Stagflation is a term that comes from the words "stagnation" and "inflation." It is used to describe elevated inflation that is accompanied by slowing economic growth and high unemployment.

As an example, in 2008 unemployment spiked to 10% as a result of the financial crisis in the United States, but inflation was above 5% for much of that year and the economy was clearly in a recession.

Understanding stagflation

Stagflation is widely regarded as a bad economic scenario. Inflation isn't necessarily a bad thing if it takes place during a period of strong economic growth, but the combination of inflation and an otherwise weak economy creates a serious challenge from a policymaker's perspective.

Think of it this way: The Federal Open Market Committee, or FOMC, is the policy-making arm of the Federal Reserve (the people who determine benchmark interest rates). They have a dual mandate: to keep inflation under control and to maximize employment. The tools at their disposal are generally meant to move both in the same general direction. For example, when the FOMC raises interest rates, it generally causes inflation to decline but also typically results in an uptick in the unemployment rate.

When unemployment is already high, raising interest rates can make it even higher. However, without raising interest rates, the Fed runs the risk of having inflation spiral out of control. In a nutshell, stagflation creates a very difficult scenario and one that can be extremely challenging for policymakers to combat. It can be extremely difficult to fix high inflation, slow growth, and elevated unemployment without causing the other metrics to move in the wrong direction.

History of stagflation

Throughout much of modern history, stagflation simply didn't happen. High inflation generally accompanied a robust economy. However, we've now seen very clearly that stagflation can and does occur.

The first public use of the term “stagflation” occurred in the British Parliament in the mid-1960s in reference to high inflation and unemployment at the time.

In the U.S., the most notable period of stagflation occurred in the 1970s. Thanks to a combination of factors, especially an oil crisis that sent supplies plunging (a great example of a supply/demand problem), inflation jumped above 7% in mid-1973 and didn't fall below that level until late 1975. The increase was accompanied by a recession with negative 3.2% GDP growth and an unemployment rate that peaked at 9% in May 1975.

In fact, since that notable occurrence, every recession that has happened in the U.S. has been accompanied by inflation to some extent. A relatively brief recession in 1980 saw unemployment spike to 7.8% and GDP decline by 2.2%, while inflation reached 13%. Another recession just a year later saw unemployment spike to 10.8% while inflation ranged from 7% to 10%. Even during the Great Recession from 2007 through 2009, inflation remained above historical averages until late 2008 despite the unemployment rate hitting double digits.

Law of Supply and Demand

Causes of stagflation

Of course, if stagflation could be predicted with 100% accuracy by identifying its causes, we'd simply choose to avoid it. But, like many other economic events, there's no bulletproof formula when it comes to predicting inflationary pressure and unemployment rates in the economy -- just some general catalysts that could contribute to it. For example, many people projected that inflation would spike after the financial crisis due to the government stimulus that took place -- and it certainly would have made economic sense -- but it didn't happen.

Having said that, the general causes of stagflation seem to be a rapid increase in the money supply or an imbalance in supply and demand. These aren't mutually exclusive. For example, a rapid increase in the money supply can cause consumer demand to spike faster than supply can keep up. But, generally speaking, these are the main potential causes of stagflation.

Rising money supply

Government stimulus is a recent example of this, but a large increase in the money in consumers' pockets typically causes inflation. As a more recent example, when the government spent trillions on an economic stimulus package during the COVID-19 pandemic, we saw a surge in demand for products such as electronics, used cars, and airline tickets. As the money supply rose, prices started to rise.

