimble, going where the best jobs are. (Yes, you can always sell a home, but you can lose money doing so -- especially if you've just paid several thousand dollars in closing costs and if you're facing 6% agent commission fees when selling it.) Owning a home carries a lot of costs, too, such as property taxes, home insurance, maintenance, repairs, and so on.

Previous

Next

25. Don't buy a new car

A common mistake many young people make is buying a new car. A new car depreciates in value significantly as soon as you drive it off the lot. You can get a car in nearly as good shape for thousands of dollars less if you buy a used one. It can be just one to three years old, too -- it doesn't have to be a decade-old jalopy.

Think, too, about whether you need a car at all. Car ownership and insurance can be costly. If you can put off that purchase for a few years, you can save (and bank) a lot of money. Maybe you can carpool to work, or use public transportation. (Living in or near a city can help with that.) Or maybe you can use a bicycle as your primary transportation mode, hailing ridesharing vehicles when necessary.

ALSO READ: I Tracked Every Car-Related Expense for 6 Years. Here's What I Learned

Previous

Next

26. Ask for a raise now and then

A common mistake many people make, and one that costs them tens if not hundreds of thousands of dollars over their working lives is not asking for a raise. Do a little prep work first, such as researching salaries for positions like yours via resources such as salary.com, glassdoor.com, salaryexpert.com, indeed.com, and the Department of Labor's Occupational Outlook Handbook. It helps to deserve a raise, too, so be sure to be a conscientious, dependable, productive, congenial worker. A survey from the folks at PayScale found that among those who asked for a raise at work, about 70% received some sort of increase.

Previous

Next

27. Don't stay at your job too long

If you want to earn as much as you can in your career, you should probably not stay in any job too long. Various studies have shown that job-hopping, versus staying with the same employer for many years, pays off. Workers get the biggest increases in their salary when they've been at their job for at least two years but not more than five years, according to one study. And annual pay increases were an average of 48% higher for those who switched jobs, according to data from the Federal Reserve Bank of Atlanta.

Previous

Next

28. Consider other careers if you're not happy

Once you're settled in your first job, see how you like it. If it's in a field you studied for years to get into but you find that you just don't like it, know that you can still change direction. Even those in their 40s and 50s have changed careers successfully -- sometimes several times. It's not worth being dissatisfied at work for decades. You might see a career counselor, too, for some sound guidance.

Previous

Next

29. Get and stay healthy

Getting and staying healthy may not sound like a smart financial move, but it is one. That's because those who are not too healthy can end up spending more on healthcare, for doctor visits, lab work, and even hospital stays. And if you tend to be sick a lot, you may use up a lot of sick days and not be as productive as others. That can hurt your progress in your career, too.

Previous

Next

30. Learn to cook

Learning to cook may also seem not too financial, but there's a sound financial angle in it: Preparing your own meals can save you a lot of money, saving you from having to get take-out or go to restaurants. You might prepare a few meals over each weekend that can carry you throughout the week, and you might prepare some or many money-saving brown-bag lunches, as well. As an added bonus, preparing your own food means you can eat healthier, if you take it easy on the salt and fat and include a lot of fruit and vegetables in your diet.

ALSO READ: How to Save More Money When You're Living Paycheck to Paycheck

Previous

Next

31. Fund a health savings account (HSA) if you can

If you're able to set up a health savings account at work, do so. You fund an HSA with pre-tax money, lowering your tax bill in the process (much like a contribution to a traditional IRA). That money can be used tax-free for qualifying healthcare expenses, such as doctor visits, lab work, and eye exams. The money in the account can accumulate over many years, too, invested and growing. Best of all, once you turn 65, you can withdraw money from your HSA for any purpose, paying ordinary income tax rates on withdrawals. That makes it a combination health savings account and retirement savings account! The HSA contribution limit for 2019 is $3,500 for individuals and $7,000 for families. Those 55 or older can chip in an additional $1,000. You'll need to have a qualifying high-deductible health insurance plan in order to be eligible to take advantage of HSAs -- but high-deductible plans make sense for many young people, anyway.

Previous

Next

32. Think about retiring early

Here's an out-there idea. Yes, you may have just graduated from college and may still be in your mid-20s, but you can still think about retiring early. It's quite achievable for those who start saving early and aggressively, and who invest effectively (such as in the stock market, for long-term money). Many people don't -- and can't -- retire until their mid-60s, but you might be able to retire in your mid-50s (or earlier), if you work toward that. After all, if you're 22 now, you can invest money for 30 years and amass a lot by the time you're just 52. (Retiring early may still not be what you want to do, but if you've accumulated a lot of money by your 40s and 50s, it might permit you to work at jobs you like the most, that might not pay as much money as some other jobs. Having a big nest egg later in life can give you a lot of freedom and flexibility.)

Previous

Next

33. Think about taking on a side hustle

Another good financial move when you're young is to take on a side hustle here and there. Some of them might offer insights that could help in your career -- or help you find a new career, if you discover you love a new field you're working in. Others can just help you generate additional cash to sock away, strengthening your finances. You might drive for a ride-hailing service, for example, or be a math or French tutor. If you're able, you might give piano or voice or guitar lessons, or be a freelance editor or singer as a side gig. You could make and sell things online or do some writing or design work. Even simply being a cashier at a local store can help plump up your accounts more quickly. Earning just $12 per hour for an extra 10 hours per week can get you more than $6,000 extra dollars annually, pre-tax.

Previous

Next

34. Have financial goals -- and a plan

All of these ideas might have your head spinning a bit, but you can keep your thoughts more organized by coming up with some specific financial goals and an overall financial plan. List what you need to attain and then come up with ways to do so, which might include saving 10% or even 15% of your income, getting a side job for a while, and living well below your means.

ALSO READ: How to Set -- and Stick With -- Financial Goals in 2019

Previous

Next

35. Start learning -- and keep learning

Finally, commit yourself to learning more about personal finance and investing -- so that you can make smarter and smarter decisions and so that you can accumulate the most money. Learn as much as you can in the coming years by reading some good books -- but plan and expect to keep reading and learning. Perhaps start with some good business and investing books, some Motley Fool books, and articles at sites such as Fool.com. The more you know, the better you'll likely do -- and you may be able to inspire some friends to become more financially secure as well.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Selena Maranjian owns shares of Amazon. The Motley Fool owns shares of and recommends Amazon. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.