The insurance business goes through wild swings, with long periods of quiet profits punctuated by major catastrophic events that put pressure on the entire industry. Cincinnati Financial (CINF 0.44%) isn't the best-known player in the property and casualty insurance business, but the Ohio-based company offers a wide range of protection through personal home, auto, and life insurance as well as business-related insurance products. With Hurricanes Harvey, Irma, and Maria having plowed through the U.S. in just the past couple of months, investors want to know if insurers like Cincinnati Financial will be in a position to keep paying solid dividends.

Let's look more closely at the insurer to see whether shareholders can confidently expect to keep getting quarterly checks.

Dividend stats on Cincinnati Financial

|

Metric | Cincinnati Financial |

|---|---|

|

Current quarterly dividend per share |

$0.50 |

|

Current yield |

2.6% |

|

Number of consecutive years with dividend increases |

57 years |

|

Payout ratio |

57% |

|

Last increase |

March 2017 |

Data source: Yahoo! Finance. Last increase refers to ex-dividend date.

Dividend yield

Cincinnati Financial's current yield is 2.6%, which puts it above the S&P 500's average yield of around 2%. That's actually relatively low for the insurance company, which has seen its yield drop steadily from as high as 6% in the early 2010s to its current level, which is the lowest in more than a decade. Yet as you'll see in more detail below, the drop in yield hasn't come from falling dividend payouts, but rather from a skyrocketing share price that has more than tripled since late 2011. Cincinnati Financial's yield is consistent with other insurance companies and doesn't raise any red flags about the safety of its payout.

Image source: Getty Images.

Payout ratio

Cincinnati Financial pays out almost three-fifths of its earnings to shareholders through dividends. That's generally in line with the range that the insurer has seen in recent years, with the figure generally fluctuating between 40% on the low side and 70% on the high side. Occasionally, Cincinnati Financial experiences unusually large losses that send its payout ratio temporarily soaring, but the insurance company has done a good job of bringing those losses into line and restoring its sustainable profitability over the long haul.

Dividend growth

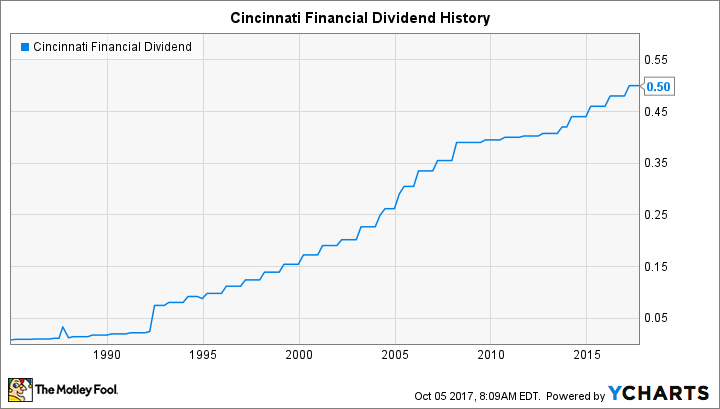

For 57 consecutive years, Cincinnati Financial has rewarded its investors with dividend increases. The most recent came earlier this year, when the insurer boosted its payout by 4% to an even $0.50 per share each quarter.

You can see in the chart below how Cincinnati Financial has varied the pace of its dividend growth in line with industry conditions. Yet even after tough times like the financial crisis, Cincinnati Financial has made it a point to keep its dividend on the rise, albeit at a slower rate than investors have seen generally. Increases in the past four years have been healthier, reflecting a better industry environment.

CINF Dividend data by YCharts.

What's happened with Cincinnati Financial lately?

Excellent conditions in property and casualty insurance have helped Cincinnati Financial post extraordinarily strong fundamental business results. After dipping during the late 2000s, revenue has bounced back to climb above pre-crisis levels. Net income hasn't yet gotten all the way back to what investors saw in strong years like 2006 and 2007, but investors are optimistic about the insurer's prospects going forward.

However, Cincinnati Financial will inevitably see some short-term hits from recent hurricanes. The company doesn't have as big of a presence in Florida as many better-known insurers, but its smaller size also leaves it with greater risk even from relatively small losses. A slightly larger presence in Texas means Cincinnati Financial will see some impact from Harvey when it reports its third-quarter results.

What to expect from Cincinnati Financial

In the long run, though, insurance companies like Cincinnati Financial end up benefiting from loss events by being able to increase their premiums. Even if the stock encounters some pressure when the full extent of hurricane-related losses becomes known, Cincinnati Financial has overcome similar episodes in its history to produce the long-term growth that has supported its dividend over the decades.