GameStop (GME 1.22%) was one of dozens of retailers to announce surprisingly strong third-quarter results over the last few weeks even as it boosted its holiday-season forecast. And yet, unlike many of its peers, the video game seller's stock didn't benefit from management's brightening outlook. In fact, shares are down sharply over the past year and aren't far from their all-time lows.

Let's take a closer look at why the pessimists might be right in pushing this growing business' dividend to an 8% yield -- and its stock to a fire-sale valuation of less than 6 times earnings.

Image source: Getty Images.

Less profitable growth

Comparable-store sales expanded by 1.9% last quarter to mark GameStop's third consecutive quarter of positive comps. Importantly, this increase included growth in the core video game business, just as management had predicted it would.

Digging deeper into the results reveals a warning sign for investors, though. GameStop's biggest gains came in its video game hardware division, which benefited from strong demand for Nintendo's Switch console. This segment is by far the retailer's least profitable, with a gross margin of 12% compared to the pre-owned game division's 44% margin.

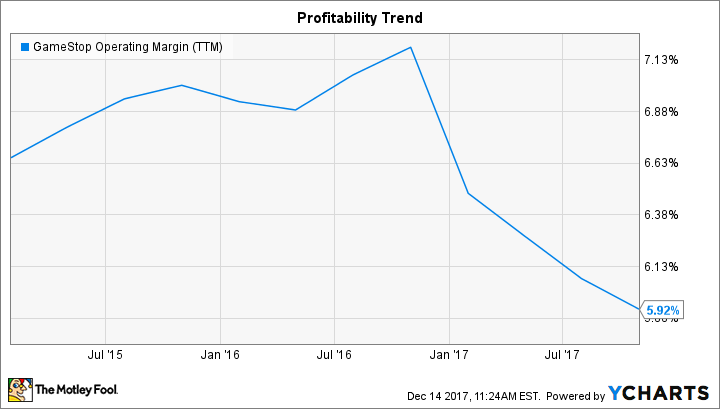

Data by YCharts.

This shifting sales mix led to a drop in overall gross profit margin, down to 34.7% of sales from 36.1% a year ago, and a worsening of operating earnings to 4.1% of sales from 4.9%. These results don't do much to ease investor fears that GameStop will lose earning power as the buy-sell-trade video game model gets disrupted by the rise of digital content delivery.

New businesses aren't booming

GameStop's new business lines were supposed to pick up the slack as the retailer transitions away from that lucrative old model. But the technology brands division that includes the Simply Mac, Spring Mobile, and Cricket stores isn't putting up great numbers, either. It posted a 10% sales decline last quarter and a 52% drop in operating earnings.

Management blamed the spotty supply of Apple's iPhone X for the stumble, and they left the door open for more weakness ahead. Depending on how well supply meets demand for that device over the holidays, GameStop might not meet management's growth goal, executives warned.

While investors shouldn't panic over short-term sales volatility like that, it's still worth keeping tabs on this underperforming operating segment. After all, GameStop is relying on it and the collectibles business to deliver an increasing portion of profits between now and 2019.

Intense seasonality raises risks

GameStop's full-year guidance predicts profits of $3.10 to $3.40 per share in 2017. The top of that outlook range would mark flat earnings compared to 2016 as comps improve to around 3% from last year's 11% slump. It also means ample coverage for the generous dividend, which costs GameStop $1.52 per share each year, or less than half of the profits the company is targeting.

However, there's a big risk built into this result. GameStop has only booked $1.39 per share in profits through the first nine months of the year, which leaves $2 per share, or close to 60% of the total, left to be generated in the 13 weeks that make up the holiday quarter.

That intense seasonality threatens to amplify even tiny missteps -- whether it's a supply issue around devices like the iPhone X or Nintendo Switch, or weak demand for a major game title -- into a major drag on sales and earnings. Thus, many investors are likely opting to wait before making the judgement that this is a healthy retailing business. Steady sales growth to date suggests that it might be, but a lot is riding on GameStop's performance in the next several weeks.