The Internet of Things (IoT) is one of the hottest tech trends right now. Not surprisingly, a huge number of companies are trying to jump on to the IoT bandwagon since it is supposed to open up a multibillion-dollar revenue opportunity.

IC Insights forecasts that IoT semiconductor sales could exceed $31 billion in 2020 as compared to $18 billion last year, thanks to deeper penetration of IoT solutions that will result in more devices connecting to the internet. This is why chipmakers Sierra Wireless (SWIR +0.00%) and Qorvo (QRVO +1.14%) have trained their sights on the IoT space.

Sierra Wireless is a pure-play IoT specialist that leads the machine-to-machine (M2M) connectivity market. The company has taken smart steps to keep itself ahead of the pack through a mix of acquisitions and product innovation. Qorvo, on the other hand, has become serious about making money in IoT as its over-reliance on Apple has started weighing on the top line.

But which of these two chipmakers is better from an investing standpoint? Let's find out.

Image Source: Getty Images.

The case for Sierra Wireless

Sierra Wireless' long-standing expertise in the IoT space has allowed it to strike deep partnerships with a number of big names. Volkswagen, for instance, will soon start using the IoT specialist's cellular modems to power speedy and safe cloud connectivity. The German automaker is scheduled to push the chipmaker's 4G modules in several of its models from 2018, paving the way for substantial top-line gains as Volkswagen delivers over 10 million cars annually.

More importantly, Sierra Wireless is busy securing its long-term success by acquiring companies in fast-growing IoT niches. For instance, it recently bolstered its position in the device-to-cloud solutions market by acquiring Numerex for $107 million. This move is expected to boost the recurring revenue from Sierra's services business to 10% of the company's total revenue.

By comparison, the company currently gets just 4% of its revenue from services. Furthermore, Numerex should help Sierra make a bigger impact in the device-to-cloud space, in the long run, thanks to its existing client base and established sales channels.

This could be a big deal for Sierra; device-to-cloud computing is going to get bigger as more IoT devices connect to the cloud. IHS, for instance, forecasts that the installed base of IoT devices will jump from 15.4 billion at the end of 2015 to over 30 billion in 2020. Sierra doesn't want to miss this gravy train, so it has put in place a comprehensive product lineup including modems, application frameworks, and connectivity solutions to securely deliver data to the cloud.

Therefore, Sierra Wireless could be a top pick to take advantage of IoT growth provided its execution remains strong.

The case for Qorvo

Qorvo's latest product development moves indicate that the company is now getting serious about the IoT opportunity. It recently launched two new IoT-centric platforms to address the fast-growing niches of smart-home systems and device-to-device communication.

Qorvo believes that its embedded chip platform for smart-home devices could be a hit among OEMs (original equipment manufacturers) because of its low power consumption and support for various connectivity protocols. The chipmaker has followed a similar path with its new device-to-device communication platform, deploying a single transceiver to support multiple connectivity standards in a bid to reduce costs and power consumption.

There's a possibility that Qorvo's move into these markets could give a nice boost to its business in the long run. After all, the smart-home devices market in North America is growing at a tearing pace and could potentially increase 55% over last year to more than 31 million devices.

But Qorvo is a lighter IoT play in comparison to Sierra Wireless, which has established relationships with well-known clients and is busy furthering its interests in this field through acquisitions. What's more, the variance in their recent performance and valuation will make it clear why Sierra is the better bet to take advantage of the IoT opportunity.

The clear winner

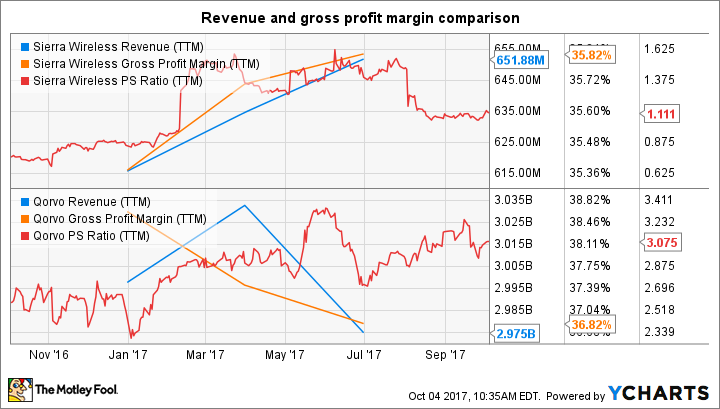

Sierra Wireless' business is on the rise, but the same isn't true for Qorvo, as the following chart clearly shows.

SWIR Revenue (TTM) data by YCharts

Qorvo's struggles can be attributed to the stiff competition it is facing in the smartphone space, and its move into IoT won't provide quick relief since the market is already crowded. Moreover, Qorvo is much more expensive than Sierra Wireless, as the price-to-sales ratio of both companies indicates. So investors have an easy choice to make here.