CarMax (KMX +0.70%) will post its third-quarter earnings report before the market opens on Thursday, Dec. 21. And despite positive business trends lately, investors are cautious about the used-car retailer's operating outlook. Shares are off their highs for the year and have missed out on most of the broader market's 2017 rally.

That underperformance could change quickly, depending on what CEO William Nash and his executive team have to say in a few days about CarMax's recent results. Investors should also have a chance to respond to the management team's updated expansion plans for the new year.

Let's dive into a few key trends to watch in Thursday's announcement.

Image source: Getty Images.

Customer traffic

CarMax's growth has been a mixed bag lately. Comparable-store sales gains slowed to a 5% pace in the second quarter from 8% in the prior quarter. On the bright side, CarMax converted more of its shoppers, both online and in its stores, into buyers. The retailer also enjoyed a 17% traffic boost to its website last quarter. However, those wins were offset by a stubborn drop in customer traffic at stores that will need to be reversed before growth can speed back up toward 8%.

Meanwhile, investors won't celebrate higher sales volumes unless they happen in the context of steady, or rising, profitability. And to judge the strength of the business on this score, keep an eye on CarMax's profit per vehicle. The company's "no-haggle" pricing strategy helps keep this metric steady. In fact, CarMax routinely logs between $2,100 and $2,200 of profit per vehicle, and so it isn't likely to break out of that range this quarter.

Spending and expenses

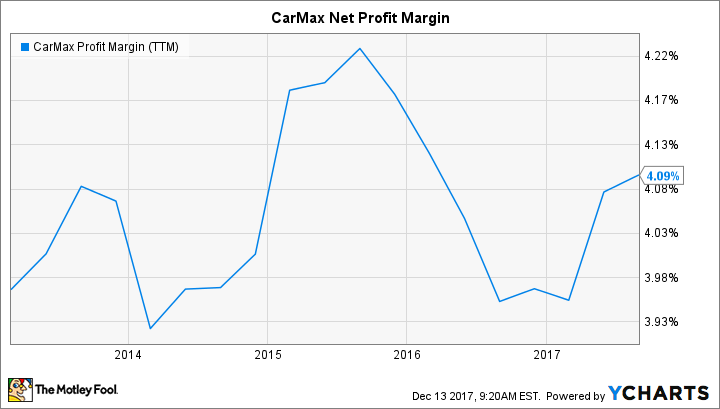

CarMax's net profit margin has ticked up to 4.4% of sales from 4.2% over the last six months. That improvement was thanks to a combination of slightly higher gross profit, steady results on the financing side of the business, and a minor dip in expenses.

KMX profit margin (TTM). Data by YCharts.

Yet investors can expect the expense category to worsen a bit over the next few quarters. CarMax is spending heavily on expanding its store base, after all, with five new lots opened in the past quarter compared to three in the prior quarter. Executives are also pouring resources into upgrading the digital sales channel, including with a new online appraisal tool. These projects will ideally lay the foundation for faster sales growth ahead, but they'll be a drag on bottom-line profitability in the short term.

Store expansion plans

A key piece of the investing thesis for this stock relies on CarMax capturing market share in a highly fragmented industry. And despite its nearly 200 locations across the country, the retailer is still only responsible for about 3% of the volume of lightly used vehicles sold in the U.S.

CarMax stands to win more of this business by improving its online shopping experience, but its expanding network of physical locations will be even more important. The retailer added 15 stores to its footprint last year and is aiming to match that number in 2017. About half of those locations will be in small markets, with the rest launching in larger, more competitive metropolitan areas. That balance seems to be working well for CarMax, but the company is free to make its expansion pace more aggressive, assuming its latest customer traffic, pricing, and volume trends are healthy.