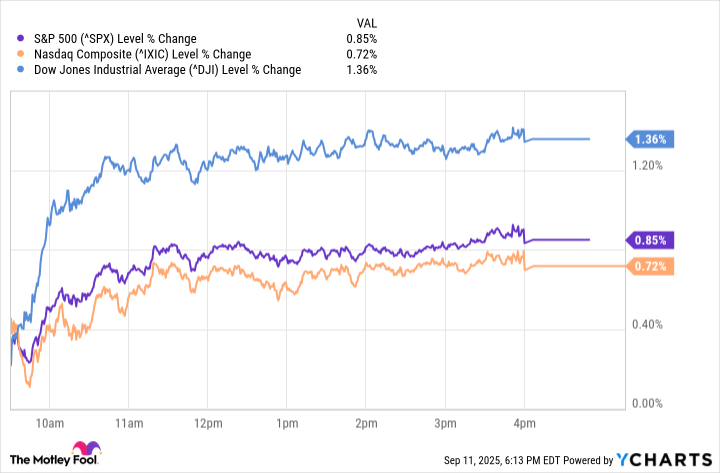

Data by YCharts

Equity markets ended Thursday at record highs after inflation ran hotter than expected and jobless claims surged, renewing hopes for rate cuts.

The S&P 500 (^GSPC +0.46%) rose 0.85% to 6,587.47. The Nasdaq Composite (^IXIC +0.57%) gained 0.72% to 22,043.07, while the Dow Jones Industrial Average (^DJI +0.16%) jumped 617.08 points, or 1.36%, to 46,108.00. Investors responded to signs that the inflationary environment remains sticky, but that labor market softness could give the Federal Reserve room to cut rates at its upcoming meeting.

August's Consumer Price Index rose 0.4% month-over-month and 2.9% year-over-year, topping forecasts. Core inflation excluding food and energy also climbed 0.3% month-over-month. Meanwhile, initial jobless claims rose to 263,000 for the week ended September 6 -- the highest level since October 2021 -- signaling a cooling in employment.

The inflation uptick complicates the Fed's decision, but the labor data has strengthened expectations of a 25 basis point rate cut next week.

Market data sourced from Google Finance on Thursday, Sept. 11, 2025.