What happened

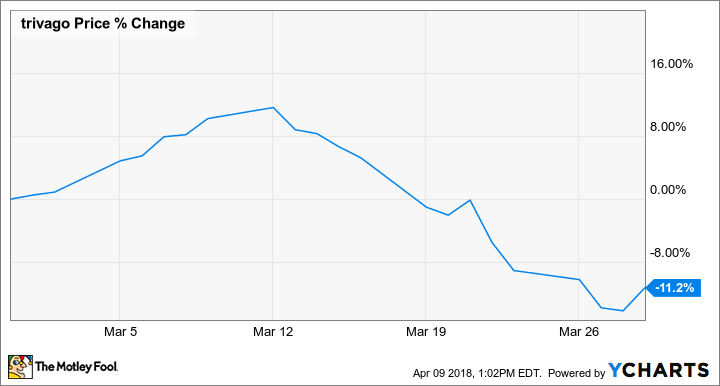

Shares of hotel-booking specialist Trivago N.V. (TRVG -0.55%) fell again last month as investor skepticism about the stock continued to build. Though there was little news out on the online travel agency during March, downward momentum from prior months seemed to carry over, as the stock has now fallen 70% since August 1 on a series of disappointing earnings reports. In March, the stock gave up another 11%, according to data from S&P Global Market Intelligence.

As the chart below shows, a steady sell-off in the second half of the month was the culprit:

So what

Trivago shares have slumped since last summer as the company's relationship with Booking Holdings (BKNG 0.33%), formerly known as Priceline, soured. As a provider of hotel metasearch, Trivago competes with peers like Booking and Expedia, but also partners with them. After Booking stepped up its bidding on Trivago's platform, leading to a jump in revenue at Trivago, Booking began violating Trivago's rules; when Trivago penalized it, Booking reduced its bidding. As a result, Trivago's revenue growth suddenly slowed over the third and fourth quarters of last year.

With the company operating at breakeven and revenue growth suddenly slowing, investors continued to seem jittery about the stock.

Image source: Trivago.

Now what

In the beginning of April, Wedbush analyst James Hardiman seemed to confirm those fears, giving an outperform rating to Booking, but neutral ratings to Trivago, Expedia, and TripAdvisor.

On Trivago, Hardiman argued that the company was facing a dilemma. He thinks it will struggle to achieve profitability. If it cuts back on its own advertising to attract new customers, it will see fewer of the referrals that generate income from partners and hotels. Right now, the company spends the vast majority of its revenue on marketing, making it highly dependent on advertising to generate brand awareness and bring in new customers. Hardiman put a $7.50 price target on the stock, above its current price, but shares still slipped after he issued the note.

CFO Axel Hefer sees revenue growth picking up later this year, but profitability will take longer. Investors hoping for a turnaround will have to continue to be patient.