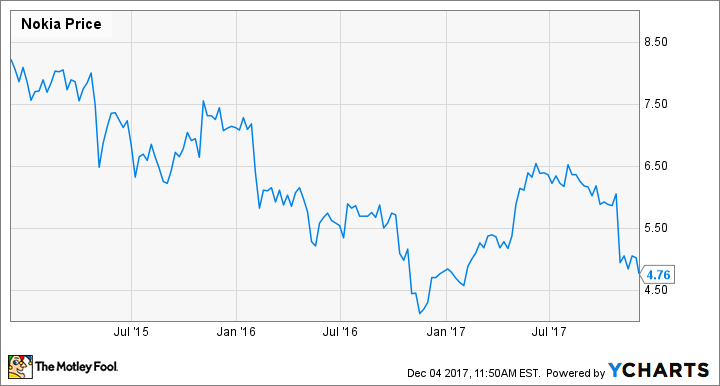

Beleaguered European tech giant Nokia (NOK 2.75%) is getting beaten up again after the third quarter 2017 report showed revenues in its telecom business declined. The company has its fair share of problems, but the stock has been sent back to near multiyear lows after the late October report. This could be setting up a buying opportunity for investors.

Data by YCharts.

The skinny on operations

Nokia was seemingly making headway on a recovery until the late October report came out. Year-over-year revenue fell 7% in the quarter, driven by a 17% decline in its biggest business segment: ultra broadband networks. The company cited challenges in the mobile networks business in North America and China.

Those headwinds are seen persisting into 2018. CEO Rajeev Suri said Nokia's total addressable market for mobile networks is expected to decline 2% to 5% in the upcoming year, driven by changes in North America and China. Suri said increased competition, network carrier consolidation, and transitions to new technology are to blame for the slowdown.

A case for buying

The shrinking of Nokia's revenue in its most important operating segment is concerning, but the accompanying decline in share price may be overdone. Not all the news in the last report was gloomy. For starters, the Nokia Technologies division revenue was up 37% year-over-year in the third quarter and up 48% year-to-date, and operating profit margin is at a whopping 81%.

The Nokia 3310 phone, a product in the technologies licensing portfolio. Image source: Nokia.

The Nokia Technologies portfolio, which licenses out technology patents and earns royalty revenue, includes smartwatches, phones, and virtual reality cameras. Though only 6.6% of total revenue this year, the division has doubled in size since 2014. With such a high profit margin, the extra gravy isn't completely offsetting declines in network sales, but it's certainly helping.

A second reason for optimism is that the 2015 merger with Alcatel-Lucent is yielding results. Operating profit is expected to have increased 8% to 10% by the end of this year, and the cost savings should continue. An additional $1.2 billion in savings should be realized in 2018, according to management projections.

As a result of those cost savings, Nokia's adjusted earnings per share were 0.09 euros in the most recent quarter, a 125% increase over the same period last year. Year-to-date adjusted profits have climbed 82% in spite of sales struggles. The company thinks that trend can continue as it streamlines operations with the old Alcatel-Lucent business in the years ahead.

A bet on the future

There are still reasons for concern in the near term that might at times outweigh those first two reasons for optimism, but investors can't ignore the longer-term potential that 5G networks present. Suri's mention of transitioning technology was no doubt a reference to 5G, which has the potential to have far-reaching implications for telecom, internet service providers, and the Internet of Things.

Nokia is confident it is well-positioned to benefit as 5G network technology gets closer to rollout. Suri had this to say about the potential:

In a market where competition remains robust, operational discipline is a must, and it is a core strength of Nokia. Furthermore, as the market transitions to 5G, I believe that the benefits of our portfolio will become even more apparent given that 5G is about much more than Radio. It requires Cloud core, IP routing, transport of many kinds, fixed wireless access, Software-Defined Networking and more -- and Nokia is one of the very few companies that is able to meet all those needs.

It could take some time for Nokia's abilities as a developer in the tech and telecom world to pay off, but 5G networks are already being worked on and tested on a very limited basis. The rollout of 5G for mainstream use will continue for years, and as it builds momentum, Nokia has a good chance of returning to growth. That makes this most recent tumble in share prices a good time to reevaluate making a purchase.