Kettle Hill Capital Management, LLC initiated a new position in LKQ (LKQ +2.69%), acquiring 1,163,355 shares valued at approximately $35.53 million, according to its November 13, 2025, SEC filing.

What Happened

Kettle Hill Capital Management, LLC disclosed a new position in LKQ, purchasing 1,163,355 shares valued at $35.53 million as of September 30, 2025, according to its SEC filing dated November 13, 2025. The addition accounted for 7.99% of the fund’s reported U.S. equity assets, increasing total positions to 36 at quarter-end.

What Else to Know

This was a new position, with LKQ accounting for 7.99% of the fund’s 13F assets under management after the trade.

Top holdings after the filing:

- NASDAQ: LKQ: $35.53 million (7.99% of AUM)

- NYSE: PSN: $30.94 million (6.96% of AUM)

- NASDAQ: WYNN: $26.98 million (6.07% of AUM)

- NYSE: IFF: $26.14 million (5.88% of AUM)

- NYSE: RKT: $24.68 million (5.55% of AUM)

As of December 05, 2025, shares were priced at $29.45, down 19.23% over the past year and underperforming the S&P 500 by 34.82 percentage points.

LKQ’s trailing twelve months revenue was $13.96 billion, with net income of $697 million and a dividend yield of 3.87%.

The position places LKQ as the fund’s 1st-largest holding.

Company Overview

| Metric | Value |

|---|---|

| Price (as of market close 12/05/25) | $29.45 |

| Market Capitalization | $7.95 billion |

| Revenue (TTM) | $13.96 billion |

| Net Income (TTM) | $697.00 million |

Company Snapshot

- Distributes automotive replacement parts, components, and systems including body panels, mechanical parts, glass, and specialty accessories across North America and Europe.

- Operates a diversified model sourcing both new and recycled auto parts, generating revenue through wholesale distribution to repair shops, dealerships, and direct retail sales.

- Serves collision and mechanical repair shops, new and used car dealerships, and retail customers seeking cost-effective vehicle repair and maintenance solutions.

LKQ Corporation is a leading global distributor of automotive replacement parts with a broad geographic footprint and a diverse product offering. The company leverages its scale and integrated supply chain to deliver both new and recycled parts to a wide spectrum of customers.

Foolish Take

Kettle Hill Capital Management, a New-York based investment firm, recently disclosed a new position in LKQ stock. The position was valued at $35.5 million at quarter-end (the three months ending on September 30, 2025) and is now the firm's largest equity holding.

Turning to LKQ, the company operates a business model based on the distribution of automotive replacement parts. However, the business -- and LKQ's stock -- hasn't performed well in recent years.

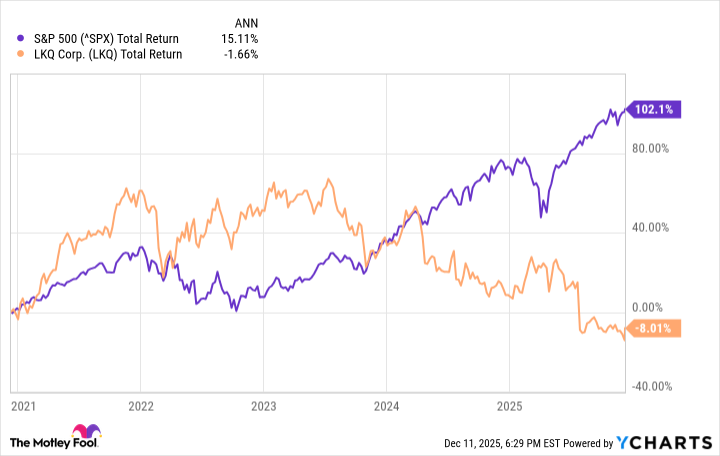

Indeed, shares have fallen by 8% over the last five years, resulting in a negative compound annual growth rate (CAGR) of -1.7%. The S&P 500, meanwhile, has more than doubled in value over the same period and has logged a CAGR of 15.1%.

Therefore, Kettle Hill appears to be betting on a major turnaround in LKQ -- or potentially a buyout. Moreover, other institutional investors, including Guardian Wealth Management, have also increased their holdings of LKQ.

Retail investors may wish to note these purchases, however, it would be unwise to transact in LKQ stock based solely on institutional transactions.

Glossary

13F assets under management: The total value of U.S. equity securities reported by an institutional investment manager in SEC Form 13F filings.

Position: The amount of a particular security or investment held by a fund or investor.

Stake: The ownership interest or share held in a company by an investor or fund.

Dividend yield: Annual dividends paid by a company divided by its share price, expressed as a percentage.

Trailing twelve months (TTM): The 12-month period ending with the most recent quarterly report.

Wholesale distribution: The sale of goods in large quantities to businesses, rather than to end consumers.

Recycled auto parts: Used vehicle parts that have been salvaged, refurbished, and resold for reuse.

Assets under management (AUM): The total market value of investments managed by a fund or investment firm.