What happened

Shares of oil-industry bigwig Chevron (CVX +0.47%) rose 9.2% in September to $117.50 per share, just a nickel away from its all-time split-adjusted high. While that sounds impressive, it was middle-of-the-road performance for the month, which saw rising crude oil prices and broad gains across the oil sector.

However, it lagged the overall oil and gas market, as measured by the SPDR S&P Oil & Gas Exploration & Production ETF.

The stock market rewarded oil-industry player Chevron in September, pushing its stock to near-record split-adjusted highs. Image source: Getty Images.

So what

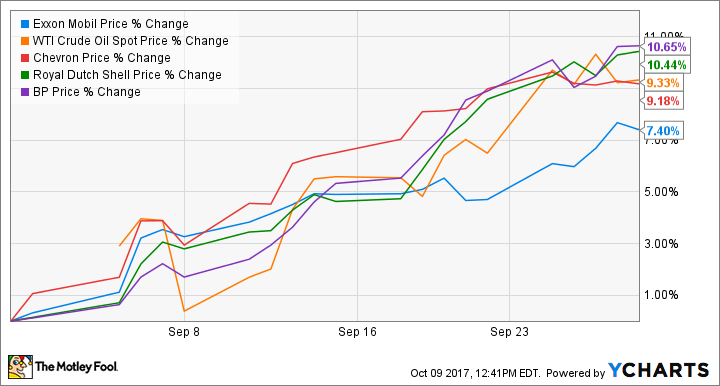

A better-than-9% gain in a single month for a company as big as Chevron is nothing to sneeze at. Certainly, not many companies with a market cap above $200 billion see those kinds of monthly gains. But in this case, the gains were shared by Chevron's big oil-industry peers. In fact, BP and Royal Dutch Shell gained more than 10% for the month, while ExxonMobil lagged only a bit behind.

The companies' gains closely mirrored the price of WTI crude, which rose for the month as well:

Now what

While Chevron's recent stock-price recovery may have fueled speculation about an impending stock split, September's performance doesn't really affect the fundamental thesis for investing in the company. When oil prices rise, oil-company stocks tend to rise along with them. If oil prices drop next month, we'll likely see a similar reaction from the shares of Chevron and its peers.

Right now, all of the integrated oil majors are trying to "do more with less": maintain profitability and cash flow neutrality -- or, better yet, become cash flow positive -- at these new, lower oil prices. Chevron's management has been trying to grow production while keeping capital spending low. We'll see from its next earnings report whether it's truly making progress.