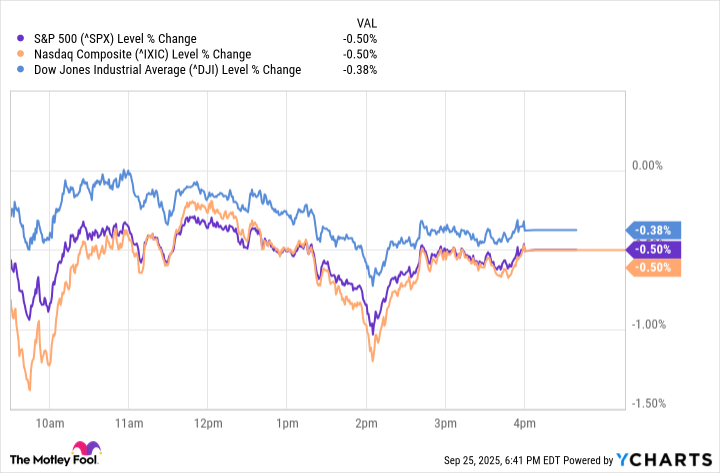

Data by YCharts.

The S&P 500 (^GSPC 0.06%) fell 0.5% to 6,604.72, while the Nasdaq Composite (^IXIC 0.06%) declined 0.5% to 22,384.70. The Dow Jones Industrial Average (^DJI 0.17%) slipped 0.4% to 45,947.32. It was the third straight session of losses, with yields hovering near recent highs and traders reluctant to add risk ahead of key inflation data.

Attention is turning to Friday's release of the Personal Consumption Expenditures (PCE) price index, considered the Fed's preferred measure of inflation. The reading will help determine whether policymakers maintain a cautious stance on rate cuts after Chair Jerome Powell recently emphasized patience.

Economic signals added to the mixed picture. Jobless claims fell this past week, but hiring remains muted, pointing to a labor market losing steam. At the same time, second-quarter GDP was revised higher, underscoring resilience in growth despite tighter financial conditions.

On the corporate front, Intel (INTC 2.81%) rose 8.9% on reports of investment talks with Apple, while IBM (IBM +2.59%) gained 5.2% on results from a quantum computing trial with HSBC. CarMax (KMX +0.64%) tumbled 20% after missing earnings expectations and warning on weak sales trends.

Market data sourced from Google Finance on Thursday, Sept. 25, 2025.