Analysts and their quarterly earnings estimates should be nothing more than a sideshow for long-term investors. Whether a company "beats" or "misses" an analyst estimate should be of little concern for those who think in years or decades instead of months or quarters.

But it is worth taking a look at what analysts think when they disagree on a particular stock, especially if that disagreement is broad. Micron Technology (MU 1.41%), a manufacturer of memory chips, has analysts at a crossroads. Some believe the company's robust earnings power will continue, and that the industry won't plunge into a deep cyclical slump anytime soon. Others think a downturn is near, with the potential to decimate Micron's bottom line.

Image source:

A massive spread

Analysts are largely in agreement about Micron's earnings for fiscal 2018, which ends in August. The first half of the year has been stellar, driven by strong demand and soaring prices for DRAM chips. It's unlikely that things will fall apart quickly enough to endanger Micron's near-term results.

But fiscal 2019 is a different story. The lowest analyst estimate for earnings per share is $5.64, according to Yahoo! Finance, about half of what analysts expect Micron to earn on average in fiscal 2018. The highest estimate is $12.88, a 17% increase year over year. That's quite the difference of opinion.

The spread for revenue estimates is large as well. The most pessimistic analyst sees fiscal 2019 revenue of $26.66 billion; the most optimistic sees revenue of $36.73 billion. That $10 billion swing represents the uncertainty facing Micron investors.

Two very different futures

Why the giant spread between the low and high analyst estimates? Because no one knows exactly where memory chip prices are going to go. In the DRAM market, demand is currently strong enough to keep prices high. It doesn't seem like demand will drop anytime soon, but there's another variable: supply. Extra production capacity in the next few years can push prices down even if demand remains robust.

An analyst at Nomura laid out what amounts to the best-case scenario for Micron last week, maintaining a $100 price target and predicting earnings somewhere between $12 and $14 per share next year. One day earlier, analysts at UBS went the other way, rating Micron a "sell." UBS has a $35 price target on the stock, and it expects a wave of DRAM supply to cause a 50% decline in DRAM prices starting in the second half of 2018.

Both analysts could be right, in a sense. An eventual downturn is inevitable, but the timing and the severity are unknowable. Micron could very well have a record fiscal 2019 only to then succumb to a collapse in DRAM prices. Or that collapse could happen sooner. Or it might be less of a collapse and more of a slump. Anyone who claims they know for sure what's going to happen and when are either lying to you or themselves. Or they're analysts that need to be precise despite enough uncertainty to render precision absurd.

Even Micron itself is bad at forecasting supply and demand very far into the future.

Be careful with PE ratios

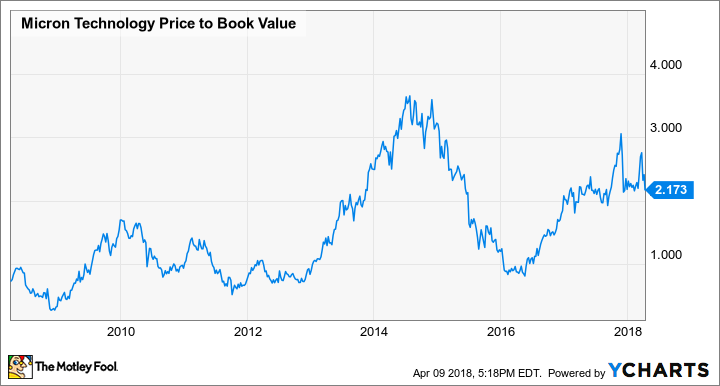

Micron stock trades for a little less than five times the average analyst earnings estimate for fiscal 2019. But that estimate comes with error bars so large that they render it largely irrelevant. On the basis of price-to-book value, Micron stock is expensive compared to typical values over the past decade, although not quite as expensive as during the last DRAM boom in 2014.

MU Price to Book Value data by YCharts.

In other words: Micron is not a no-brainer bargain like the P/E ratio suggests, but it's probably not dramatically overpriced either.

With so much uncertainty, it's a dangerous thing to latch onto analyst estimates to justify buying Micron stock. Maybe the most optimistic estimates will be close to reality. But maybe not.