Investors, do you prefer stocks that give you sleepless nights and require constant babysitting, or ones that let you keep your cool, even during tough times when impatient investors may be sweating in fear? The "chill" stocks are the ones that are made of steel and can weather storms, fetching you strong returns in the long run. Having a long-term outlook is, after all, a key trait of a Foolish investor.

That's why our contributors have dug up three such stocks for you today that require little monitoring and have the potential to grow big in the years to come. They're Disney (DIS 0.45%), Illinois Tool Works (ITW +0.39%), and Microsoft (MSFT 2.16%).

A magical entertainment legacy

Keith Noonan (Disney): From the first Mickey Mouse cartoon to its present status as one of the world's largest and most influential media companies, the Walt Disney Company has demonstrated remarkable creative savvy and staying power. Its business segments are diversified across media networks, theme parks & resorts, filmed entertainment, and consumer products. However, if you'd like to see a microcosm of how it's been so successful through the years, take a look at its Beauty and the Beast franchise.

Image source: Getty Images.

The company's original take on the fairytale was released in 1991 and immediately joined the ranks of Disney's most esteemed animated classics. The film also quickly became an asset for its theme parks and consumer products divisions, creating ongoing revenue streams that benefited the company all the way through to the present day, when a live-action version of Beauty and the Beast has grossed more than $1 billion in ticket sales and joined the ranks of the most successful films ever.

Beauty's success isn't an isolated incident, either. Across projects like Star Wars, the Marvel Cinematic Universe, and The Jungle Book, Disney has demonstrated remarkable consistency when it comes to re-energizing and utilizing potent entertainment franchises. It's still bringing forth new hit properties, as well -- with billion-dollar blockbusters including Frozen and Zootopia introducing stories and characters that will reverberate for decades to come.

The magic that helped Disney conquer the world is alive and well. For that reason, it stands out as a stock that investors can buy and hold for the long-term without the need for micromanagement along the way.

A proven multi-bagger stock

Neha Chamaria (Illinois Tool Works): After you've traveled to the magical world of Disney, coming back to a boring industrials stock might be hard-hitting -- but hear me out. Keith subtly pointed out how diversified Disney is, albeit in its own space. I'm going to take a cue from there and tell you why Illinois Tool Works is one stock you simply can't ignore when you want stocks that need no babysitting.

I'll point to the company's diversification, which can hugely help mitigate business risks and usually result in more stable returns for the company in the long run versus a specialized company. Illinois Tool Works is a perfect example from that standpoint as it operates seven diverse businesses that serve both cyclical and defensive industries, including automotive, oil and gas, healthcare, food equipment, consumer packaging, electronics, aerospace, construction, and more.

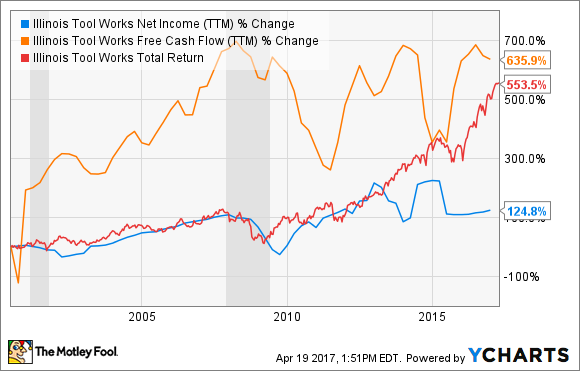

This diversity, backed by prudent management, is largely why Illinois Tool Works has been able to grow its profits and free cash flows over the years.

ITW Net Income (TTM) data by YCharts.

To be fair, growth did take a back seat during recessionary periods, but it's the way that the company bounced back to make investors rich in the long run that matters. On a total-return basis, Illinois Tool Works' shares have tripled in the past decade. You can partly credit the company's regular dividend increases -- it has been paying higher dividends year after year for more than five decades now -- for the growth.

Shareholders can safely expect Illinois Tool Works stock to continue to grow, backed by growth in earnings and dividends. Given its track record, you need not worry about returns, even in a low-growth business environment.

The best is yet to come

Tim Brugger (Microsoft): It's been a relatively bumpy ride since CEO Satya Nadella implemented Microsoft's transformation to a "mobile-first, cloud-first" provider. But for patient investors, the wait for Microsoft's transition to take hold has been well worth it. Better still, the best is yet to come.

Microsoft ended fiscal 2016's second quarter with an annual cloud revenue run rate of over $14 billion, putting the company at or near the top of the heap in one of tech's fastest-growing markets. Part of what makes Microsoft a stock that investors don't have to babysit is that its cloud growth is due to its emphasis on delivering software as a service (SaaS), which is recognized by many pundits as a market with nearly limitless potential.

Image source: Getty Images.

The success of Microsoft's SaaS-first strategy was evident again last quarter. Microsoft's legacy Office 365's commercial sales soared 47% compared to a year ago, largely due to its success in the cloud. Azure, the platform Microsoft uses to deliver its SaaS offerings, enjoyed a 93% jump in revenue in the second quarter. Look for more of the same when third-quarter results are announced on April 27.

A surprisingly strong PC market, led by longtime Microsoft partner HP's (HPQ 0.17%) 13.1% year-over-year increase in shipments, also bodes well for the Windows 10 king. Worldwide adoption of Windows 10 combined with a stable PC market should help the resurgence of Bing search and ad revenue -- where revenue jumped 10% last quarter -- to continue.

Toss in its 2.4% dividend yield, along with a leadership position in skyrocketing markets, and Microsoft is a stock to buy, hold, and enjoy for years to come.