It's been a great year for owning public companies. The S&P 500 has gained 13% this year and continues to set new record highs. Nearly everywhere investors look -- infrastructure, energy, industrials, healthcare -- they'll find companies that seem to have the wind at their back. Although right now it may seem that the good times may never end, even Warren Buffett thinks the market looks a little pricey.

Whether or not a marketwide reset is on the horizon, there are always stocks with expensive valuations that can be readjusted lower. Sometimes they drop quickly, and sometimes they gradually slide lower over several quarters or years due to becoming less effective at their market niche. That's why I think there are good reasons shares of Tesla (TSLA +0.49%), Northern Dynasty Minerals (NAK +3.85%), and CF Industries (CF 4.05%) are set to drop.

Image source: Getty Images.

Can anything upset this story stock?

Tesla told the world that during the third quarter of 2017 it whiffed on production of the Model 3 -- the potential for which is arguably the single biggest driver of the company's lofty valuation. Naturally, shares ended the next day higher than the day before. So it goes with story stocks.

While I want Tesla to succeed and think more entrepreneurs should work on "hard tech" rather than building empires based on digital advertising, it's possible to both root for the integrated renewable energy company and realize that it may never earn its current $59 billion valuation.

To be fair, falling short of the target for Model 3 production in the first quarter of ramp-up isn't an existential threat, but if that gap widens in future periods, then Mr. Market may be forced to rethink the company's valuation -- at least temporarily. Sure, investors have electric semis to turn their attention to next, but that's hardly more important than cranking out tens of thousands of Model 3s per quarter.

It's also worth pointing out that Tesla is about to face a step change increase in competition. Will that make the story stock lose some of its luster? For instance, General Motors just revealed plans to launch 20 new all-electric vehicles by 2023. It has money and production scale that dwarfs anything Tesla could dream of having in the next several years.

Wall Street won't overlook the competition, which means the stock may actually face consequences when Elon Musk's ambitious targets aren't met. I'm not saying the stock is worthless, but it seems reasonable that another delay would make Tesla stock worth less than $59 billion.

Wanted: wealthy friend(s)

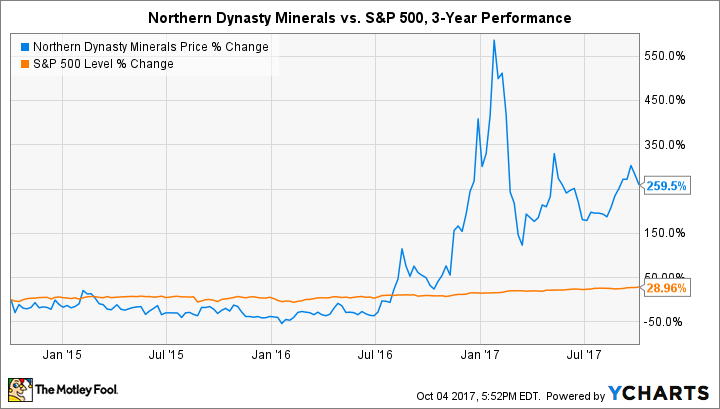

Northern Dynasty Minerals has received new life thanks to a deregulation-friendly agenda from the U.S. Environmental Protection Agency. That means its Pebble Project in Alaska -- the world's largest undeveloped copper and gold mine -- can finally start to be developed. Previous regulators said the mine would cause unnecessary harm to the world's largest sockeye salmon fishery. That's no longer a concern.

There's just one thing standing in the way: money -- and a lot of it. The bad news is that Northern Dynasty Minerals ended the second quarter of 2017 with just $48 million, which would be a rounding error in the operations of a mine as large as Pebble. The good news is the company is in the "repartnering" process as we speak (a nod to the fact that it had partners before those darn fish got in the way). However, I don't think investors realize just how weak the position is at the bargaining table.

While the undeveloped asset itself is a pretty good bargaining chip, Northern Dynasty Minerals absolutely needs outside help to bring it online. The partner or partners that sign onto the project will be the ones footing most of the bill, and they'll surely use that fact to their advantage. Essentially, I think many will be surprised at the terms that are agreed to and just how much the miner-to-be has to give up.

Northern Dynasty Minerals could announce some combination of a partnership and a massive debt financing, but that would take the risk to a whole new level. The amount of debt needed could only be secured with the Pebble Mine, making any delay between now and 2024 -- when the mine is expected to come online -- a potentially binary event for the company's survival.

A nitrogen fertilizer stock breaking the mold... for now

Investors have long been attracted to fertilizer stocks for their incredible dividends. CF Industries has always been among the leaders in dishing out distribution payments to shareholders, and even in today's historically awful market, it continues to pay a 3.4% dividend. Not bad.

The stock has turned in a respectable 2017 campaign, especially compared to its industry peers, although much of the gains have come since the company reported second-quarter 2017 earnings in early August. There are hints that the ride won't last.

In a way, CF Industries embodies everything that's wrong with the nitrogen fertilizer market. In its last quarterly update, the company boasted about "record sales and production volumes" and simultaneously warned that the market was still reeling in excess supply. No kidding.

Due to the unusual duration of the nitrogen fertilizer market rut, many producers have attempted to make ends meet by selling higher volumes, even though that's exacerbating the problem of historically low selling prices. Nitrogen fertilizer prices are now at multi-year lows. Ammonia prices are nearing a low last seen briefly during the Great Recession, while urea prices are at their lowest point since 2004.

CF Industries owns a relatively healthy operation, but has posted positive earnings -- of $0.01 per share -- in only one of the last four quarters. Its own outlook calls for current conditions to continue into 2018. And although it thinks supply growth will "slow in the future" thanks almost entirely to expectations for Chinese production to be removed from global supply, that's been the idea for almost three years now.

Without companies making difficult decisions to actually address the supply glut, selling prices don't have a shot at recovering. There aren't many reasons to believe the stock can sustain its 20% gain since August.

What does it mean for investors?

Stocks go up and stocks go down. The key is to buy great companies at great prices and hold forever. Now, just because these stocks appear set to drop based on public knowledge today doesn't mean future potential drops won't uncover a buying opportunity.

Tesla could hit its manufacturing targets for the Model 3 over time. Northern Dynasty Minerals could announce the partnership of all partnerships on favorable terms for shareholders. CF Industries stock could be worth a look if supply does in fact come offline before the end of the decade. Just don't be surprised if these stocks drop in the near future.