The straddle options strategy is a way for traders to take advantage of changes in market volatility. Buying a straddle can profit from a swing in the underlying security price, but it doesn’t matter whether it goes up or down. Conversely, selling a straddle will profit when the underlying security stays near the same price until the options expire.

Read on to learn more about the straddle options strategy and when it works best.

What is a straddle options strategy

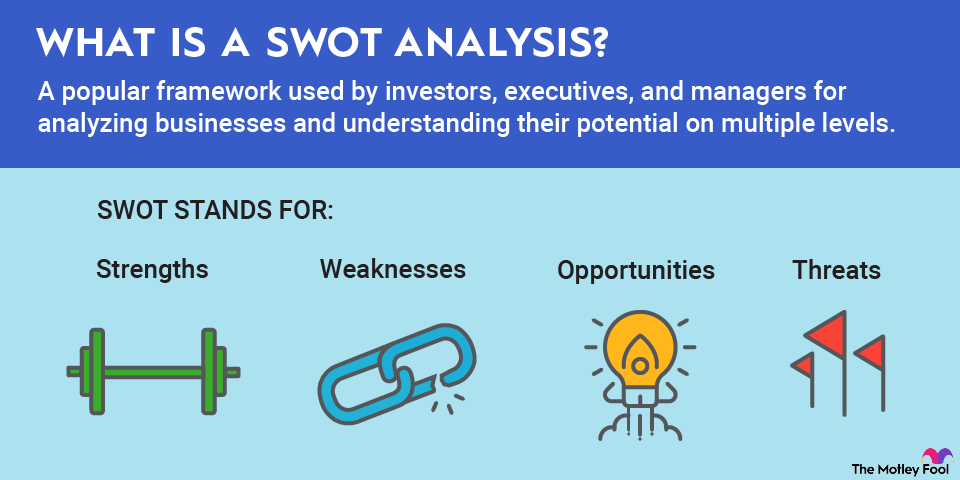

A straddle options strategy involves buying or selling both a call option and a put option with the same strike price. The value of a straddle is lowest when the underlying security price is closest to the strike price.

There are two parts to a straddle:

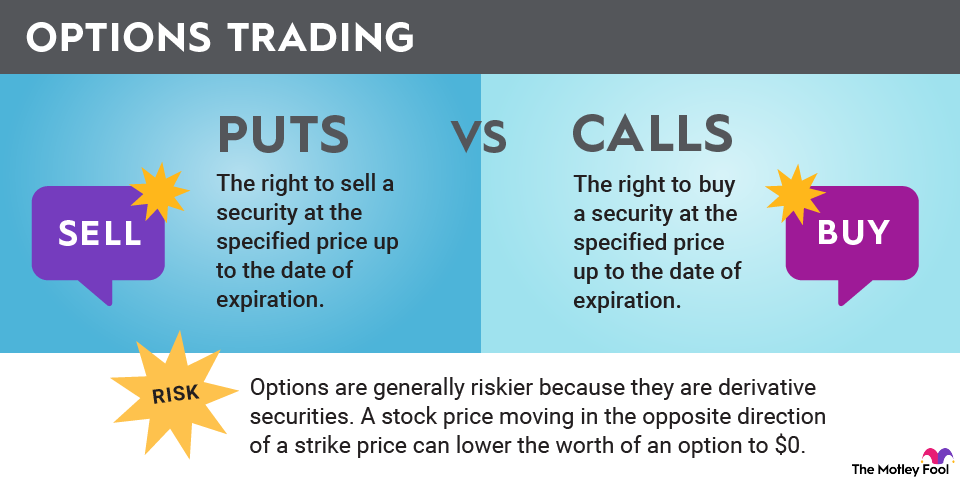

- The put option gives the holder the right to sell the underlying security at its designated strike price. So, the value of a put option increases when the underlying security’s price decreases.

- The call option gives the holder the right to buy the underlying security at the designated strike price. So, a call option increases in value as the price of the underlying security increases.

Combining the two options contracts means one will expire worthless and the other will be in the money. That makes the straddle options trade direction agnostic, as the stock could move either way and the strategy can still make a profit.

Buying and selling a straddle

A trader expecting big swings in the underlying security’s stock price may buy a straddle while someone expecting the price to remain relatively stable could sell the straddle.

Buying a straddle has defined risk. You can only lose as much as you pay for the straddle. Your profit potential is unlimited but typically requires a big move in the underlying security.

Selling a straddle has unlimited risk. You’ll collect the premium for selling both legs of the straddle, but you could lose a lot if the stock moves significantly. Keep in mind that one of the options is guaranteed to expire in the money. Selling straddles will require you to close the trade before expiration in order to avoid assignment.

The straddle vs. iron butterfly options strategy

The iron butterfly options strategy may sound complicated, but it’s simply a hedged straddle.

Strike Price

To protect against a decline in the underlying security’s price on a straddle, a seller could also buy a put with a strike price below the strike price of the straddle. That way, if the price falls significantly, they’ll be assigned on the short put at the strike price, but they’ll be able to sell the underlying security with the put contract they bought as a hedge.

Related investing topics

Likewise, buying a call with a strike price above the strike price of the straddle will protect the straddle seller from the unlimited risk of the underlying security increasing in price.

A straddle buyer could do the inverse, selling a put and a call. Doing so will lower the cost of initiating the trade, but cap the profit potential.

When a straddle options strategy works best

A straddle works best when you expect big news to produce a significant movement in the underlying security. Conversely, you may sell a straddle if you expect the underlying security to trade within a range.

Buying a straddle heading into earnings can be expensive. Everyone knows the potential for earnings to produce lots of movement in stock prices. As such, option premiums are high due to the high implied volatility. If you’re buying a straddle ahead of earnings, you’re betting that the stock will move more than the cost of the straddle. So, even if the stock price moves a lot, you still might not make a profit.

Selling a straddle works well for securities that are trading within a range. Periods of low volatility can make a straddle profitable very quickly, allowing you to close the trade for a profit well before expiration.