What happened

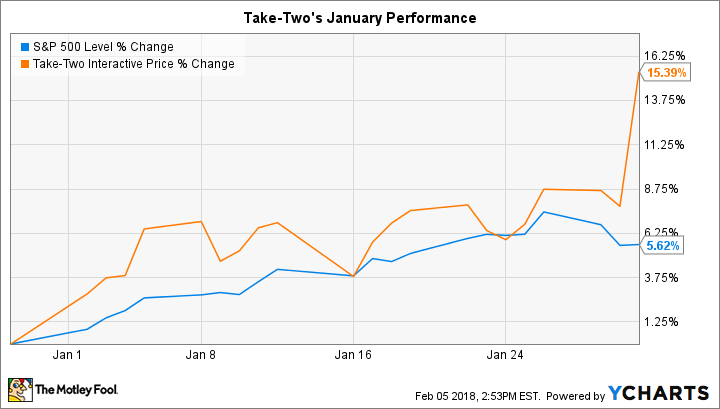

Take-Two (TTWO 0.04%) stock gained 15% last month, according to data provided by S&P Global Market Intelligence. That marked a solid outperformance over the 6% gain in the broader market.

The bounce contributed to a strong rally for Take-Two investors, who have seen their stock more than double since early 2017.

So what

January's spike occurred late in the month, when shares rose in sympathy with rival Electronic Arts (EA -0.09%). EA announced banner holiday-quarter results on Jan. 31 despite struggles with its Star Wars: Battlefront II title.

Image source: Getty Images.

That launch missed expectations, but EA noted that gamers continued to spend enthusiastically on high-margin digital content across its other titles, including subscription products within franchises like FIFA and The Sims. That gaming trend bodes well for Take-Two's Grand Theft Auto franchise and its sports titles, including NBA 2K18.

Now what

Shareholders will get detailed information on Take-Two's holiday quarter when the developer releases its official results after the market closes on Feb. 7. In a disappointing twist, the company recently delayed the release of its highly anticipated Red Dead Redemption 2 title. However, executives said that they still plan to hit their financial targets for the full year, which suggests Take-Two, like EA, is seeing healthy demand across its gaming portfolio today.