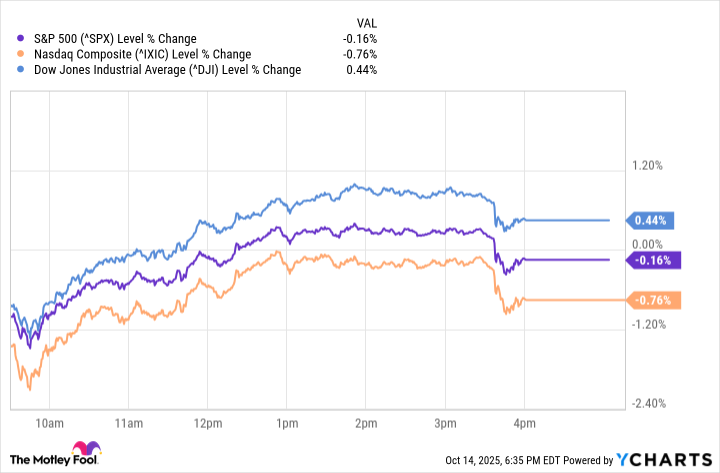

Data by YCharts

The S&P 500 (^GSPC 0.06%) fell 0.16% to 6,644.31, while the Nasdaq Composite (^IXIC 0.06%) dropped 0.76% to 22,521.70. The Dow Jones Industrial Average (^DJI 0.17%) managed a 0.44% gain to 46,270.46, lifted by banking and industrial stocks earlier in the session before broader markets turned lower into the close.

Equities lost momentum in afternoon trading as renewed U.S.–China trade tensions rattled investors. Reports that Beijing restricted new business with certain foreign manufacturers raised fears of a broader slowdown in cross-border investment and supply chain disruptions.

Federal Reserve Chair

The S&P 500 (SNPINDEX:^GSPC) fell 0.16% to 6,644.31, while the Nasdaq Composite (NASDAQINDEX:^IXIC) dropped 0.76% to 22,521.70. The Dow Jones Industrial Average (DJINDICES:^DJI) managed a 0.44% gain to 46,270.46, lifted by banking and industrial stocks earlier in the session before broader markets turned lower into the close.

Equities lost momentum in afternoon trading as renewed U.S.–China trade tensions rattled investors. Reports that Beijing restricted new business with certain foreign manufacturers raised fears of a broader slowdown in cross-border investment and supply chain disruptions.

Federal Reserve Chair Jerome Powell's latest comments reinforced a cautious tone, suggesting the Fed remains data-dependent as it evaluates the timing of potential rate cuts. The combination of trade anxiety and tempered policy outlook sent tech and semiconductor names lower, with Nvidia Corp. (NASDAQ: NVDA) and Intel Corp. (NASDAQ: INTC)among the biggest decliners.

By contrast, Wells Fargo & Co. (NYSE: WFC), Citigroup Inc. (NYSE: C), and Caterpillar Inc. (NYSE: CAT) helped the Dow stay afloat, buoyed by strong earnings and industrial resilience.

Investors will continue to monitor developments in U.S.–China relations and upcoming inflation data for signs of whether global trade and growth momentum can stabilize.

's latest comments reinforced a cautious tone, suggesting the Fed remains data-dependent as it evaluates the timing of potential rate cuts. The combination of trade anxiety and tempered policy outlook sent tech and semiconductor names lower, with Nvidia Corp. (NVDA 0.44%) and Intel Corp. (NASDAQ: INTC) among the biggest decliners.

By contrast, Wells Fargo & Co. (WFC 0.65%), Citigroup Inc. (C +0.49%), and Caterpillar Inc. (CAT 0.04%) helped the Dow stay afloat, buoyed by strong earnings and industrial resilience.

Investors will continue to monitor developments in U.S.–China relations and upcoming inflation data for signs of whether global trade and growth momentum can stabilize.

Market data sourced from Google Finance on Tuesday, Oct. 14, 2025.