A transition takes place when you enter your 60s. In that decade of life, your investing goals shift from capital appreciation to preserving capital and generating income. That's why high-yielding Magellan Midstream Partners, L.P. (MMP +0.00%) and Duke Energy Corp (DUK +0.27%) are two companies that you should consider buying.

Big yield and big growth

Magellan Midstream Partners is an oil and gas midstream partnership, which means it helps move these two fuels from where they are pulled from the ground to the places where they get processed and used. Roughly 85% of its operating margin is generated from fee-based businesses. So the price of oil and natural gas are less important to its results than overall demand for fuel.

Image source: Getty Images.

For example, the partnership's distributable cash flow increased every year between 2012 and 2016. That period includes the oil decline that started in mid-2014, taking oil from over $100 a barrel to a low of around $30. Oil is currently hovering in the $50-a-barrel area. So Magellan's business is very stable.

Magellan is also conservatively financed, with a debt-to-EBITDA ratio below that of most of its peers. That includes industry giant Enterprise Products Partners L.P. (EPD +0.86%), which is generally considered one of the best run midstream partnerships. You might actually be tempted to pick Enterprise over Magellan, particularly since Enterprise offers a 6.4% yield compared to Magellan's 5%. But don't jump for the higher yield just yet.

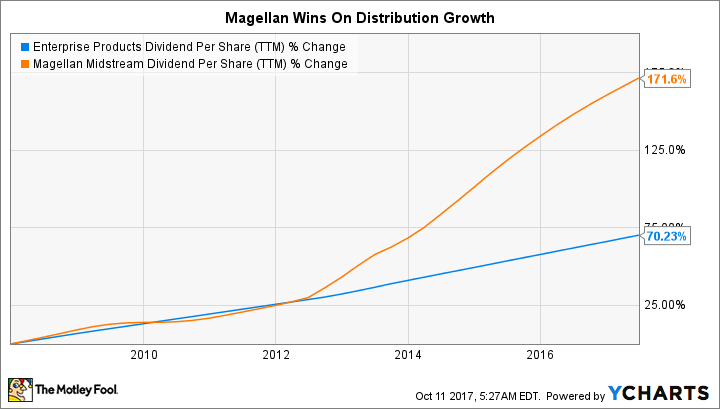

EPD Dividend Per Share (TTM) data by YCharts.

Where Magellan bests its larger peer is in distribution growth. Both have very long histories of regular annual distribution increases. But Enterprise's distribution has grown at around 5% historically. Magellan's has grown at about twice that rate. That's led to a 170% increase in Magellan's distribution over the past decade versus a 70% gain for Enterprise. A lower level of debt is a part of this, too, since it allows more cash to flow through to investors.

In your 60s you still have around 20 to 30 years of retirement to pay for, so adding an investment that will increase the spending power of your distribution materially over time is a good option. Magellan has proven it can do that. And you can rest assured in knowing that it has over $1.6 billion worth of capital spending planned over the next few years to back its continued distribution growth.

Slow and steady

Another name you should be looking at today is giant U.S. utility Duke Energy and its roughly 4.1% yield. Duke serves around 7.4 million electric customers and another 1.5 million natural gas customers. Those natural gas customers are largely a new development, related to the 2016 acquisition of Piedmont Natural Gas.

The Piedmont transaction was really the capstone of a major business overhaul at Duke. Over the last few years the utility sold its foreign assets and a carbon-based merchant power business, both of which had been a drag on results and faced uncertain futures. While it was doing this, management was building a renewable power merchant business, expanding its U.S. electric reach via the acquisition of Progress Energy, and moving into natural gas with the Piedmont deal.

Today the vast majority of its business is regulated (electricity and natural gas utilities) or operates under long-term contracts (natural gas pipelines and renewable power). And it has plans to expand, largely via investments in infrastructure. Regulators tend to look favorably on such investments and they expand the asset base on which the company can charge fees. At this point, Duke is expecting roughly 5% annual growth in earnings and the dividend.

Duke won't excite you, but that's the point. Adding this utility to your portfolio helps to build a strong foundation. But one where dividend growth will best the historical 3% growth in inflation -- one of the biggest threats to your retirement portfolio.

Get some yield and some dividend growth

You need to balance the investments you make against each other. Duke is a foundational holding, a slow and steady utility on which to layer more aggressive investments -- which is where Magellan and its fast-growing distribution come into play. Both are interesting on their own, but together they create a nice balance. Take a deep dive and you might find you have a place for each in your portfolio.