The automotive industry is quickly expanding from Detroit to include Silicon Valley. Image source: Getty Images.

If we've heard it once, we've heard it a million times: The auto industry is going to evolve more in the next two decades than it has in the past century. While fully autonomous vehicles are a long ways off, there's no denying that our vehicles are becoming more connected to every facet of our lives. It's this wildly enticing potential that has lured in many companies not historically associated with the automotive industry. Here are two recent, and somewhat surprising, examples of tech companies leaping into the auto industry.

Let's forget about exploding smartphones

Given Samsung's recent smartphone "issues," expanding into automotive electronics to help diversify its revenue streams can only be even more enticing. Samsung certainly made a splash when it announced it would acquire Harman International Industries (HAR +0.00%) for $112 per share, or a total equity value of about $8 billion.

Harman is mostly known for its premium audio speakers, but what many investors unfamiliar with the company may not realize is that it does so much more. Harman designs and engineers connected products and solutions for consumers and automakers such as navigation systems, audio and multimedia systems, telematics and even cybersecurity solutions, to name only a few. In fact, roughly 65% of Harman's $7 billion in sales during the 12-month period that ended Sept. 30 were automotive related.

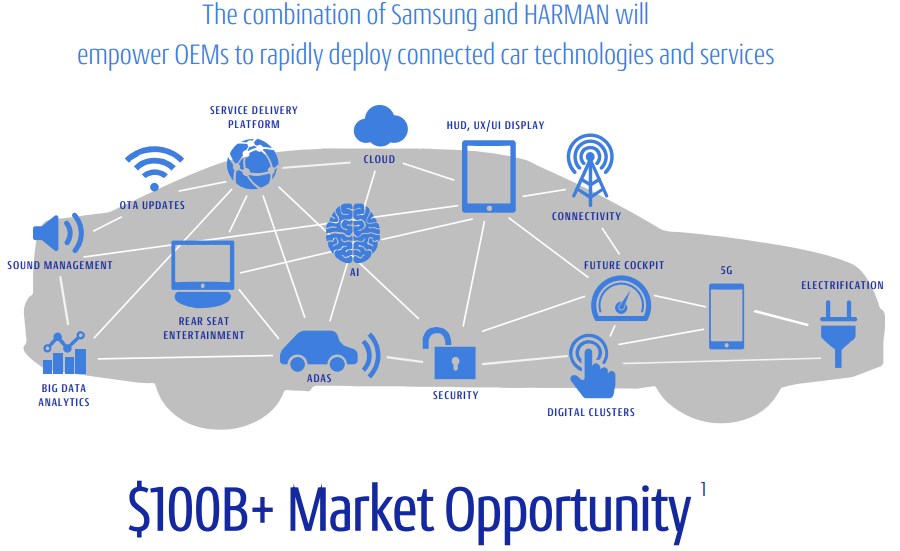

And, as previously mentioned, the potential market for the products that are making our cars increasingly smarter is vast.

Image source: Samsung's acquisition presentation.

This is a great move for Samsung, and signals the company's sincerity about being a big player in the evolving auto industry; for instance, Harman offers 36 global auto brands with a backlog of orders worth $24 billion, and roughly 30 million vehicles already have Harman technology.

In the grand scheme of things, this is Samsung's next step in creating an ecosystem for its products that can rival those of its major competitors, as it will have connected products in your home, on your person, in your car, and at public venues. And hey, despite the price tag that was 28% premium to Harman's closing price on Nov. 11, 2016, it's instantly accretive to Samsung's earnings.

A computer chip juggernaut wants in on the fun

Intel's (INTC +4.96%) splash was in a different area, more focused on the technology for autonomous vehicles, and it was a much smaller investment than Samsung's $8 billion acquisition of Harman. Intel announced at the Los Angeles Auto Show that it plans to invest more than $250 million over the next two years to develop autonomous vehicle technology, including vision processing, 5G connectivity, cloud computing, and security.

In fact, just this summer Intel partnered up with Mobileye and BMW to develop a self-driving system for the iNext BMW, which is poised to play a big role in the automaker's future. This is part of a shift in strategy for Intel, which hasn't had a long history of supplying products to the auto industry, but it has recently done roughly $1 billion of wide-ranging business with well-known automakers such as BMW, Infiniti, Jaguar, Lexus, and Tesla, among many others.

It's abundantly clear with the rush of tech companies into the auto industry that things are rapidly changing. Investors who keep abreast of these moves and stay on the lookout for businesses with high-quality auto technology could find the next big winner. Stay tuned, this story is just beginning.