Aerospace components manufacturer Triumph Group (TGI +0.00%) has worked out a deal with customer Gulfstream Aerospace to reallocate wing assembly work to Gulfstream's facility in Savannah, Georgia. It's a good deal for both sides in the near term, but could telegraph a loss of future business for Triumph.

The details

The deal, in effect, makes General Dynamics-owned (GD +2.58%) Gulfstream both a customer of and subcontractor to Triumph on G650 wing box and wing completion work. Wing production work currently being performed at Triumph facilities in Nashville, Tennessee, and Tulsa, Oklahoma, will move to Gulfstream's Georgia facility.

A Gulfstream wing assembly. Image source: Triumph Group.

Triumph said it would maintain its role as the supply chain integrator on the program, saying the agreement is expected to have a positive impact on its long-term financial results. This appears to be a win for both sides, helping to bring down production costs and working capital demand for Triumph while lowering overall costs for Gulfstream. It also gives Gulfstream more control over production rates at a time when demand for business jets is expected to grow.

Making the best of a tough situation

This wing business has been an albatross for multiple owners. Spirit AeroSystems was losing money doing wing work on the Gulfstream G650 and Gulfstream G280 before paying Triumph $160 million in December 2014 to take over the contract. Triumph already had a close relationship with Gulfstream at the time and believed its experience working on other production programs -- including making wings for the G450 and G550 -- would allow it to make a profit from the G650 and G280 wing work.

But it appears the wing work has not lived up to initial expectations. The company last December said it would combine its $4 billion wing business with its precision-component unit as part of a restructuring designed to streamline operations and reduce costs.

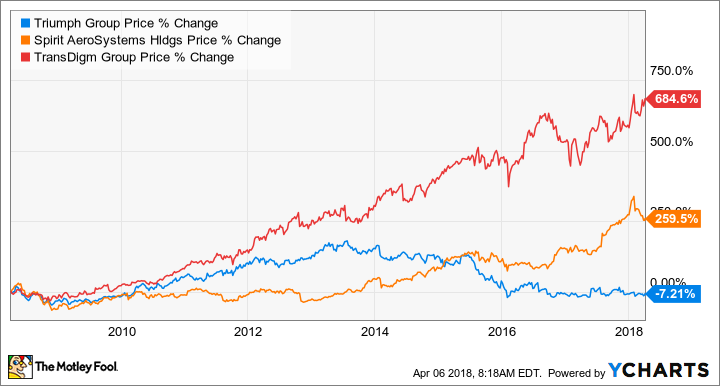

Triumph, an amalgamation of dozens of acquisitions over nearly four decades, has missed out on a long-running rally fueled by a strong up-cycle in commercial aerospace sales. Shares of Triumph are down more than 7% over the past 10 years, a time when shares of Spirit are up 259% and shares of aerospace components manufacturer TransDigm Group are up 684%.

Data by YCharts

Current Triumph Group CEO Daniel J. Crowley was brought on board in January 2016, well after the Spirit wing assembly transfer, and has been hard at work simplifying a company that had grown to house 47 different operating entities spread across 72 locations worldwide. Through divestitures and division mergers, he has reduced Triumph to 17 operating entities and has trimmed the company's overall footprint by 1.3 million square feet by closing a dozen locations.

This deal with General Dynamics continues Crowley's push to focus Triumph on the company's best businesses, and find alternatives for the laggards.

What next?

The G650 wing deal is a win for Triumph because it allows the company to keep revenue coming in, while reducing costs. But if, as implied, it means that it is cheaper for Gulfstream to do the work in-house than it is for it to work with Triumph, it seems likely Gulfstream will not bother going through a third party on future models, downgrading Triumph from an integrator and assembler to a component supplier on Gulfstream wings.

That's a bitter pill for Triumph to swallow, given that companies gravitate toward higher-value assembly work over easily commoditized part supplies. But given the economics of this particular line of business, moving on is probably the best possible outcome for Triumph shareholders.