Supply/demand imbalance

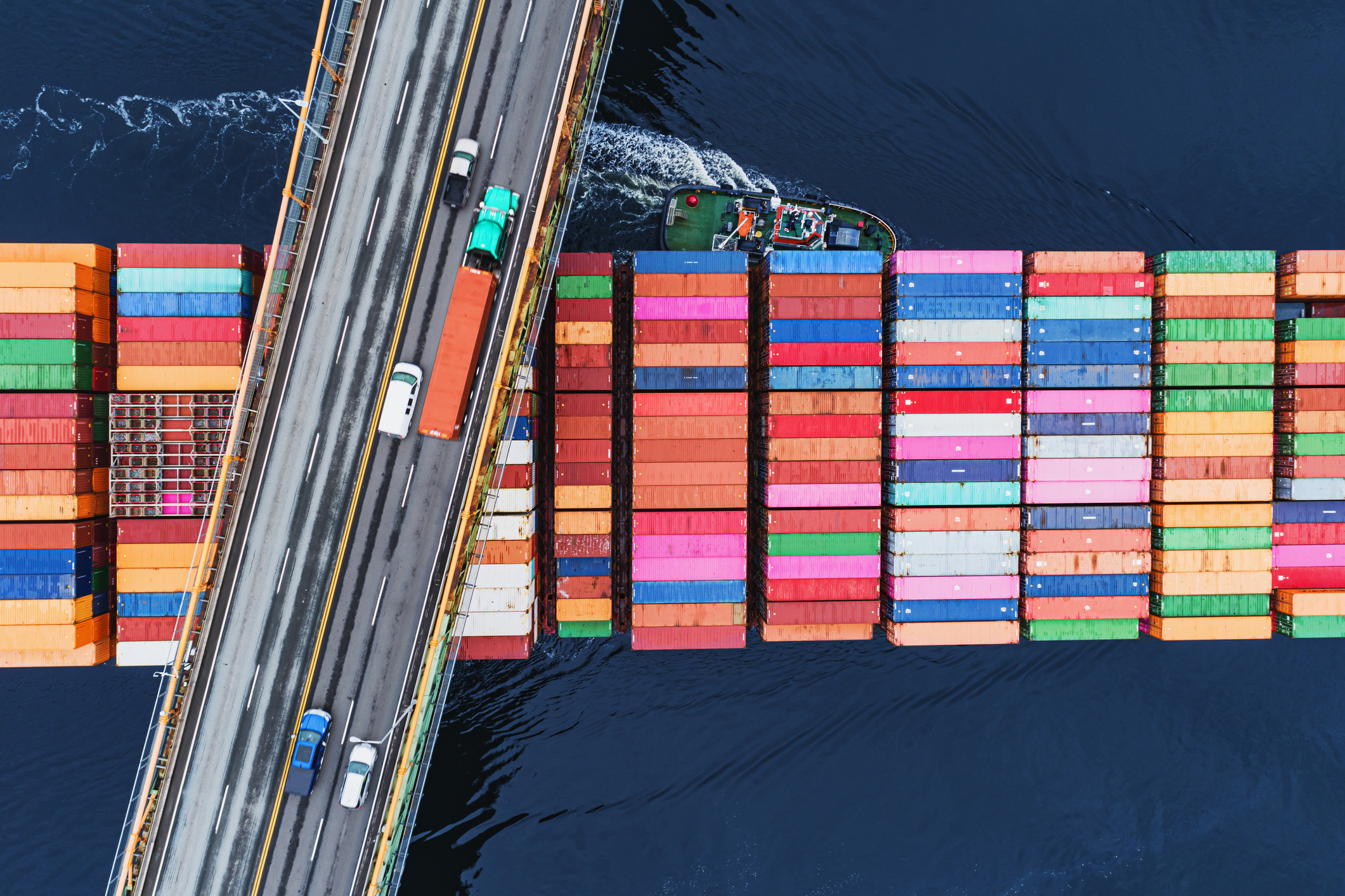

Consider the recent supply chain disruptions in the U.S. It has been next to impossible to buy a new car, the inventory of homes on the market has been at an extremely low level, and many industries have been grappling with various supply chain problems.

Note that this isn't an exhaustive list, although most causes of past periods of stagflation tend to fit into these categories. However, there could be other contributing factors as well. As an example, the end of the gold standard (where currencies were directly linked to gold) is widely considered to have contributed to the stagflation in the U.S. in the 1970s.

Inflation vs. stagflation

Inflation is a broad term that refers to an increase in the prices consumers pay for goods and services as defined by the Consumer Price Index, or CPI. However, the word "inflation" only describes rising prices -- it doesn't have anything to do with things such as unemployment or gross domestic product (GDP) growth.

Stagflation, on the other hand, is a type of inflation that is accompanied by slow or stagnant GDP growth, as well as elevated unemployment. In other words, stagflation refers to a combination of economic conditions, not just one.

Expert views

Academic views on stagflation

Related investing topics

The bottom line

High inflation isn't fun. Neither is high unemployment or stagnant economic growth. But when all of these things happen at the same time, it creates a particularly scary economic situation that leaves policymakers with some difficult choices. In stagflation environments, the Federal Reserve might be forced to raise interest rates to the point where it severely harms economic activity just to avoid hyperinflation.