Last year, oil and gas was one of the top-performing sectors of the market as the industry slowly clawed back from an oil price of less than $30 a barrel at the beginning of the year. Pending some sort of Christmas miracle, it doesn't look as if oil and gas will be able to repeat that performance in 2017. So far this year, energy stocks are one of only two sectors in the S&P 500 posting losses this year.

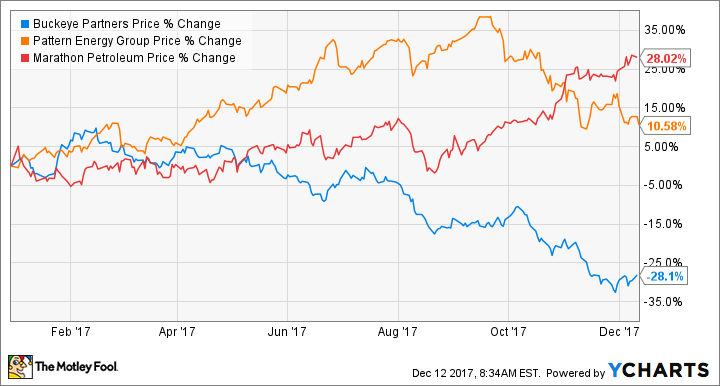

Just because the sector isn't doing so well doesn't mean there aren't some stocks investors should consider in energy. So we asked three of our investing contributors to each highlight a stock they see as a potential buy in December. Here's why they picked Buckeye Partners (BPL), Pattern Energy (PEGI), and Marathon Petroleum (MPC 0.55%).

Image source: Getty Images

High risk, huge opportunity

Reuben Gregg Brewer (Buckeye Partners, L.P.): Buckeye Partners isn't for the faint of heart. This storage-focused midstream partnership's roughly 11% distribution yield comes with a fair amount of risk. But it's also an opportunity to grab a fat yield from a company that's increased its distribution every year for 22 consecutive years -- the last hike coming in August.

So what's the problem? Buckeye recently bought a 50% stake in VTTI, a move that materially expanded its global storage footprint. However the $1.15 billion acquisition price tag was large for a partnership with a $6.8 billion market cap. It was also on the hook for another $237 million to help VTTI simplify its business structure.

There are a lot of moving parts right now, and despite the opportunity management sees, there's some near-term turbulence -- Buckeye's distribution coverage fell below 1 in the third quarter. That's not a good sign for an L.P. and justifiably has investors worried, noting that the third quarter broke an over four-year streak of consecutive quarterly increases.

But Buckeye has been here before, with distribution coverage falling below 1 in 2013 and 2014 while the partnership waited for investments to bear fruit. Today it has high hopes for VTTI and other expansion projects, like a pipeline in Texas that will add connections to its storage assets in the state.

Buckeye has been playing in this space since 1886 and has a long history of rewarding investors as it grows. I don't expect this time to be any different, and the current sell-off could turn out to be a short-lived opportunity to grab this high yielder. But only if you have a strong stomach.

Forget oil: The future of energy is in the wind

Sean O'Reilly (Pattern Energy): My pick for energy stock to buy this month is a bet on the future of electricity generation: Pattern Energy. A stock I've recommended before, Pattern Energy makes money every time the wind blows. It owns 20 wind farms that produce over 2.7 gigawatts (GW) of electricity. While most of its assets are in the U.S., it also has turbines in Chile and Canada and expansion opportunities all around the world, including Japan.

Pattern Energy contracts out the electricity generated from its wind assets to local utilities, with an average contract life of 14 years, and pays out the profits as dividends -- it's that simple. Energy investors will no doubt like the dividend, which currently yields just under 8% annually. The company has increased its dividend steadily since its IPO in 2013 and looks to continue growing it further in the years ahead.

As noted in a recent investor presentation, the company has the rights of first offer on 10 GW of wind assets -- nearly 4 times its current portfolio size. While it probably won't exercise its rights on all of these projects, Pattern's management does have a goal of reaching 5 GW by fiscal 2020.

With a foothold in the wind industry, Pattern Energy is a fantastic stock for Foolish energy investors.

Overlooking its value to investors

Tyler Crowe (Marathon Petroleum): Oil refiners have a reputation for being incredibly cyclical stocks and hard to predict in regard to when the market cycle will turn for or against them. As an industry heavily influenced by the price difference between the various types of crude oil and refined products, a refiner's success is much less predictable. These past couple of years have been tough for refiners, as the price difference between domestic and international crudes has been quite small, whereas it had benefited from cheaper domestic crude back when shale drilling was becoming popular.

Marathon Petroleum's results are heavily influenced by these price dynamics, but not as much as one might assume. The company also generates a large portion of its earnings from its network of Speedway retail filling stations and an equity investment in its subsidiary pipeline master limited partnership, MPLX LP (MPLX 0.86%). Combined, these two segments generate more than $500 million in operating income quarterly, which provides a more stable source of cash that makes it easier to stomach the ups and downs of the refining market.

What's also important is that management uses that cash flow to reward shareholders much better than its dividend yield of 2.05% suggests. Since the company was spun off from Marathon Oil back in 2010, the company has repurchased 29% of all shares outstanding, and management has a current authorization to buy back another $3 billion in shares.

The refining market is starting to swing back in Marathon's favor. The price for domestic crude is trading at a noticeable discount to international benchmark prices, and heavy crudes from Canada are priced at an even larger discount to domestic crudes. These cheap feedstocks should lead to outsize profits for its refining business. Combined with its non-refining investments, Marathon looks poised to deliver a lot of value to investors in the coming year.