Worried About a Retirement Income Shortfall? 15 Steps to Take

Worried About a Retirement Income Shortfall? 15 Steps to Take

Secure the steady stream of income you need

Although many people look forward to retirement, it can be an intimidating period of life. In fact, seniors routinely experience their share of stress once their regular paychecks go away. If you're concerned about not having enough money in retirement, here are some key moves to make.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

1. Commit to saving from a very young age

The more time you give your nest egg to grow, the more retirement income you're likely to wind up with. Ideally, you should start funding an IRA or 401(k) plan from the moment you start collecting a steady paycheck.

Previous

Next

2. Work regular retirement plan contributions into your budget

Your IRA or 401(k) isn't something you should fund when it works out. Rather, you should commit to contributing to that account every month, and your budget should account for that. You may need to cut back in other spending categories to make that possible, but those are sacrifices worth making.

Previous

Next

3. Find an IRA with an automatic transfer option

Some IRAs let you transfer funds from your checking account to your retirement plan automatically every month. Going this route is a great way to stay on track with your savings goals.

Previous

Next

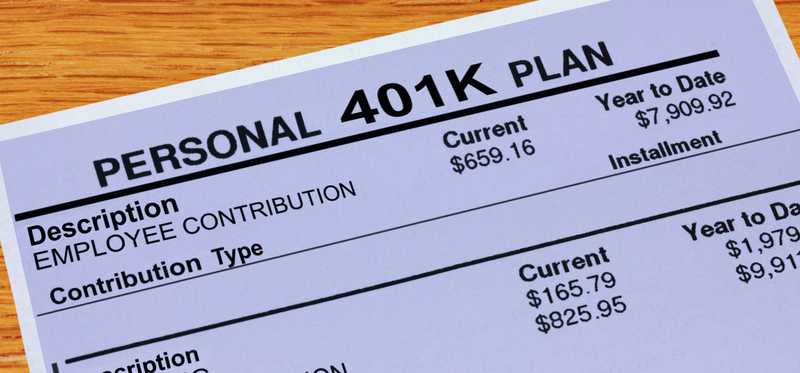

4. Snag your full 401(k) match

Many companies that offer 401(k) plans also match worker contributions to varying degrees. Claiming your full employer match will leave you with a lot more money in time.

ALSO READ: 21% of People Who Recently Quit a Job Made This Huge 401(k) Mistake

Previous

Next

5. Work at least 35 years to maximize your Social Security benefits

Your Social Security benefits are calculated based on your wages during your 35 highest-paid years in the labor force. If you don't work a full 35 years, you'll have a $0 factored into your benefits equation for each year you're without an income, resulting in a lower benefit. But if you work at least 35 years, you can get more from Social Security.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. Make sure your Social Security earnings record is accurate

Each year, the Social Security Administration issues a summary of your wages. Be sure to check those earnings statements for errors, because if your income is underreported, it could result in lower Social Security benefits.

Previous

Next

7. Delay Social Security as long as possible

You're entitled to your full monthly Social Security benefit based on your wage history at full retirement age, which kicks in at 67 if you were born in 1960 or later. But for each year you delay your filing past that point, your benefits grow 8%. This incentive happens to run out at age 70. But if your full retirement age is 67, you could snag a 24% boost to your Social Security benefits -- for life.

ALSO READ: Is Social Security's Full Retirement Age the Same for Everyone?

Previous

Next

8. Fund a health savings account

While steadily contributing to an IRA or 401(k) is a smart bet for building retirement wealth, you're not limited to those savings plans alone. If you're enrolled in a high-deductible health insurance plan, you may be eligible to fund a health savings account, which has a balance you can carry forward and use during retirement.

Previous

Next

9. Invest your IRA or 401(k) in stocks

The more you manage to grow your retirement plan, the more income you'll be privy to down the line. To this end, it pays to invest your IRA or 401(k) in stocks. Though there's risk involved, stocks tend to generate much higher returns than safer investments, like bonds.

Previous

Next

10. Limit your investment fees

Investment fees can eat away at your retirement balance, so it's best to minimize them. That generally means investing your savings in index funds, which are passively managed and don't charge the same hefty fees as actively managed mutual funds.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

11. Avoid an early IRA or 401(k) withdrawal

Withdrawing funds from your IRA or 401(k) before age 59 1/2 could trigger a 10% early withdrawal penalty. Plus, the more money you remove from your retirement savings before wrapping up your career, the less you'll have down the line. That's why it pays to leave your nest egg alone and find other ways to cope with unplanned expenses. Building an emergency fund could make it so you have cash to cover surprise bills.

ALSO READ: How to Grow Your Emergency Fund From $1,000 to $5,000 in a Year

Previous

Next

12. Extend your career a few years

If you're concerned about not having enough retirement income, consider delaying that milestone. Holding off even a couple of years could make it so you're able to add to your IRA or 401(k), all the while leaving your existing balance untapped for longer.

Previous

Next

13. Get a side gig you can keep doing in retirement

Working a side gig could make it possible to contribute more money to your IRA or 401(k). Better yet, try finding a gig you can keep doing once you retire. Not only will that help you stay busy, but it'll be a good way to score an income boost.

Previous

Next

14. Downsize your home as retirement nears

Housing can be a huge expense in retirement, even if your mortgage is paid off. It pays to look at downsizing as you approach retirement. Doing so could not only lower your housing costs but potentially leave you with a pile of cash from the sale of a larger home that can serve as another income source.

Previous

Next

15. Set priorities to make the most of the retirement income you have

You may have a limited amount of income to enjoy once you retire. But if you prioritize how you spend it, you'll be less likely to run out or end up forced to deny yourself the things you've always dreamed of doing. If travel is very important to you, for example, you can allocate more money to taking trips and aim to keep your remaining costs low.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

Minimize your financial stress

The last thing you deserve is to spend your senior years perpetually worried about money. Make these moves, and you'll be less likely to be plagued by financial concerns.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.