There are two components to generating income from your portfolio: current yield and income growth over time. It's the interplay between those two factors that's the difference between a good long-term investment and a bad one. Right now, Kinder Morgan Inc (KMI 0.27%) is calling for divided growth of 25% a year between 2018 and 2020. Magellan Midstream Partners, L.P. (MMP) has only provided guidance for 8% growth this year. Don't jump at Kinder Morgan just yet, though; there's more to this story you need to understand.

Impressive projections

Kinder Morgan is set to increase its dividend from $0.50 a share per year in 2017 to $0.80 per share this year. The goal is to up it to $1.00 per share per year in 2019 and $1.25 in 2020. That's a massive increase in a very short period of time. Income investors should be interested in learning more about Kinder.

Image source: Getty Images.

Unfortunately, the rest of the story isn't as pleasing as the oil and gas midstream company's dividend growth plans. For starters, the current yield is just 2.9% -- that's relatively low compared to competitors. Magellan's yield, for example, is 5.4%. So, you're forgoing a significant amount of current income if you buy Kinder Morgan today.

That said, Magellan is only calling for 8% growth in the distribution this year, and its annual distribution growth rate over the past decade only averaged about 10%. While impressive, that's well below the projections Kinder has put out there for the next few years. Using today's stock price, Kinder's yield will be roughly 7.2% in 2020. Assuming 8% growth each year, Magellan's distribution yield will be roughly 6.7% using today's unit price.

You could easily argue that Kinder is the better option. But is it?

The past matters

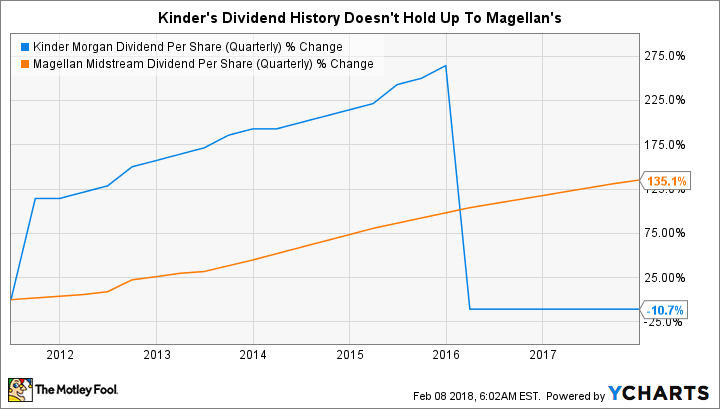

Kinder's dividend is so low today because of a dividend cut that took place in 2016. Notably, management had been talking about dividend increases just a few months prior to the cut. That's a trust issue in my book, but even if that fact doesn't bother you, there's another reason to pause here. The massive increases over the next few years are only possible because of the low starting point following the 75% dividend cut in 2016. These increases aren't a trend you can project indefinitely into the future. After 2020, dividend growth is likely to settle back down to a much lower number than 25% per year.

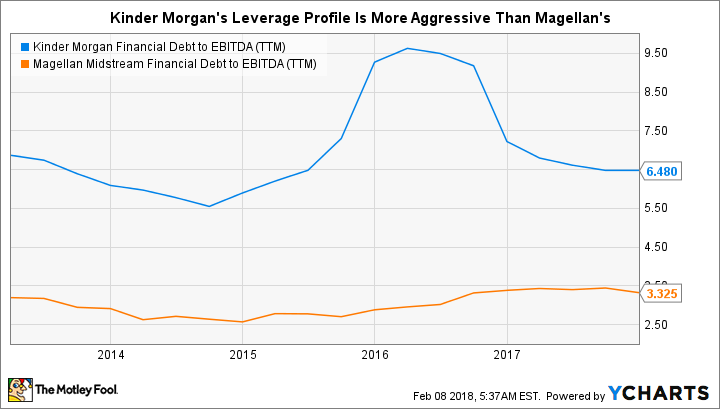

KMI Financial Debt to EBITDA (TTM) data by YCharts.

Then there's the reason for the cut, which was Kinder's heavy reliance on leverage. The company's debt to EBITDA peaked at a massive 9.5 times or so in 2016, which provides some context to the dividend cut story. Essentially, management had to choose between trimming its growth spending at a time when access to capital was strained by high leverage and low oil prices...or cutting the dividend. The dividend cut was probably the right move for the company, but income investors got hurt.

Magellan's debt to EBITDA stayed below 3.5 times throughout 2016. It's currently 3.3 times compared to Kinder's 6.5 times. Kinder's leverage is better than it was, but it is still relatively high compared to Magellan's. Even though debt reduction is part of the plan over the next few years, it looks like the core reason for Kinder's dividend cut hasn't really changed all that much.

KMI Dividend Per Share (Quarterly) data by YCharts.

And then there's the history behind Magellan's distribution. The partnership has increased the disbursement every quarter since coming public in 2001. It's up to 18 consecutive years worth of annual increases. And while 8% this year seems low compared to the 12% annualized rate it achieved over the entire span, if you start to compound 8% a year, the long-term annualized number begins to creep higher. Magellan looks like a tortoise that eventually wins because it keeps steadily plodding along.

Looking to the future

Both Kinder Morgan and Magellan have material spending plans over the next few years. Both have long histories of successful project execution and deft acquisitions. Both businesses are backed by fee-based assets.

But despite the solid outlook for Kinder's business, its planned dividend hikes aren't as great of a deal as they may seem when you put them into the bigger context of its dividend history, relatively high leverage levels, and low current yield. Magellan's slow, steady, and conservative approach easily wins this contest if you are looking to invest for the long term.