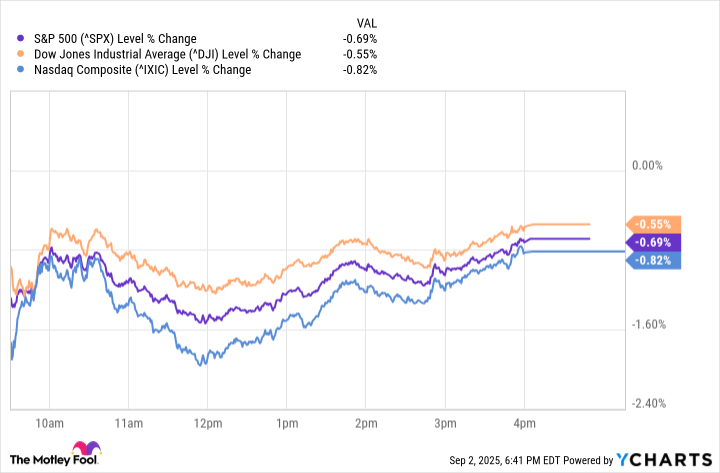

Data by YCharts

U.S. markets opened September on a defensive note, as seasonal weakness and rising yields weighed on stocks across all three benchmarks.

The S&P 500 (^GSPC 0.43%) lost 0.69% to 6,415.54, while the Nasdaq Composite (^IXIC 0.94%) slid 0.82% to 21,279.63--its steeper drop highlighting tech-sector vulnerability amid elevated bond yields and renewed worries over inflation and tariff uncertainty. The Dow Jones Industrial Average (^DJI 0.36%) also slipped, down 0.55% to 45,295.81, underscoring a broad risk-off tone as investors reposition ahead of what is historically the weakest month for equities.

Seasonal headwinds are already in motion: analysts reference the long‑standing "September Effect," where the S&P often declines an average of 0.8% during the month. This year, political tensions over Fed independence and concerns about government debt only amplify the downside bias.

Traders are turning their attention to upcoming economic reports--including jobs data and inflation updates--that could influence the Federal Reserve's next policy steps. Seasonal headwinds combined with persistent macro uncertainty leave September starting on a cautious note.

Market data sourced from Google Finance on Tuesday, Sept. 2, 2025.