There are valid reasons to buy, sell, or stay put for almost any investment. Not every stock that's trading at all-time highs should be sold, nor avoided. Similarly, not every stock that's down on its luck should be bought based on the simplistic logic that a long-term rebound must be on the horizon -- one may never arrive. This complexity is why even the best investors bet wrong -- sometimes in a big way.

It's also why the simple narratives don't always make the strongest arguments about whether or not to buy a particular stock. For instance, Cameco Corp. (CCJ +1.70%) and Hecla Mining (HL +6.85%) have near- and long-term growth potential, but there are also solid reasons to avoid both companies. Meanwhile, the boring business of A.O. Smith Corp. (AOS +0.17%) might be easy to overlook or dismiss, but its strong cash flow and ample growth opportunities hint that the stock is a buy.

Image source: Getty Images.

Stocks to avoid

While you can sometimes earn huge returns by being greedy when others are fearful, those "others" aren't always missing the big picture. The latter situation appears to be the case for Cameco Corp. That is, a stock that investors would be better off avoiding.

The bull argument is pretty simple and not unreasonable. Sure, the world's leading uranium miner has fallen on tough times, but it will be among the first to rebound when uranium markets improve. And a rebound is plausible. There are 60 nuclear reactors under construction worldwide today, which will add to the global fleet of 449 operating reactors. Another 23 reactors in Japan could be about to come back online, compared to just three reactors there that have restarted since the Fukushima disaster in 2011.

Yet even though it's the best uranium stock on the market, and its price is down by around 50% over the past three years, that doesn't necessarily mean the current situation is a clear buying opportunity. Cameco recently sliced its dividend payout from $0.10 per share to $0.074 per share, but it would be better off suspending it altogether. Meanwhile, the company has reduced headcount, pulled back on exploration, and decreased output to cut operating costs and protect margins. Those were all wise moves, but you can only reduce operations by so much.

Continually falling uranium prices, coupled with rising pressures against nuclear energy in advanced economies, hint that the power source may be going the way of the dodo in the decades to come. Investors should avoid Cameco stock for now, and perhaps for good.

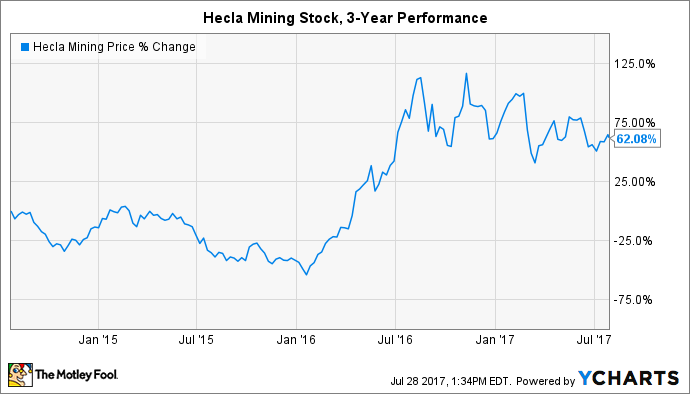

Meanwhile, investors will find one or two parallels between precious metals miner Hecla Mining and Cameco. Hecla has handily beaten the stock performance of its gold and silver mining peers in the last five years, making it one of the best gold stocks on the market. However, the company was caught off guard by the sudden collapses in gold and silver prices. Its extraction costs were simply too high.

Fast-forward a few years to the present, and Hecla Mining is well-positioned to capitalize on its investments in operational efficiency. Investors already began rewarding the stock early last year.

But once again, that doesn't necessarily make the current situation a buying opportunity. I recently argued that Hecla Mining stock should be held if it's already in your portfolio, but should not become a new addition to your investment holdings. Why?

Although the company is positioned for growth over the next several years so long as precious metals prices cooperate, there's one caveat that must be considered: Gold mining stocks have an awful track record against the S&P 500 over long periods of time. Simply put, investors can do better.

One stock to buy

That brings us to boring old A. O. Smith, which has made a comfortable living and consistently built wealth for shareholders by being a leading provider of water heaters. It owns leading market positions in the U.S. and China for residential and commercial water heaters, boilers, and more. But it isn't done yet.

The company is forecasting 9.5% revenue growth and 12% EPS growth in 2017. Most of that will be driven by continued growth in China, a market that accounted for one-third of its revenue in 2016. Management sees plenty of evergreen growth opportunities in the country -- many households have purchased their first water heaters in the last 10 years -- and is building new brands with home air and water purification systems.

Its strong performances in mature markets in North America as well as growth markets in Asia have pushed operating cash flow to record highs, led to dividend payments, and allowed management to make bigger bets on growth opportunities.

One market A. O. Smith has high hopes for is India. Management thinks there's an opportunity in the country as large as what it has achieved in China over the past 20 years. The scary part about that is that its revenue from India totaled just $18 million in 2016, compared to $888 million from China. Win or lose in that new market, this stock is one of the lowest-risk growth investments I've found, which is why I see A. O. Smith stock as a buy.

What does it mean for investors?

Any individual can make their own investing decisions and find success, but complexity ensures no one will have a perfect track record. Even stocks supported by logical arguments or easy-to-identify growth opportunities can fail to live up to their long-term potential. That's why I would avoid Cameco Corp. and Hecla Mining, respectively.

The flip side is also true. Businesses that are overlooked as boring can be some of the best long-term investments you can make. Water heaters may not be on your radar, but A. O. Smith's stock may make you reconsider.