How ARV relates to fix-and-flip financing

The after repair value isn't just used to formulate an offer; it's also used when getting financing for the fix and flip. There are private and hard money lenders that specifically offer loans for rehabs, typically with a maximum loan amount of 65% of the ARV. So if the ARV of the property is $250,000 the most the lender would finance is $162,500.

Knowing what the maximum loan can be helpful as you craft your offer. Let's say in that scenario above you are able to negotiate a purchase price of $110,000 and the repair cost will be around $55,000. This means the loan amount almost fits in the lending parameters that most hard money lenders or private lenders offer, and the investor only needs to bring a few thousand dollars to closing.

Things to keep in mind when using ARV as a real estate investor

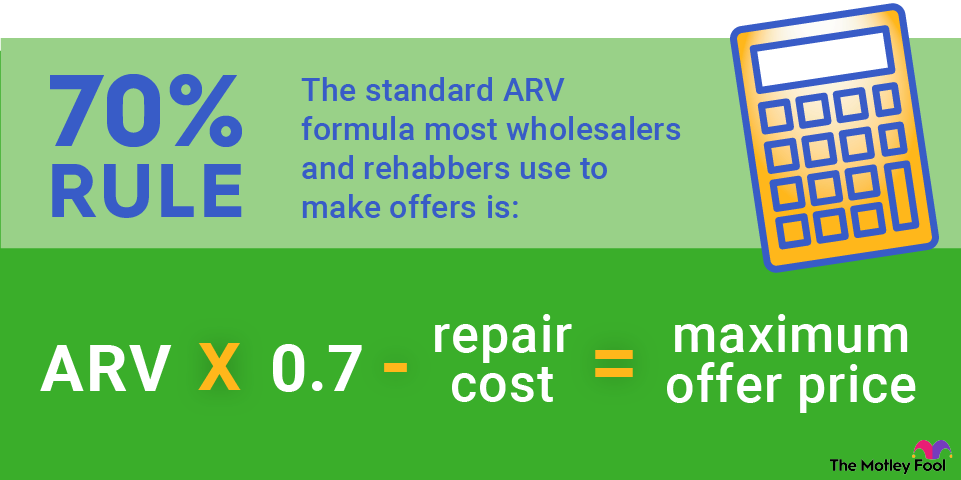

I receive emails from wholesalers' advertising fix-and-flip opportunities. Sometimes their estimations of ARV and repairs are spot-on; other times, they are widely off base. You cannot always trust other's ARV or estimated repair cost even if they used the 70% rule or ARV formula.

After repair value is a valuable tool to help real estate investors quickly determine a starting offer price or determine if an investment property is worthwhile or not. Just keep in mind that the ARV is only useful or valid if the method and comps used to determine the ARV are accurate.

If you underestimated repair costs or used poor comps to derive the ARV, your estimation of a likely sales price could be way off base, leaving you with a property that you put more money into than it's worth.

If you aren't comfortable with calculating repair costs, get quotes before making an offer. Maybe you don't feel confident comping a property on your own. Ask for a local Realtor to help you determine a current market value and after repair value with a CMA. The more you practice calculating ARV, the better you will get.